Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

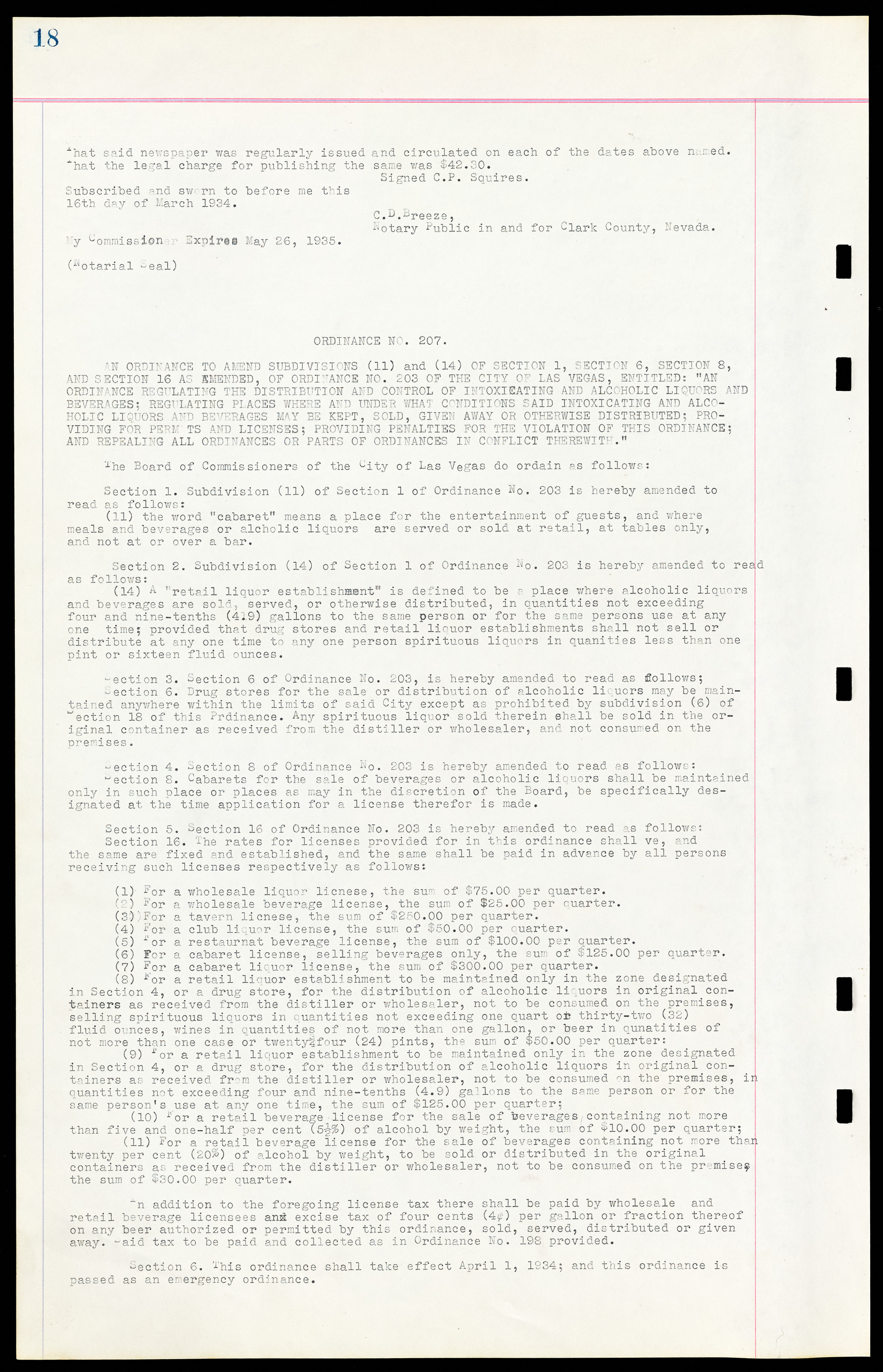

That said newspaper was regularly issued and circulated on each of the dates above named. That the legal charge for publishing the same was $42.30. Signed C.P. Squires. Subscribed and sworn to before me this 16th day of March 1934. C.D. Breeze, Notary Public in and for Clark County, Nevada. My Commission Expires May 26, 1935. (Notarial Seal) ORDINANCE NO. 207. AN ORDINANCE TO AMEND SUBDIVISIONS (11) and (14) OF SECTION 1, SECTION 6, SECTION 8, AND SECTION 16 AS EMENDED, OF ORDINANCE NO. 203 OF THE CITY OF LAS VEGAS, ENTITLED: "AN ORDINANCE REGULATING THE DISTRIBUTION AND CONTROL OF INTOXICATING AND ALCOHOLIC LIQUORS AND BEVERAGES; REGULATING PLACES WHERE AND UNDER WHAT CONDITIONS SAID INTOXICATING AND ALCOHOLIC LIQUORS AND BEVERAGES MAY BE KEPT, SOLD, GIVEN AWAY OR OTHERWISE DISTRIBUTED; PROVIDING FOR PERMITS AND LICENSES; PROVIDING PENALTIES FOR THE VIOLATION OF THIS ORDINANCE; AND REPEALING ALL ORDINANCES OR PARTS OF ORDINANCES IN CONFLICT THEREWITH." The Board of Commissioners of the City of Las Vegas do ordain as follows: Section 1. Subdivision (11) of Section 1 of Ordinance No. 203 is hereby amended to read as follows: (11) the word "cabaret" means a place for the entertainment of guests, and where meals and beverages or alcoholic liquors are served or sold at retail, at tables only, and not at or over a bar. Section 2. Subdivision (14) of Section 1 of Ordinance No. 203 is hereby amended to read as follows: (14) A "retail liquor establishment" is defined to be a place where alcoholic liquors and beverages are sold, served, or otherwise distributed, in quantities not exceeding four and nine-tenths (419) gallons to the same person or for the same persons use at any one time; provided that drug stores and retail liquor establishments shall not sell or distribute at any one time to any one person spirituous liquors in quantities less than one pint or sixteen fluid ounces. Section 3. Section 6 of Ordinance No. 203, is hereby amended to read as follows; Section 6. Drug stores for the sale or distribution of alcoholic liquors may be maintained anywhere within the limits of said City except as prohibited by subdivision (6) of Section 18 of this Ordinance. Any spirituous liquor sold therein shall be sold in the original container as received from the distiller or wholesaler, and not consumed on the premises. Section 4. Section 8 of Ordinance No. 203 is hereby amended to read as follows: Section 8. Cabarets for the sale of beverages or alcoholic liquors shall be maintained only in such place or places as may in the discretion of the Board, be specifically designated at the time application for a license therefor is made. Section 5. Section 16 of Ordinance No. 203 is hereby amended to read as follows: Section 16. The rates for licenses provided for in this ordinance shall be, and the same are fixed and established, and the same shall be paid in advance by all persons receiving such licenses respectively as follows: (1) For a wholesale liquor license, the sum of $75.00 per quarter. (2) For a wholesale beverage license, the sum of $25.00 per quarter. (3) For a tavern license, the sum of $250.00 per quarter. (4) For a club liquor license, the sum of $50.00 per quarter. (5) For a restaurant beverage license, the sum of $100.00 per quarter. (6) For a cabaret license, selling beverages only, the sum of $125.00 per quarter. (7) For a cabaret liquor license, the sum of $300.00 per quarter. (8) For a retail liquor establishment to be maintained only in the zone designated in Section 4, or a drug store, for the distribution of alcoholic liquors in original containers as received from the distiller or wholesaler, not to be consumed on the premises, selling spirituous liquors in quantities not exceeding one quart or thirty-two (32) fluid ounces, wines in quantities of not more than one gallon, or beer in quantities of not more than one case or twenty-four (24) pints, the sum of $50.00 per quarter: (9) For a retail liquor establishment to be maintained only in the zone designated in Section 4, or a drug store, for the distribution of alcoholic liquors in original containers as received from the distiller or wholesaler, not to be consumed on the premises, in quantities not exceeding four and nine-tenths (4.9) gallons to the same person or for the same person's use at any one time, the sum of $125.00 per quarter; (10) For a retail beverage license for the sale of beverages containing not more than five and one-half per cent (5½%) of alcohol by weight, the sum of $10.00 per quarter; (11) For a retail beverage license for the sale of beverages containing not more than twenty per cent (20%) of alcohol by weight, to be sold or distributed in the original containers as received from the distiller or wholesaler, not to be consumed on the premises the sum of $30.00 per quarter. In addition to the foregoing license tax there shall be paid by wholesale and retail beverage licensees an excise tax of four cents (4¢) per gallon or fraction thereof on any beer authorized or permitted by this ordinance, sold, served, distributed or given away. Said tax to be paid and collected as in Ordinance No. 198 provided. Section 6. This ordinance shall take effect April 1, 1934; and this ordinance is passed as an emergency ordinance.