Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

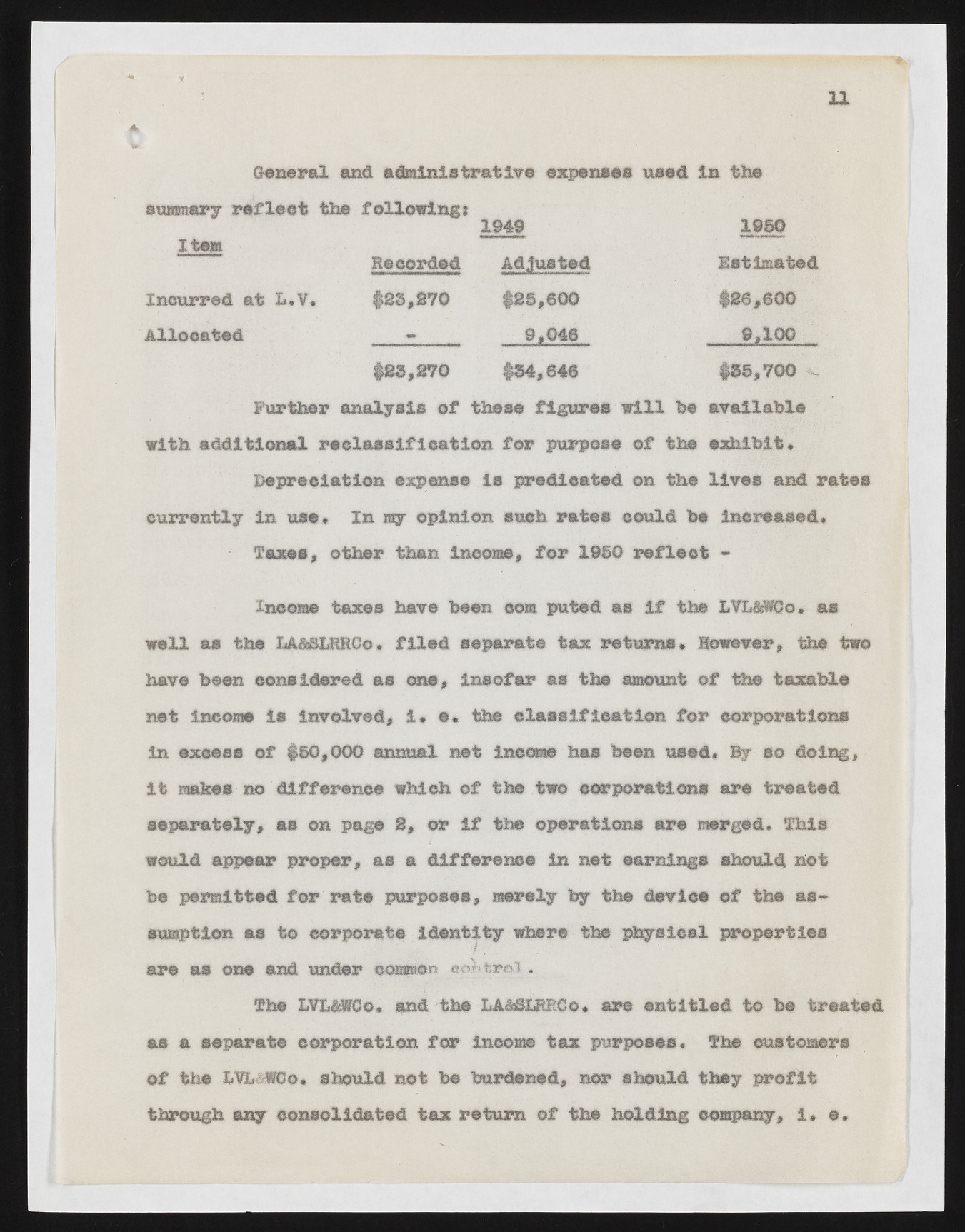

XX General and administrative expenses used in the summary refleet the following} 1949 1980 Item Recorded Adjusted Estimated Incurred at L.V, $25,270 #25,600 #26,600 Allocated - 9,046 9,100 $25,270 #54,646 $55,700 Further analysis of these figures will he available with additional reelasslfleatlon for purpose of the exhibit• Depreciation expense is predicated on the lives and rates currently in use. In my opinion such rates could bs increased* Taxes, other than income, for 1950 reflect - Income taxes have been com puted as If the LVL&WCo. as well as tbs LA&SLRRCo• filed separate tax returns* However, the two have been considered as one, insofar as the amount of the taxable net Income is involved, 1* e* the classification for corporations in excess of $50,000 annual net income has been used. By so doing, it makes no difference which of the two corporations are treated separately, as on page 2, or if the operations are merged* This would appear proper, as a difference in net earnings should hot be permitted for rate purposes, merely by the device of the assumption as to corporate identity where the physical properties are as one and under common control. The LVL&WCo. and the LA&SLRRCo* are entitled to be treated as a separate corporation for Income tax purposes. The customers of the LVLWCo. should not be burdened, nor should they profit through any consolidated tax return of the bolding company, 1, e.