Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

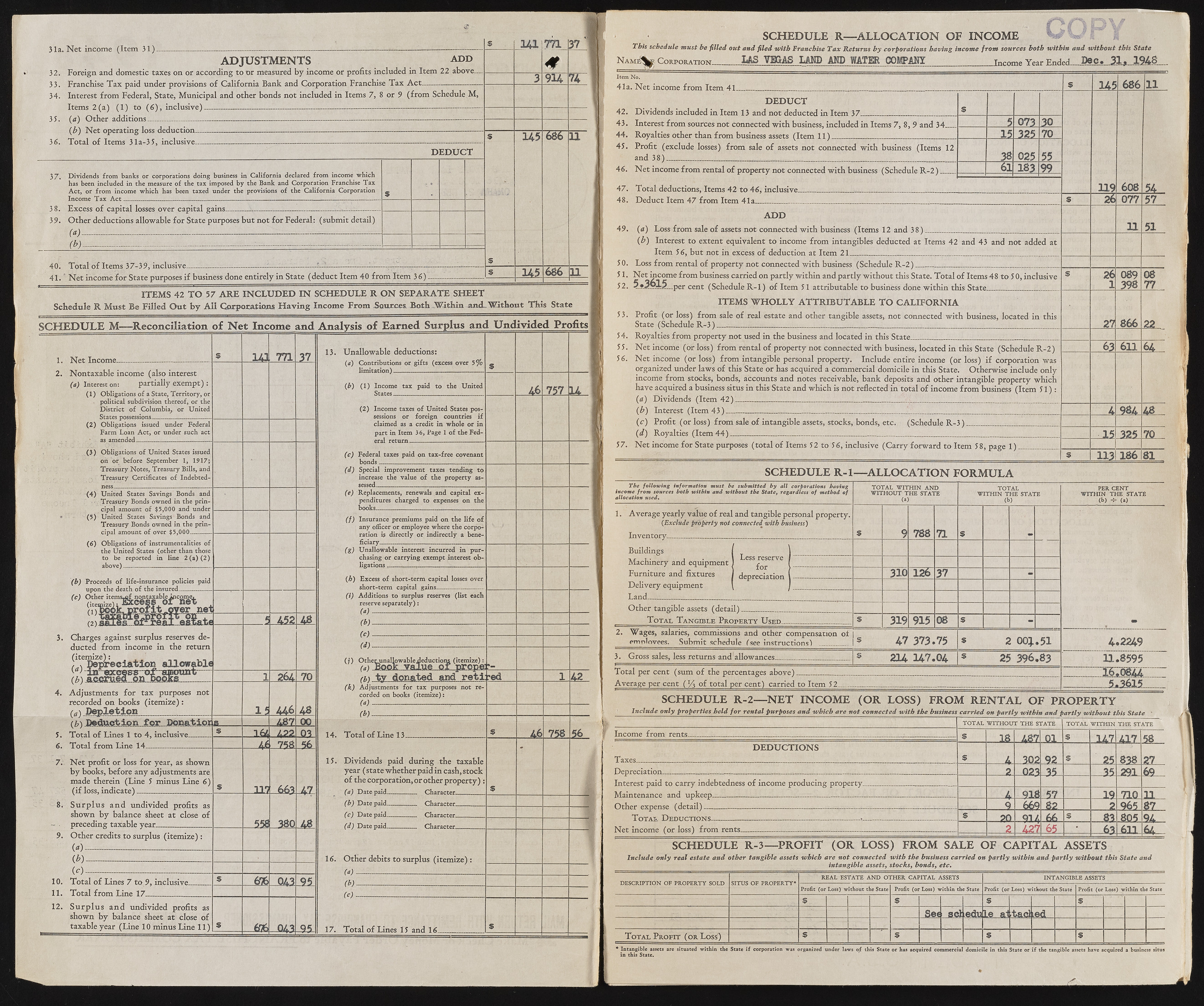

9 1411771 37 1 ADJUSTMENTS ADD 33. Franchise Tax paid under provisions of California Bank and Corporation Franchise Tax / 34. Interest from Federal, State, Municipal and other bonds not included in Items 7, 8 or 9 ( 3 914 74 from Schedule M, 36. Total of Items 31a-35, inclusive________— — - _ — - - . DEDU CT 9 9 145 686 11 37. Dividends from banks or corporations doing business in California declared from income which has been included in the measure of the tax imposed by the Bank and Corporation Franchise Tax Act, or from income which has been taxed under the provisions of the California Corporation $ 39. Other deductions allowable for State purposes but not for Federal: (submit detail) fa) ....... fh) ________ _ ___ ____ .____ "TV/. lUUUVi IUWW4IV----- ---------- ------ 4 1 .' Net income for State purposes if business done entirely in State (deduct Item 40 from Item 9 145 686 11 ITEMS 42 T O 57 ARE IN CLUDED IN SCHEDULE R O N SEPARATE SHEET Schedule R Must Be Filled O ut by A ll Corporations H aving Income From Sources Both .Within and-W ithout This State SCHEDULE M—-Reconciliation of N et Income and Analysis of Earned Surplus and Undivided. Profits $ 141 771 37 13. Unallowable deductions: (a) Contributions or gifts (excess over 5% 9 2. Nontaxable income (also interest (a) Interest on: partially exempt) : (1) Obligations of a State, Territory, or • political subdivision thereof, or the District of Columbia, or United (b) (1) Income tax paid to the United 46 757 14 (2) Income taxes of United States possessions or foreign countries if claimed as a credit in whole or in part in Item 36, Page 1 of the Fed- (2) Obligations issued under Federal Farm Loan Act, or under such act (3) Obligations of United States issued on or before September 1, 1917; Treasury Notes, Treasury Bills, and Treasury Certificates of Indebted- (c) Federal taxes paid on tax-free covenant (d) Special improvement taxes tending to increase the value of the property as- (4) United States Savings Bonds and • • Treasury Bonds owned in the principal amount of $5,000 and under (5) United States Savings’ Bonds and Treasury Bonds owned in the prin- (e) Replacements, renewals and capital expenditures charged to expenses on the (f) Insurance premiums paid on the life of any officer or employee where the corporation is directly or indirectly a bene- (6) Obligations of instrumentalities of the United States (other than those to be reported in line 2(a)(2) (g) Unallowable interest incurred in purchasing or carrying exempt interest ob- (b) Proceeds of life-insurance policies paid (h) Excess of short-term capital losses over short-term capital gains ............ (c) Other itemSrftf nontaxable ijicome, (itemize) i ^ x c e s s o r ne t n book, n r o f i t -over net (i) Additions to surplus reserves (list each reserve separately): (a) 5 452 48 (h) 3. Charges against surplus reserves deducted from income in the return (itemize): . . . _ _ , _ HI D e p re c ia tio n a llo w a b ly (r) _____ fj) (;) Otherunallowabledeductions (itemize): m Book \a> m e x c e s s o f amount ~ v alue o r prop©: H fb) accrued o n Books 1 26A 70 (t,i ty donated and r e t i red 1 42 4. Adjustments for tax purposes not recorded on books (itemize) : O ) D e p le tio n 15 446 48 (k) Adjustments for tax purposes not recorded on books (itemize): (a) (h) (&) D eduction fo r Don&tlor u u 5. Total of Lines 1 to 4, inclusive- * 16 4 14. Total of Line 13_ __ i A6 758 56 6. Total from T.ine 14 4.6 758 56 13. Dividends paid during the taxable year ( state whether paid in cash, stock of the corporation, or other property) :$ 7.'. Net profit or loss for year, as shown by books, before any adjustments are made therein (Line 5 minus Line 6) (if loss, indicate) S . 117 663 47 8. Surplus and undivided profits as shown by balance sheet at close of - ? preceding taxable year 558 380 48 (b) Date paid _ Character (c) Date paid. _ Character 9. Other credits to surplus (itemize) : (a) ___..... 16. Other debits to surplus (itemize) : (a) '(b)_____ (c). . - 1 10. Total o f Lines 7 to 9, inclusive i 6% 043 95 (b) 11. Total from Line 17 _ __ (c) 12. Surplus and undivided profits as shown by balance sheet at close of taxable year (Line 10 minus Line 11) $ 6% 043 95 17. Total of Lines 15 and 16- $ SCHEDULE R— ALLOCATION OF INCOME This schedule must be filled out and filed with Franchise Tax Returns by corporations having income from sources both within and without this State N am£^|j^ Corporation_____ IAS VEGAS LAMP AND WATER COMPANY____________ Income Year Ended_DSC. 31. 19A8 Item No. 41a. Net income from Item 41 * 145 686 11 DEDU CT 42. Dividends included in Item 13 and not deducted in Ttem 37 9 219 608 54 43. Interest from sources not connected with business, included in Items 7, 8, 9 and 34 _5 073 30 44. Royalties other than from business assets (Item 11)__ - —- „ 15 325 70 4S. Profit (exclude losses) from sale of assets not connected with business (Items 12 and 3 8 ) . - . __ 38 025 55 46. Net income from rental of property not connected with business (Schedule R-2) 61 183 99 47. Total deductions, Items 42 to 46, inclusive........ 48. Deduct Item 47 from Item 41a____ __________ n 26 077 57 A D D 49. (a) Loss from sale of assets not connected with business (Items 12 and 38) 11 51 ( b) Interest to extent equivalent to income from intangibles deducted at Items 42 and 43 and not added at Item 56. but not in excess of deduction at. Ttem 21 50. Loss from rental of property not connected with business (Schedule R-2) 51. Net income from business carried on partly within and partly without this State. Total of Items 48 to 5 0, inclusive 52. 5_.3®15__per cent (Schedule R -l) of Item 51 attributable to business done within this State __ 9 26 1 309889 08 77 ITEMS W H O LLY ATTRIBU TABLE T O CALIFORN IA 53. Profit (or loss) from sale of real estate and other tangible assets, not connected with business, located in this State (Schedule R-3) 27 866 22 54. Royalties from property not used in the business and located in this State __ 55. Net income (or loss) from rental of property not connected with business, located in this State (Schedule R-2) 56. Net income (or loss) from intangible personal property. Include entire income (or loss) if corporation was organized under laws of this State or has acquired a commercial domicile in this State. Otherwise include only income from stocks, bonds, accounts and notes receivable, bank deposits and other intangible property which have acquired a business situs in this State and which is not reflected in total of income from business (Item 51): (a) Dividends (Item 42) _ ............ ................ . _ . 63 611 64 (b) Interest (Ttem 43) 4 984 48 (c) Profit (or loss) from sale of intangible assets, stocks, bonds, etc. (Schedule R- (d) Royalties (Item 44) _ _ _____ ____________ ___________ ____ 3)_____________ __________ 15 325 70 57. Net income for State purposes (total of Items 52 to 56, inclusive (Carry forward to Item 58, page 1) 9 113 186 81 SCHEDULE R -l— ALLOCATION FORMULA The fo llo w in g inform ation must be subm itted by a ll corporations having income fro m sources both w ith in and w ith o u t the State, regardless o f method o f allocation used. TOTAL W ITH IN AND WITHOUT THE STATE 00 TOTAL W ITH IN THE STATE (b) PER. CENT W ITH IN THE STATE (b) -r- (a) 1. Average yearly value of real and tangible personal property. ( E x c lu d e p ro p e rty n o t connected^ w ith business) Inventory___________ _ __ 9 9 788 71 9 Buildings Machinery and equipment Furniture and fixtures Delivery equipment | \ Less reserve I depreciation l------------- 310 126 37 - ) __ _________ Land - _ . _ Other tangible assets (detai Total Tangible Prc i)---------------------------- -- iperty Used____ __ __ 9 319 915 08 9 - 2. eWmangleosv,e essa.l ariSesu,b mcoimt mscihsseidounlse a(nsede oitnhsetrru ccotmionpes!nsation of * 47 373.75 * 2 00}.51 4.2249 3. Gross sales, less returns and allowances - * 214 147.04 | 25 396.83 11.8595 Total per cent (sum of the pel Average per cent ( % of total t rcentages above) _ _ 16*0844 i.er cent) carried to Item 52 — ___ ___ ?.................. . -5*3.615 SCHEDULE R -2— NET INCOME (OR LOSS) FROM RENTAL OF PROPERTY Include only properties held for rental purposes and which are not connected with the business carried on partly within and partly without this State ' TOTAL WITHOUT THE STATE TOTAL WITHIN THE STATE Income from rents 1®_ 58 DEDUCTIONS Taxes ... ...... . . __ ______ „ _ 9 4 30? 92 9 25 838 .wty I, 27 Depreciation _ . _ . - ___________________ _ „ . 2 0?3 35 35 ?91 69 Interest paid to carry indebtedness of income producing property Maintenance and upkeep_ _ __ - - ________ _ _ _________ _ ______ __ /. 918 57 19 710 11 Other expense (detail) _ . . _ _ ............ .... ............. .. _ . ...... 9 669 8? 2 965 87 Total Deductions — _ - - ___ - __ »„ _ - - ............ 9 on Q1 / 66 9 83 805 9A Net income (or loss) from rents . _ ------------ ---------- --------- . ---- 2 427 65 • 63 611 64 SCHEDULE R -3— PROFIT (OR LOSS) FROM SALE OF CAPITAL ASSETS Include only real estate and other tangible assets which are not connected with the business carried on partly within and partly without this State and intangible assets, stocks, bonds, etc. DESCRIPTION OF PROPERTY SOLD SITUS OF PROPERTY* REAL ESTATE AN D OTHER CAPITAL ASSETS INTANGIBLE ASSETS Profit (or Loss) ?without the State Profit (or Loss) within the State Profit (or Loss) without the State Profit (or Loss) within the State 9 $ * 9 S e t s d eduLe a1Ltfid Led T otal Profit (or Loss) 9 9 $ 9 * Intangible assets are situated within the State i f corporation was organized under laws o f this State or has acquired commercial domicile in this State or i f the tangible assets have acquired : in this State. business situs