Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

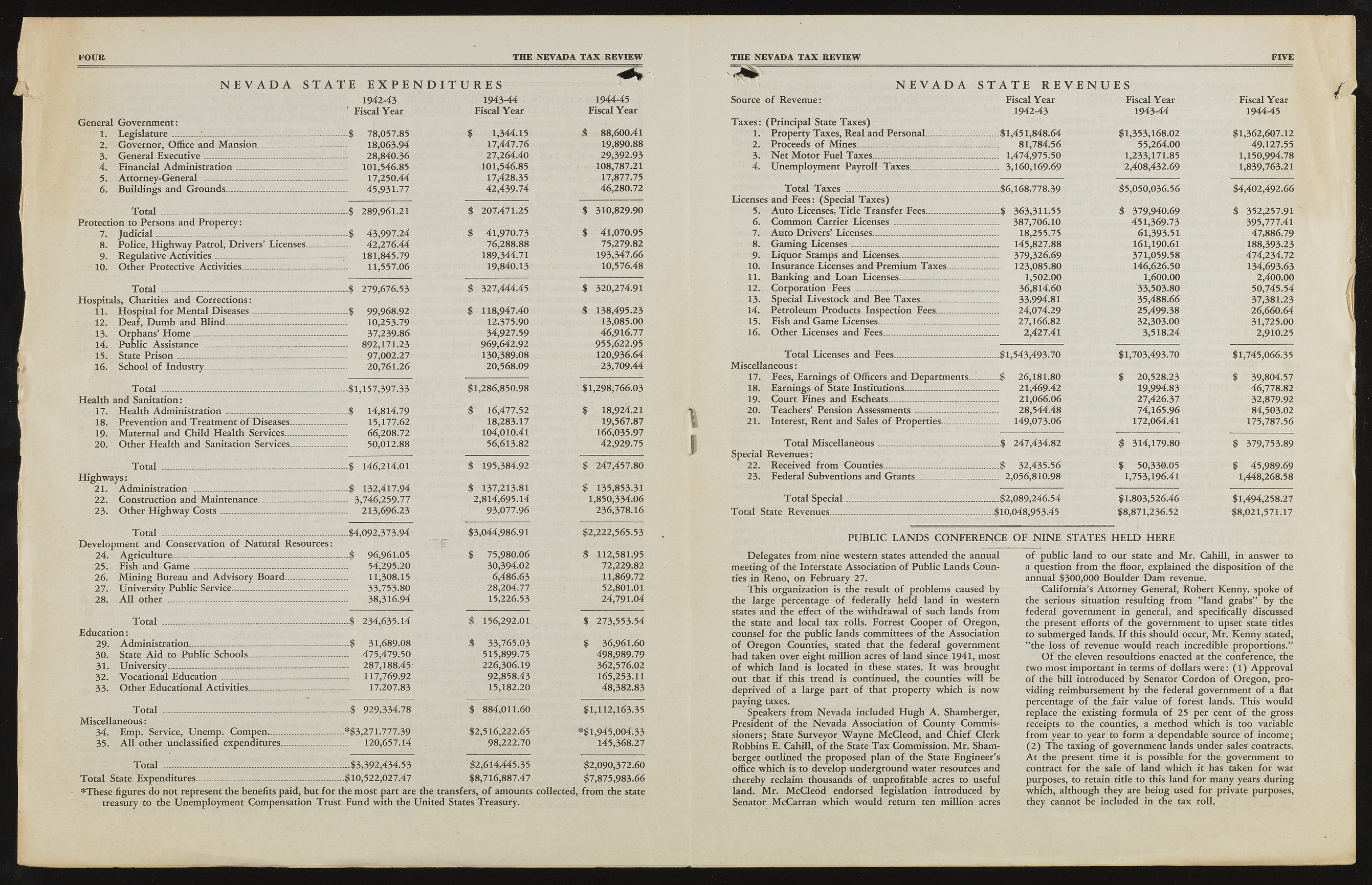

FOUR THE NEVADA TAX REVIEW 1942-43 Fiscal Y e a r 1943-44 Fiscal Y e a r 1944-45 Fiscal Y e a r G en eral G overnm en t: 1. L e g is la t u r e ...........1.................................................... — .$ 78,057.85 $ 1,344.15 $ 88,600.41 2. G overn or, Office an d M an sio n ............................... 18,063.94 17,447.76 19,890.88 3. G en eral E x e c u tiv e ............ ................ .................... 28,840.36 27,264.40 29,392.93 4. Financial A d m in is tra tio n ................. ...................... .... 101,546.85 101,546.85 108,787.21 5. A ttorn ey-G en eral ........... 1.................................. HR 17,250.44 17,428.35 17,877.75 6. B u ild in gs an d G ro u n d s.............. 1............................ 45,931.77 42,439.74 46,280.72 T o ta l ....................................... -............................ ..-$ 289,961.21 $ 207,471.25 $ 310,829.90 Protection to Persons and P roperty: 7. J u d ic ia l......................|......................... -...................... - - $ 43,997.24 $ 41,970.73 $ 41,070.95 8. Police, H ig h w a y Patrol, D riv e rs’ Licenses......... 42,276.44 76,288.88 75,279.82 9. R egulative A c tiv itie s.............................. ......1.......... -.. 181,845.79 189,344.71 193,347.66 10. O th er Protective Activities............................... 1.... 11,557.06 19,840.13 10,576.48 T o ta l ..................................................................... -...$ 279,676.53 $ 327,444.45 $ 320,274.91 H ospitals, Charities and Corrections: 11. H osp ital fo r M e n ta l D ise a se s.............. .............. . - - $ 99,968.92 $ 118,947.40 $ 138,495.23 12. D e a f, D u m b an d B lin d ............................................ 10,253.79 12,375.90 13,085.00 13. O rph an s’ H o m e ........................................................ 37,239.86 34,927.59 46,916.77 14. P u blic Assistance ............................ ......... .............. — 892,171.23 969,642.92 955,622.95 15. State P r i s o n .............. ................................................ 97,002.27 130,389.08 120,936.64 16. School o f Industry............ ...................................:.... 20,761.26 20,568.09 23,709.44 T o ta l ..................................................................... ....$1,157,397.33 $1,286,850.98 $1,298,766.03 H ealth and Sanitation: 17. H ealth A d m in is tra tio n ................................. 1.............$ 14,814.79 $ 16,477.52 $ 18,924.21 18. Prevention and Treatm ent o f Diseases............... . 15,177.62 18,283.17 19,567.87 19. M atern al and C h ild H ealth Services.................... 66,208.72 104,010.41 166,035.97 20. O th er H ealth and Sanitation Services----- ----------- 50,012.88 56,613.82 42,929.75 T o ta l ............. ...... ................................................. ....$ 146,214.01 $ 195,384.92 $ 247,457.80 H ig h w a y s : 21. A dm in istration ..................................................... —.... .$ 132,417.94 $ 137,213.81 $ 135,853.31 22. Construction and M aintenance.................................... 3,746,259-77 2,814,695.14 1,850,334.06 23- O th er H ig h w a y C o s t s .............................................. .... 213,696.23 93,077.96 236,378.16 T o ta l ........................................................ '............. D evelopm en t and Conservation o f N a tu ra l Resources: ... $4,092,373.94 $3,044,986.91 $2,222,565.53 24. A g ric u ltu re ............. ......... 1......... 1................... ? ....... .... $ 96,961.05 $ 75,980.06 $ 112,581.95 25. Fish an d G a m e ................................ R...................... 54,295.20 30,394.02 72,229.82 26. M in in g B ureau and A d v iso ry B o a rd ..... .............. 11,308.15 6,486.63 11,869.72 27. U n iversity P u b lic Service..........................? .......... 33,753.80 28,204.77 52,801.01 , 28. A l l other .......... .................................. 1.................... 38,316.94 15,226.53 24,791.04 T o ta l ........................................1........................... .... $ 234,635.14 $ 156,292.01 $ 273,553.54 E d u cation : 29. A dm in istration .............................. ........................... .... $ 31,689.08 $ 33,765.03 $ 36,961.60 30. State A id to P u blic Schools................ ............ — .... 475,479.50 515,899.75 498,989.79 31. U n iv ersity .................................................................. .... 287,188.45- 226,306.19 362,576.02 32. V ocation al E d u c a tio n ............ ~~............................ .... 117,769.92 92,858.43 165,253.11 33. O th er Educational Activities......1........................ 17,207.83 15,182.20 48,382.83 T o ta l .......................—.......................................... .... $ 929,334.78 $ 884,011.60 $1,112,163.35 M iscellaneous: 34. Em p. Service, U n em p. C om pen ................... ....... -*$3,271,777.39 $2,516,222.65 *$1,945,004.33 35. A l l other unclassified expenditures..................... .... 120,657.14 98,222.70 145,368.27 T o ta l ................ — .......... .................................... .....$3,392,434.53 $2,614,445.35 $2,090,372.60 T o ta l State Expenditures........................................................ ...$10,522,027.47 $8,716,887.47 $7,875,983.66 * These figures d o not represent the benefits paid, but fo r the m o st part are the transfers, o f amounts collected treasury to the U nem ploym ent Com pensation T ru st F u n d w ith the U n ited States Treasury. , from the state THE NEVADA TAX REVIEW FIVE N E V A D A S T A T E R E V E N U E S Source o f R evenue: T a x e s: (P rin c ip a l State T a x e s) Fiscal Y e a r 1942-43 Fiscal Y e a r 1943-44 Fiscal Y e a r 1944-45 1. Property Taxes, R eal and Personal..................... .......$1,451,848.64 $1,353,168.02 $1,362,607.12 2. Proceeds o f M ines............ |................................... ....... 81,784.56 55,264.00 49,127.55 3. N e t M o to r Fuel T axes........................................... ....... 1,474,975.50 1,233,171.85 1,150,994.78 4. U nem ploym ent P a y ro ll T axes............................ .. .... 3,160,169.69 2,408,432.69 1,839,763.21 T o ta l T axes ................ .................................... Licenses and Fees: (Special T a x e s ) .......$6,168,778.39 $5,050,036.56 $4,402,492.66 5. A u to Licenses, T itle T ran sfer Fees..................... .......$ 363,311.55 $ 379,940.69 $ 352,257.91 6. Com m on C arrier Licenses ............... ................ ....... 387,706.10 451,369.73 395,777.41 7. A u to D riv e rs’ Licenses........................................... ....... 18,255.75 61,393.51 47,886.79 8. G am in g L icen ses................................................... ____ 145,827.88 161,190.61 188,393.23 9. L iq u o r Stamps and Licenses................................ ....... 379,326.69 371,059.58 474,234.72 10. Insurance Licenses and Prem ium T axes............. ....... 123,085.80 146,626.50 134,693.63 11. B an k in g and Loan Licenses.............................. ....... 1,502.00 1,600.00 2,400.00 12. C orporation Fees ................................................. ...... 36,814.60 33,503.80 50,745.54 13. Special Livestock and Bee T axes....................... 33,994.81 35,488.66 37,381.23 14. Petroleum Products Inspection Fees................. ....... 24,074.29 25,499.38 26,660.64 15. Fish and G am e Licenses........................................ ....... 27,166.82 32,303.00 31,725.00 16. O th er Licenses and Fees............................................. 2,427.41 3,518.24 2,910.25 T o ta l Licenses and Fees.................................. M iscellan eou s: .......$1,543,493.70 $1,703,493.70 $1,745,066.35 17. Fees, Earnings o f Officers and D epartm ents___ .... ..$ 26,181.80 $ 20,528.23 $ 39,804.57 18. E arnings o f State Institutions.............................. 21,469.42 19,994.83 46,778.82 19. C ou rt Fines and Escheats.................................... ....... 21,066.06 27,426.37 32,879-92 20. Teachers’ Pension A ssessm ents.......................... ....... 28,544.48 74,165.96 84,503.02 21. Interest, Rent and Sales o f Properties.....!......... ....... 149;073.06 172,064.41 175,787.56 T o ta l M iscellan eo u s........................................ Special R evenues: .......$ 247,434.82 $ 314,179.80 $ 379,753.89 22. Received from Counties...................................... ....:..$ 32,435.56 $ 50,330.05 $ 45,989.69 23. Federal Subventions and G ran ts.......................... ....... 2,056,810.98 1,753,196.41 1,448,268.58 T o ta l S p e c ia l..................................................... $2,089,246.54 $1,803,526.46 $1,494,258.27 T o ta l State Revenues.................................................. 1....... .....$10,048,953.45 $8,871,236.52 $8,021,571.17 P U B L I C L A N D S C O N F E R E N C E O F N I N E S T A T E S H E L D H E R E D elegates from nine western states attended the annual m eeting o f the Interstate Association o f P u blic Lands C o u n ties in R eno, on February 27. T h is organization is the result o f problem s caused by the la rg e percentage o f federally h eld lan d in western states and the effect o f the w ith d raw al o f such lands from the state and local tax rolls. Forrest C oop er o f O regon , counsel fo r the pu blic lands committees o f the Association o f O re g o n Counties, stated that the federal governm ent h ad taken over eight m illion acres o f lan d since 1941, most o f w h ich lan d is located in these states. It w as brough t out that if this trend is continued, the counties w ill be deprived o f a la rg e p art o f that property w hich is n o w payin g taxes. Speakers from N e v a d a included H u g h A . Sham berger, President o f the N e v a d a Association o f County Com m issioners; State Surveyor W a y n e M c C le o d , and C h ie f Clerk R obbin s E. C ah ill, o f the State T a x Com m ission. M r . Sham berger outlined the proposed p lan o f the State Engineer’s office w h ich is to develop un dergrou n d w ater resources and thereby reclaim thousands o f unprofitable acres to useful land. M r . M c C le o d endorsed legislation introduced by Senator M c C a rra n w hich w o u ld return ten m illion acres o f pu blic lan d to ou r state and M r . Cahill, in answer to a question from the floor, explained the disposition o f the annual $300,000 B o u ld er D a m revenue. C alifo rn ia’s A ttorn ey G eneral, R obert Kenny, spoke o f the serious situation resulting from "la n d grabs” by the federal governm ent in general, and specifically discussed the present efforts o f the governm ent to upset state titles to subm erged lands. I f this should occur, M r . K en n y stated, "th e loss o f revenue w o u ld reach incredible proportions.” O f the eleven resoultions enacted at the' conference, the tw o most im portant in terms o f dollars w e re : ( 1 ) A p p ro v a l o f the b ill introduced by Senator C o rd o n o f O regon , p ro vid in g reim bursem ent by the federal governm ent o f a flat percentage o f the Jfair value o f forest lands. T his w o u ld replace the existing form u la o f 25 per cent o f the gross receipts to the counties, a m ethod w hich is too variable from year to year to fo rm a dependable source o f incom e; ( 2 ) T h e taxin g o f governm ent lands under sales contracts. A t the present time it is possible fo r the governm ent to contract fo r the sale o f lan d w hich it has taken fo r w ar purposes, to retain title to this land/for m any years du rin g which, although they are bein g used fo r private purposes, they cannot be included in the tax roll.