Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

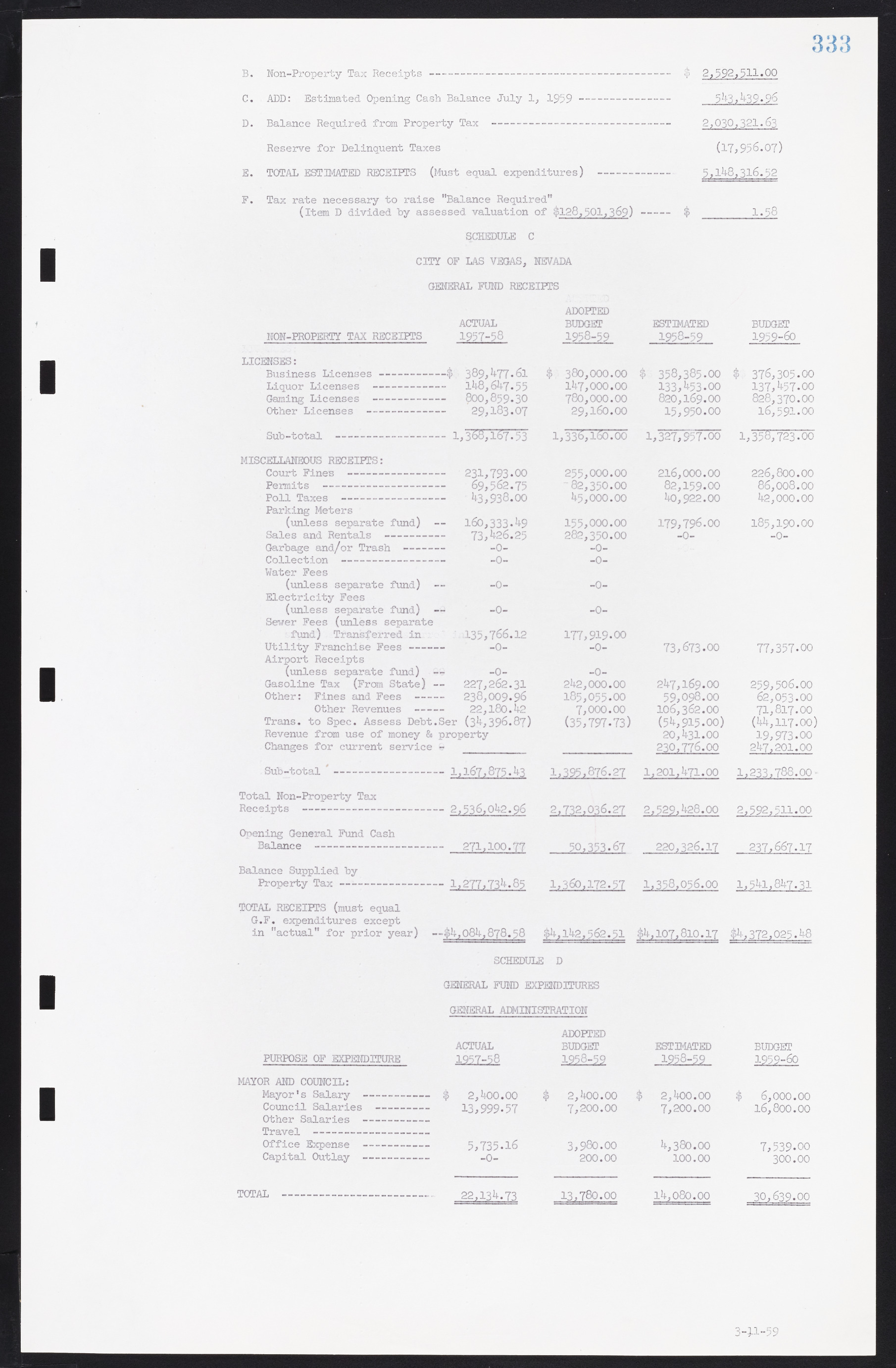

B. Non-Property Tax Receipts---------------------------------------------------------------- $ 2,592,511.00 C. ADD: Estimated Opening Cash Balance July 1, 1959 ------------------------ 543,439.96 D. Balance Required from Property Tax ----------------------------------------------- 2,030,321.63 Reserve for Delinquent Taxes (17,956.07) E. TOTAL ESTIMATED RECEIPTS (Must equal expenditures) -------------------- 5,148,316.52 F. Tax rate necessary to raise "Balance Required" (item D divided by assessed valuation of $128,501,369)____ $ ________1.58 SCHEDULE C CITY OF LAS VEGAS, NEVADA GENERAL FUND RECEIPTS ADOPTED ACTUAL BUDGET ESTIMATED BUDGET NON-PROPERTY TAX RECEIPTS 1957-58 1958-59 1958-59 1959-66 LICENSES: Business Licenses -----------------$ 389,477.61 $ 380,000.00 $ 358,385.00 $ 376,305.00 Liquor Licenses ------------------- 148,647.55 147,000.00 133,453.00 137,457.00 Gaming Licenses ------------------- 800,859.30 780,000.00 820,169.00 828,370.00 Other Licenses --------------------- 29,183.07 29,160.00 15,950.00 16,591.00 Sub-total ......... 1,368,167.53 1,336,160.00 1,327,957.00 1,358,723.00 MISCELLANEOUS RECEIPTS: Court Fines -------------------------- 231,793.00 255,000.00 216,000.00 226,800.00 Permits -..................... 69,562.75 82,350.00 82,159.00 86,008.00 Poll Taxes --------------------------- 43,938.00 45,000.00 40,922.00 42,000.00 Parking Meters (unless separate fund) — 160,333.49 155,000.00 179,796.00 185,190.00 Sales and Rentals ---------------- 73,426.25 282,350.00 -0- -0- Garbage and/or Trash ---------------- -0- -0- Collection --------------------------------- -0- -0- Water Fees (unless separate fund) — -0- -0- Electricity Fees (unless separate fund) — -0- -0- Sewer Fees (unless separate fund) Transferred in 135,766.12 177,919.00 Utility Franchise Fees --------- -0- -0- 73,673.00 77,357.00 Airport Receipts (unless separate fund) — -0- -0- Gasoline Tax (From State) — 227,262.31 242,000.00 247,169.00 259 506.00 Other: Fines and Fees -------- 238,009.96 185,055.00 59,098.00 62,053.00 Other Revenues -------- 22,180.42 7,000.00 106,362.00 71,817.00 Trans, to Spec. Assess Debt.Ser (34,396.87) (35,797.73) (54,915.00) (44,117.00) Revenue from use of money & property 20,431.00 19 973.00 Changes for current service - __________ _________ 230,776.00 247.201.00 Sub-total ---------------------1,167,875.43 1,395,876.27 1,201,471.00 1,233,788.00 Total Non-Property Tax Receipts ------------------------------------- 2,536,042.96 2,732,036.27 2,529,428.00 2,592,511.00 Opening General Fund Cash Balance ---------------------------------- 271,100.77 50,353.67 220,326.17 237,667.17 Balance Supplied by Property Tax --------------------------- 1,277,734.85 1,360,172.57 1,358,056.00 1,541,847.31 TOTAL RECEIPTS (must equal G.F. expenditures except in "actual" for prior year) — $4,084,878.58 $4,142,562.51 $4,107,810.17 $4,372,025.48 SCHEDULE D GENERAL FUND EXPENDITURES GENERAL ADMINISTRATION ADOPTED ACTUAL BUDGET ESTIMATED BUDGET PURPOSE OF EXPENDITURE 1957-58 1958-59 1958-59 1959-60 MAYOR AND COUNCIL: Mayor's Salary ----------------- $ 2,400.00 $ 2,400.00 $ 2,400.00 $ 6,000.00 Council Salaries ------------------ 13,999.57 7,200.00 7,200.00 16,800.00 Other Salaries ----------------- Travel ------------------------------ Office Expense ----------------- 5,735.16 3,980.00 4,380.00 7,539.00 Capital Outlay ------------------------ -0- 200.00 100.00 300.00 TOTAL ..................................................... 22,134.73 13,780.00 14,080.00 30,639.00 3-11-59