Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

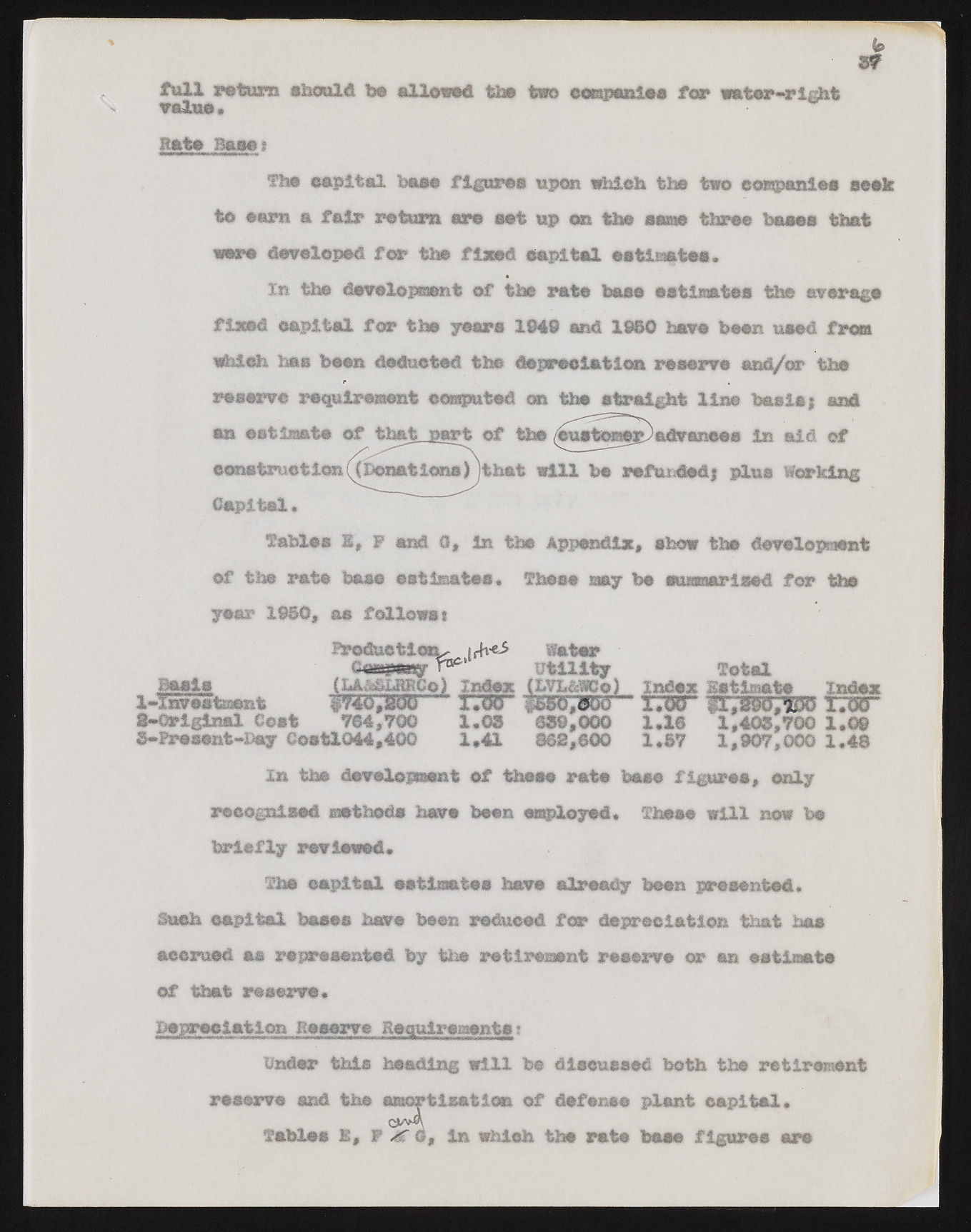

fta3Jl rotor® should bo allows the two companies for water~rl#it vain*. Koto Base? fhs capital, base figures upon which Ms§ two companies soak to earn a fair return are cot up on the asms three baaes that wore developed for the fi*ed capital estimates. flaed capital for the years 1949 and 1990 have been used from *hl®h has been deducted the depreciation reserve and/or the r * reserve requirement computed on the straight line basisj and an estimate of that peart of the advance# in aid of construction ((donations) )thet will be refunded! plus Waking Capital. fables 9, F and a, in the Append!*, show the development of the rate base estimates* fhese may be summarised for the year 1900, as followsi 9-original Cost 764,700 1.05 359,000 1.16 1,405,700 1,09 5-freseat-Day Costl044,400 1,41 369,300 1,67 1,907,000 1.48 In the development of these rate base figures, only recognised methods have been employed* these will now be briefly reviewed. the capital estimates have already been presented* Such capital bases have been reduced for depreciation that has accrued as represented by tiae retirement reserve or an estimate of that reserve. Depreciation Reserve Resatosmeate? bnder this heading will be discussed both the retirement reserve and the amortisation of defense plant capital. tn the development of the rate base estimates the average ?ve capital, fables 1, F & 3, in which the rate base figure# are