Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

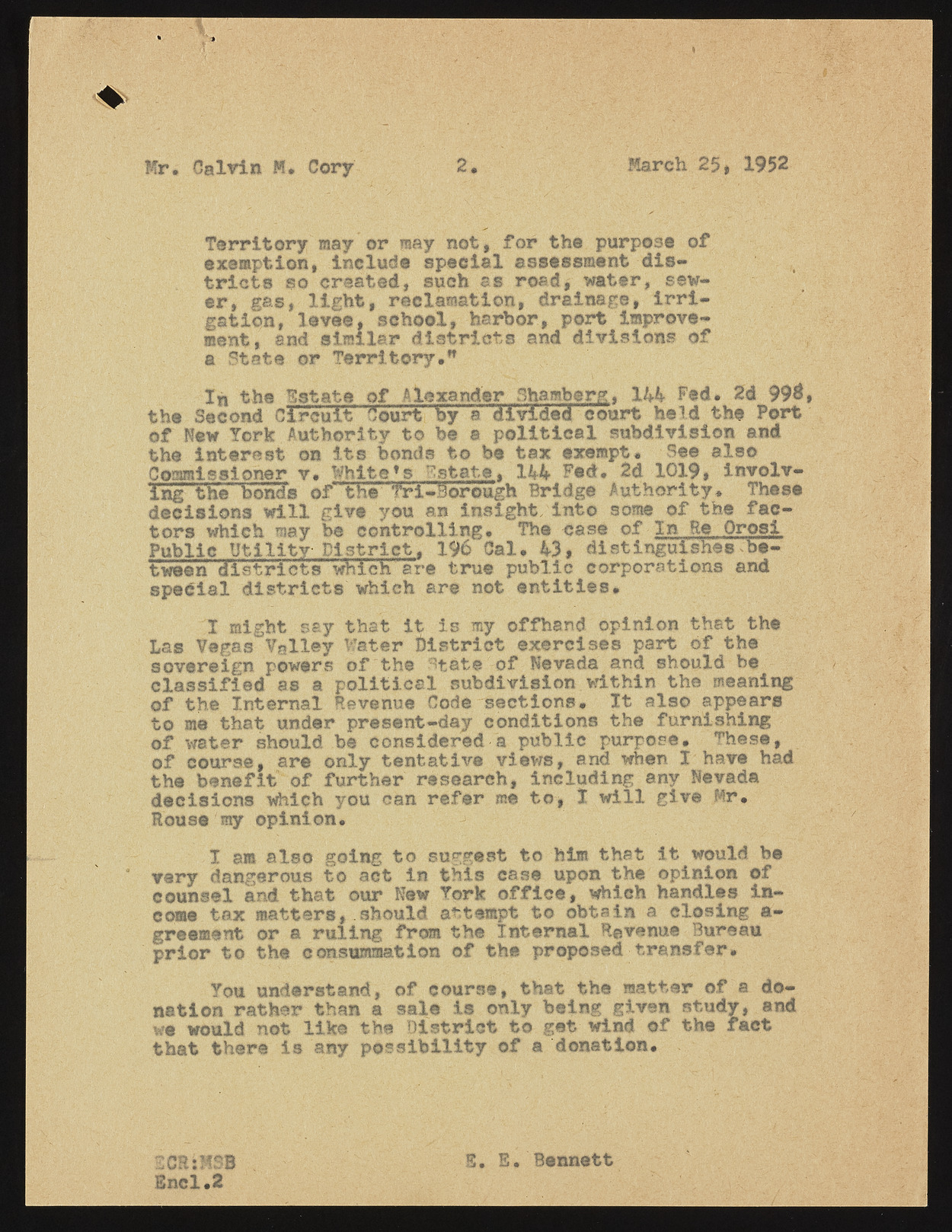

i Mr, Calvin M. Cory 2. March 25» 1952 Territory may or may not, for the purpose of exemption, include special assessment districts so created, such as road, water, sewer, gas, light, reclamation, drainage, irrigation, levee4 school, harbor, port improvement, and similar districts and divisions of a State or Territory," lit the Estate of Alexander Chambers, 144 Fed, 2d 993, the Second Circuit Court by a divided court held the Port of New York Authority to be a political subdivision and the interest on its bonds to be tax exempt. See also Commissioner v. Whitefs Estate, 144 Fed, 2d 1019, Involving the bonds of "the ‘fri-Borough Bridge Authority# These decisions will give you an insight, into some of the factors which may be controlling. The case of In Re Orosj Public Utility District, 196 Cal. 43, distinguishes-between districts which are true public corporations and special districts which are not entities, I might say that it is my offhand opinion that the Las Vegas Valley Water district exercises part of the sovereign powers of the estate of Nevada and should be classified as a political subdivision within the meaning of the Internal Revenue Code sections. It also appears to me that under present-day conditions the furnishing of water should be considered a public purpose. These, of course, are only tentative views, and when I have had the benefit of further research, including any Nevada decisions which you can refer me to, I will give Mr, Rouse ray opinion. I am also going to suggest to him that it would be very dangerous to act in this case upon the opinion of counsel and that our New York office, which handles income tax matters, should attempt to obtain a closing a- greement or a ruling from the Internal Revenue Bureau prior to the consummation of the proposed transfer. You understand, of course, that the matter of a donation rather than a sale is only being given study, and we would not like the District to get wind of the fact that there is any possibility of a donation. SCRiMSB Enel,2 S, E. Bennett