Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

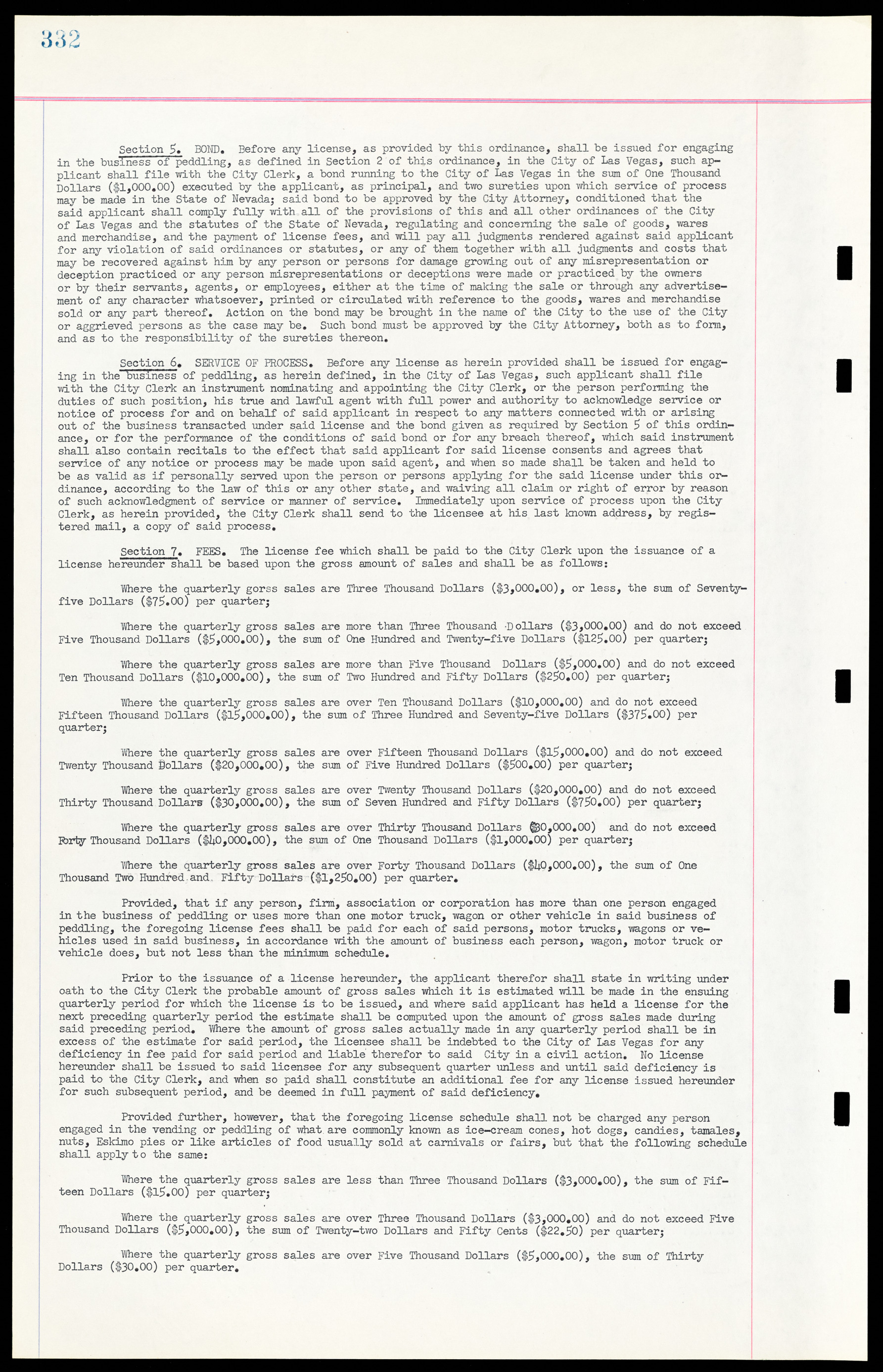

Section 5. BOND. Before any license, as provided by this ordinance, shall be issued for engaging in the business of peddling, as defined in Section 2 of this ordinance, in the City of Las Vegas, such applicant shall file with the City Clerk, a bond running to the City of Las Vegas in the sum of One Thousand Dollars ($1,000.00) executed by the applicant, as principal, and two sureties upon which service of process may be made in the State of Nevada; said bond to be approved by the City Attorney, conditioned that the said applicant shall comply fully with all of the provisions of this and all other ordinances of the City of Las Vegas and the statutes of the State of Nevada, regulating and concerning the sale of goods, wares and merchandise, and the payment of license fees, and will pay all judgments rendered against said applicant for any violation of said ordinances or statutes, or any of them together with all judgments and costs that may be recovered against him by any person or persons for damage growing out of any misrepresentation or deception practiced or any person misrepresentations or deceptions were made or practiced by the owners or by their servants, agents, or employees, either at the time of making the sale or through any advertisement of any character whatsoever, printed or circulated with reference to the goods, wares and merchandise sold or any part thereof. Action on the bond may be brought in the name of the City to the use of the City or aggrieved persons as the case may be. Such bond must be approved by the City Attorney, both as to form, and as to the responsibility of the sureties thereon. Section 6. SERVICE OF PROCESS. Before any license as herein provided shall be issued for engaging in the business of peddling, as herein defined, in the City of Las Vegas, such applicant shall file with the City Clerk an instrument nominating and appointing the City Clerk, or the person performing the duties of such position, his true and lawful agent with full power and authority to acknowledge service or notice of process for and on behalf of said applicant in respect to any matters connected with or arising out of the business transacted under said license and the bond given as required by Section 5 of this ordinance, or for the performance of the conditions of said bond or for any breach thereof, which said instrument shall also contain recitals to the effect that said applicant for said license consents and agrees that service of any notice or process may be made upon said agent, and when so made shall be taken and held to be as valid as if personally served upon the person or persons applying for the said license under this ordinance, according to the law of this or any other state, and waiving all claim or right of error by reason of such acknowledgment of service or manner of service. Immediately upon service of process upon the City Clerk, as herein provided, the City Clerk shall send to the licensee at his last known address, by registered mail, a copy of said process. Section 7. FEES. The license fee which shall be paid to the City Clerk upon the issuance of a license hereunder shall be based upon the gross amount of sales and shall be as follows: Where the quarterly gross sales are Three Thousand Dollars ($3,000.00), or less, the sum of Seventy- five Dollars ($75.00) per quarter; Where the quarterly gross sales are more than Three Thousand Dollars ($3,000.00) and do not exceed Five Thousand Dollars ($5,000.00), the sum of One Hundred and Twenty-five Dollars ($125.00) per quarter; Where the quarterly gross sales are more than Five Thousand Dollars ($3,000.00) and do not exceed Ten Thousand Dollars ($10,000.00), the sum of Two Hundred and Fifty Dollars ($250.00) per quarter; Where the quarterly gross sales are over Ten Thousand Dollars ($10,000.00) and do not exceed Fifteen Thousand Dollars ($13,000.00), the sum of Three Hundred and Seventy-five Dollars ($375.00) per quarter; Where the quarterly gross sales are over Fifteen Thousand Dollars ($13,000.00) and do not exceed Twenty Thousand Dollars ($20,000.00), the sum of Five Hundred Dollars ($300.00) per quarter; Where the quarterly gross sales are over Twenty Thousand Dollars ($20,000.00) and do not exceed Thirty Thousand Dollars ($30,000.00), the sum of Seven Hundred and Fifty Dollars ($730.00) per quarter; Where the quarterly gross sales are over Thirty Thousand Dollars ($30,000.00) and do not exceed Forty Thousand Dollars ($40,000.00), the sum of One Thousand Dollars ($1,000.00) per quarter; Where the quarterly gross sales are over Forty Thousand Dollars ($40,000.00), the sum of One Thousand Two Hundred and Fifty Dollars ($1,230.00) per quarter. Provided, that if any person, firm, association or corporation has more than one person engaged in the business of peddling or uses more than one motor truck, wagon or other vehicle in said business of peddling, the foregoing license fees shall be paid for each of said persons, motor trucks, wagons or vehicles used in said business, in accordance with the amount of business each person, wagon, motor truck or vehicle does, but not less than the minimum schedule. Prior to the issuance of a license hereunder, the applicant therefor shall state in writing under oath to the City Clerk the probable amount of gross sales which it is estimated will be made in the ensuing quarterly period for which the license is to be issued, and where said applicant has held a license for the next preceding quarterly period the estimate shall be computed upon the amount of gross sales made during said preceding period. Where the amount of gross sales actually made in any quarterly period shall be in excess of the estimate for said period, the licensee shall be indebted to the City of Las Vegas for any deficiency in fee paid for said period and liable therefor to said City in a civil action. No license hereunder shall be issued to said licensee for any subsequent quarter unless and until said deficiency is paid to the City Clerk, and when so paid shall constitute an additional fee for any license issued hereunder for such subsequent period, and be deemed in full payment of said deficiency. Provided further, however, that the foregoing license schedule shall not be charged any person engaged in the vending or peddling of what are commonly known as ice-cream cones, hot dogs, candies, tamales, nuts, Eskimo pies or like articles of food usually sold at carnivals or fairs, but that the following schedule shall apply to the same: Where the quarterly gross sales are less than Three Thousand Dollars ($3,000.00), the sum of Fifteen Dollars ($13.00) per quarter; Where the quarterly gross sales are over Three Thousand Dollars ($3,000.00) and do not exceed Five Thousand Dollars ($5,000.00), the sum of Twenty-two Dollars and Fifty Cents ($22.50) per quarter; Where the quarterly gross sales are over Five Thousand Dollars ($3,000.00), the sum of Thirty Dollars ($30.00) per quarter.