Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

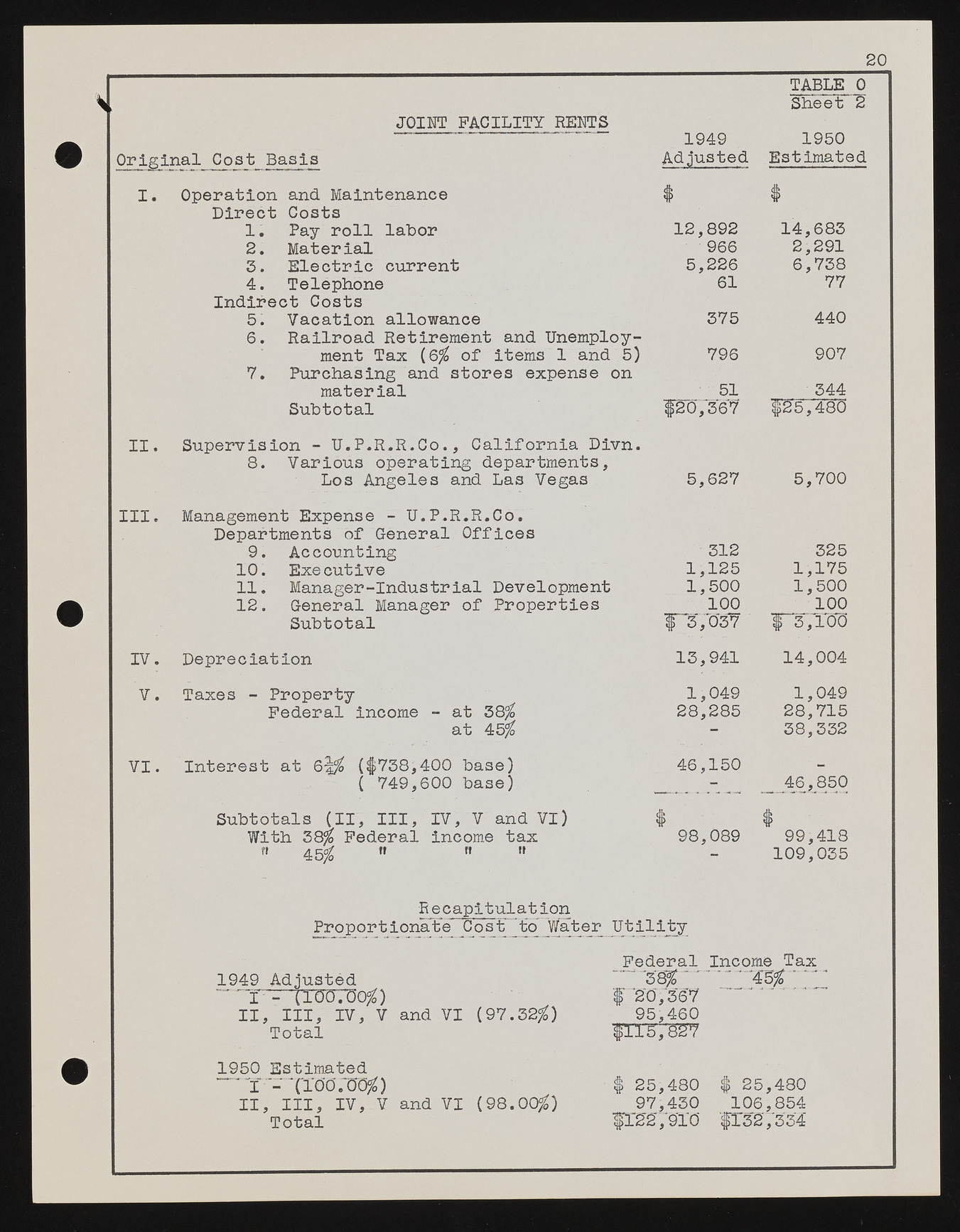

20 JOINT FACILITY RENTS Original Cost Basis I. Operation and Maintenance Direct Costs 1 . Pay roll labor 2. Material 5. Electric current 4. Telephone Indirect Costs 5. Vacation allowance 6 . Railroad Retirement and Unemployment Tax (6$ of items 1 and 5) 7. Purchasing and stores expense on material Subtotal II. Supervision - U.P.R.R.Co., California Divn. 8 . Various operating departments, Los Angeles and Las Vegas III. Management Expense - U.P.R.R.Co. Departments of General Offices 9. Accounting 10. Executive 11. Manager-Industrial Development 12. General Manager of Properties Subtotal IV. Depreciation V. Taxes - Property income - at 38$ at 45$ Federal VI. Interest at 6 f$ (#738,400 base) ( 749,600 base) TABLE 0 Sheet 2 1949 1950 Adjusted Estimated $ # 12,892 14,683 966 2,291 5,226 6,738 61 77 375 440 796 907 51 344 $20,367 #25,480 5,627 5,700 312 325 1,125 1,175 1,500 1,500 1 0 0 1 0 0 $“37037 $“3,100 13,941 14,004 1,049 1,049 28,285 28,715 - 38,332 46,150 - _46,850 # I 98,089 99,418 - 109,035 Subtotals (II, III, IV, V and VI) With 38% n 45^ Feden ral incon me ta»x R e capitulat ion Proportionate Cost "to Water Utility __ Federal Income Tax 1949 Adjusted 7 T - '(1 0 0 .'00$) II, III, IV, V and VI (97.32$) Total 1950 Estimated f 20,367 95,460 II, III, IV, V and VI (98.00$) Total $ 25,480 97,430 K ' O # 25,480 106,854 :,334