Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

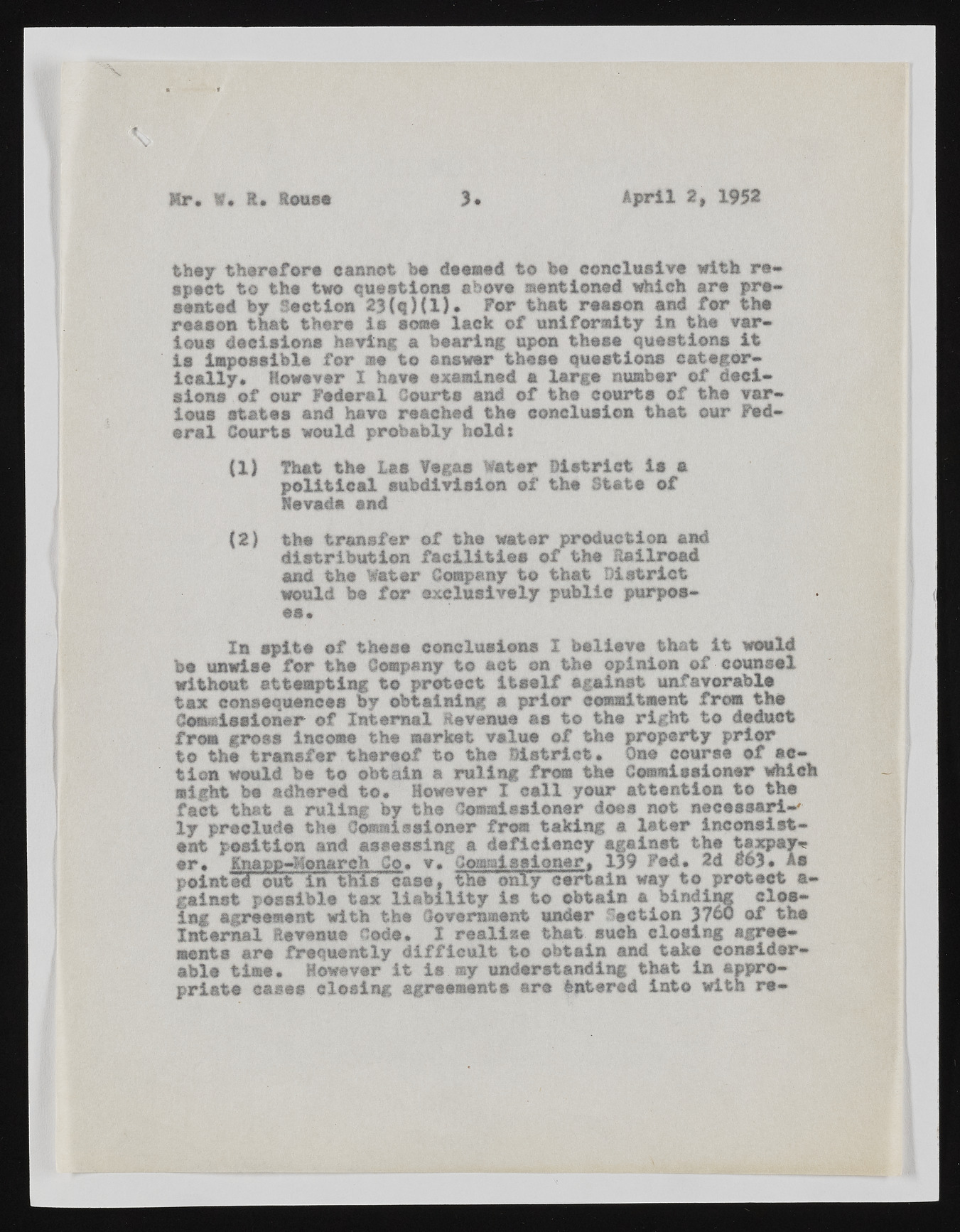

Mr* w* ft, Rouse 3 . April a, 1952 they therefore cannot be deemed to bo conclusive with respect to the two questions above mentioned which are presented by Section 23(q)(l). For that reason and for the reason that there is some lack of uniformity in the various decisions having a bearing upon these questions it is impossible for me to answer these questions categorically* However I have examined a large number of decisions of our Federal Courts and of the court# of the various states and have reached the conclusion that our Federal Courts would probably holds (1) That the las Vegas Water District is a political subdivision of the Stats of Nevada and (2) the transfer of the water production and distribution facilities of the Railroad and the Water Company to that District would be for exclusively public purposes* In spit# of these conclusions I believe that it would be unwise for the Company to act on the opinion of counsel without attempting to protect itself against unfavorable tax consequences by obtaining a prior commitment from the Commissioner of Internal Revenue as to the right to deduct from gross income the market value of the property prior to the transfer thereof to the District• One course of action would be to obtain a ruling from the Commissioner which might be adhered to. However I call your attention to the fact that a ruling by the Commissioner does not necessari-' ly preclude the Commissioner from taking a later inconsistent position and assessing a deficiency against the taxpay* er* Knapp-Honarch Co* v* Comalsalonsr, 139 Fed* 2d 0©3# As pointed out in Wi'a cast, the only curtain way to protect a-gainat possible tax liability is to obtain a binding closing agreement with the Government under 'action 3760 of the Internal Revenue node. I realise that such closing agreements are frequently difficult to obtain and taka considerable time. However it is my understanding that in appropriate cases closing agreement# are Entered into with re-