Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

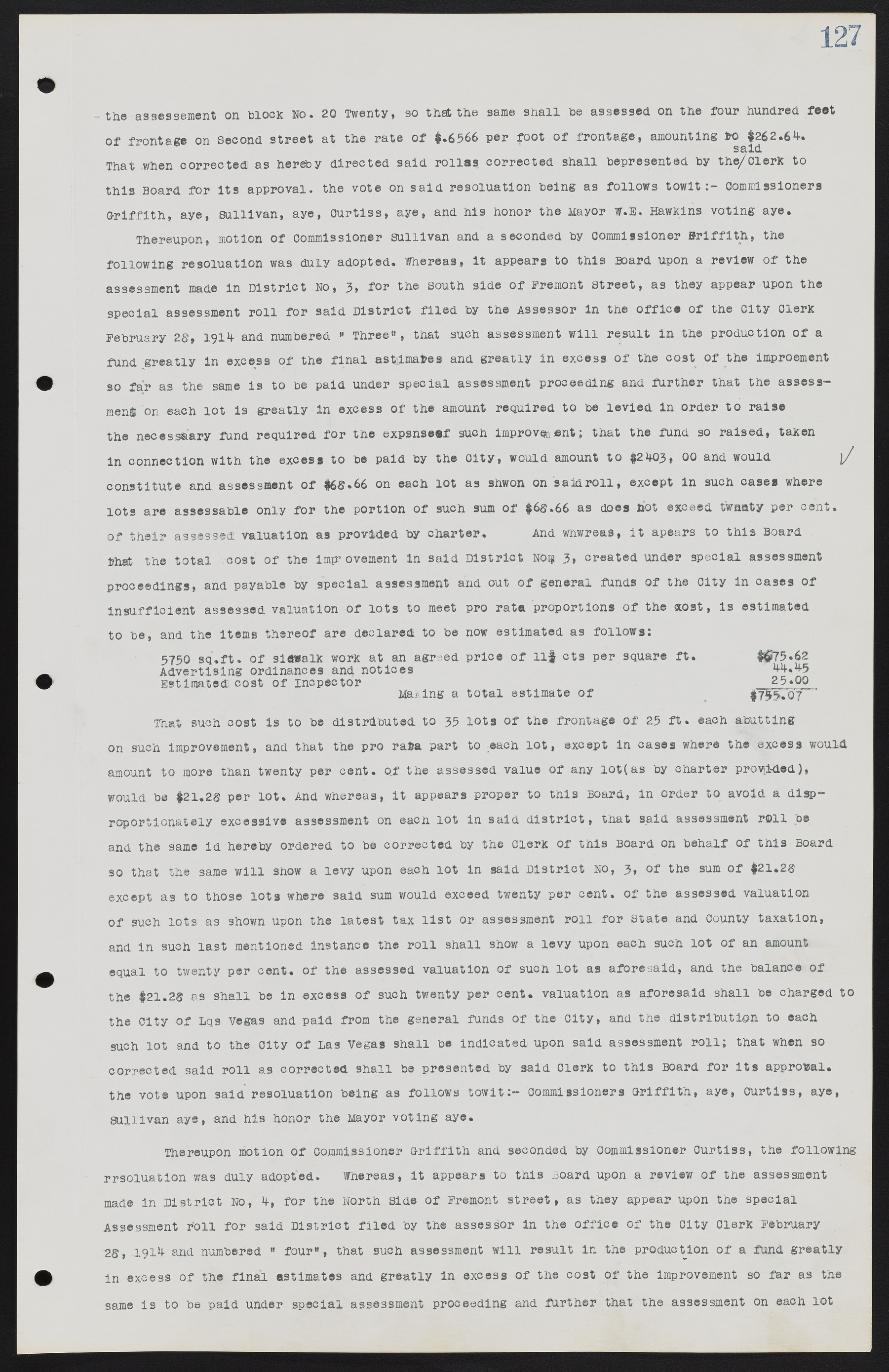

the assessment on block No. 20 Twenty, so that the same shall be assessed on the four hundred feet of frontage on Second street at the rate of $.6566 per foot of frontage, amounting to $262.64. That when corrected as hereby directed said rolls corrected shall be presented by the said Clerk to this Board for its approval. the vote on said resolution being as follows towit:- Commissioners Griffith, aye, Sullivan, aye, Curtiss, aye, and his honor the Mayor W.E. Hawkins voting aye. Thereupon, motion of Commissioner Sullivan and a seconded by Commissioner Griffith, the following resolution was duly adopted. Whereas, it appears to this Board upon a review of the assessment made in District No, 3, for the south side of Fremont Street, as they appear upon the special assessment roll for said District filed by the Assessor in the office of the City Clerk February 28, 1914 and numbered " Three", that such assessment will result in the production of a fund greatly in excess of the final estimates and greatly in excess of the cost of the improvement so far as the same is to be paid under special assessment proceeding and further that the assessment on each lot is greatly in excess of the amount required to be levied in order to raise the necessary fund required for the expense of such improvement; that the fund so raised, taken in connection with the excess to be paid by the City, would amount to $2403, 00 and would constitute and assessment of $68.66 on each lot as shown on said roll, except in such case* where lots are assessable only for the portion of such sum of $68.66 as does not exceed twenty per cent. of their assessed valuation as provided by charter. And whereas, it appears to this Board that the total cost of the improvement in said District No, 3, created under special assessment proceedings, and payable by special assessment and out of general funds of the City in cases of insufficient assessed valuation of lots to meet pro rata proportions of the cost, is estimated to be, and the items thereof are declared to be now estimated as follows: 5750 sq.ft. of sidewalk work at an agreed price of 11 3/4 cts per square ft. $675.62 Advertising ordinances and notices 44.45 Estimated cost of Inspector 25.00 Making a total estimate of $755.07 That such cost is to be distributed to 35 lots of the frontage of 25 ft. each abutting on such improvement, and that the pro rara part to each lot, except in cases where the excess would amount to more than twenty per cent. of the assessed value of any lot (as by charter provided), would be $21.28 per lot. And whereas, it appears proper to this Board, in order to avoid a disproportionately excessive assessment on each lot in said district, that said assessment roll be and the same is hereby ordered to be corrected by the Clerk of this Board on behalf of this Board so that the same will show a levy upon each lot in said District No, 3, of the sum of $21.28 except as to those lots where said sum would exceed twenty per cent. of the assessed valuation of such lots as shown upon the latest tax list or assessment roll for State and County taxation, and in such last mentioned instance the roll shall show a levy upon each such lot of an amount equal to twenty per cent. of the assessed valuation of such lot as aforesaid, and the balance of the $21.28 as shall be in excess of such twenty per cent. valuation as aforesaid shall be charged to the City of Las Vegas and paid from the general funds of the City, and the distribution to each such lot and to the City of Las Vegas shall be indicated upon said assessment roll; that when so corrected said roll as corrected shall be presented by said Clerk to this Board for its approval. the vote upon said resolution being as follows towit:- commissioners Griffith, aye, Curtiss, aye, Sullivan ays, and his honor the Mayor voting aye. Thereupon motion of Commissioner Griffith and seconded by Commissioner Curtiss, the following resolution was duly adopted. Whereas, it appears to this Board upon a review of the assessment made in District No, 4, for the North Side of Fremont street, as they appear upon the special Assessment roll for said District filed by the assessor in the office of the City Clerk February 28, 1914 and numbered " four", that such assessment will result in the production of a fund greatly in excess of the final estimates and greatly in excess of the cost of the improvement so far as the same is to be paid under special assessment proceeding and further that the assessment on each lot