Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

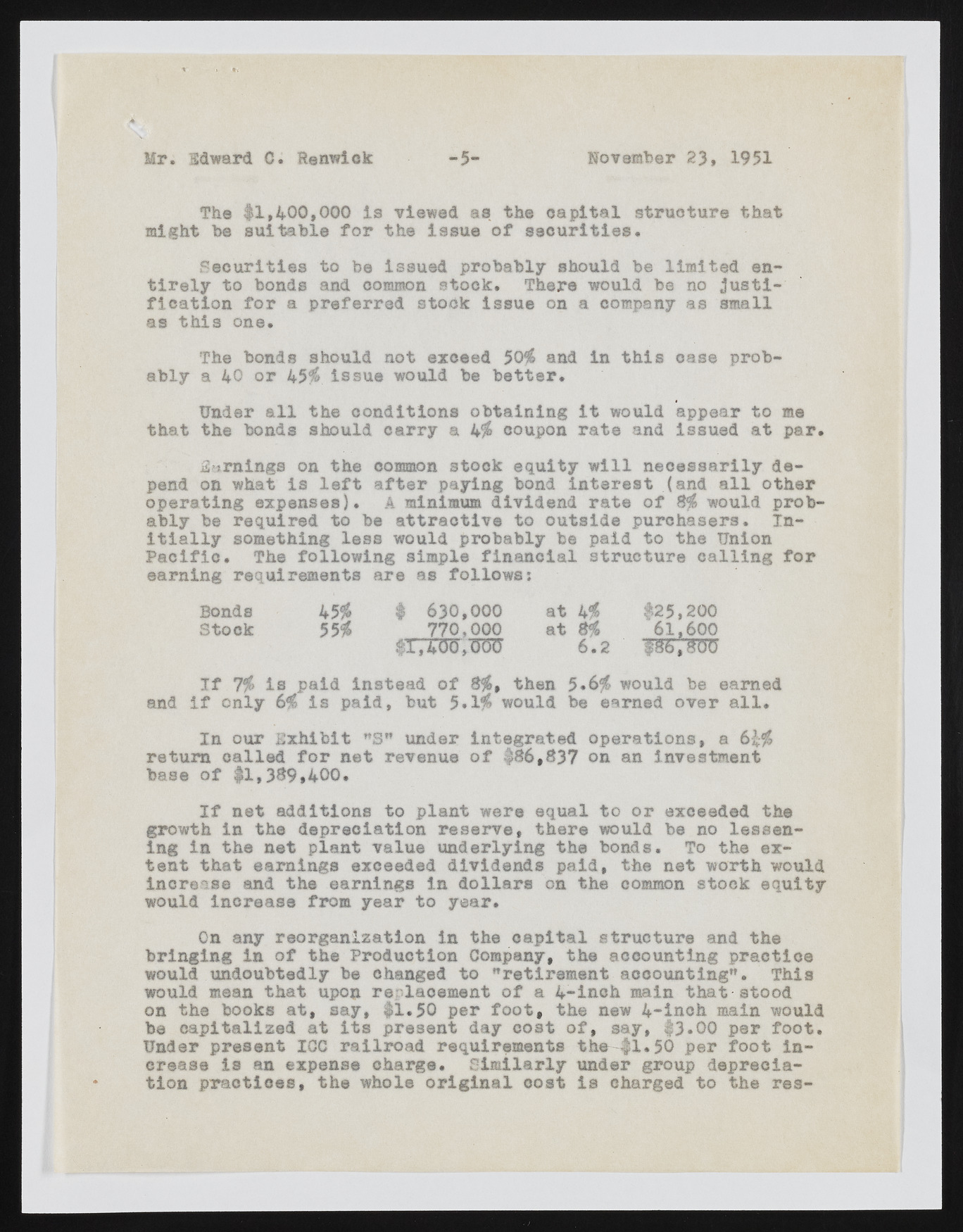

Mr. Edward G. Renwiok -5- November 23, 1951 The # 1 ,4 0 0 ,0 0 0 i s v ie w e d as th e c a p i t a l s t r u c t u r e t h a t m igh t be s u it a b le f o r th e is s u e o f s e c u r i t i e s . S e c u r i t i e s to be is s u e d p r o b a b ly should be lim it e d ent i r e l y t o bonds and common s t o c k . T h ere would be no j u s t i f i c a t i o n f o r a p r e fe r r e d s to c k Is s u e on a company as sm a ll as t h i s on e. The bonds should n ot exceed 50$ and in t h i s ca se prob a b ly a 40 o r 45$ is s u e would be b e t t e r . U nder a l l th e c o n d it io n s o b t a in in g i t would a p p ea r t o me t h a t th e bonds should c a r r y a 4$ coupon r a t e and is s u e d a t p a r . E a rn in gs on th e common s to c k e q u it y w i l l n e c e s s a r ily d e pend on what i s l e f t a f t e r p a y in g bond i n t e r e s t (and a l l o t h e r o p e r a t in g e x p e n s e s ). A minimum d iv id e n d r a t e o f 8$ would p rob a b ly be r e q u ir e d to be a t t r a c t i v e to o u ts id e p u rc h a s e rs . I n i t i a l l y som eth in g le s s w ould p r o b a b ly be p a id t o th e Union P a c i f i c . The f o l lo w i n g sim p le f i n a n c i a l s t r u c t u r e c a l l i n g f o r e a r n in g re q u irem e n ts a r e as f o l lo w s : Bonds 45$ # 630,000 a t 4$ #25,200 S to c k 55$ 770,000 a t 8$ 61,600 $ r , W , O T ? 6 .2 w t s g u I f 7$ i s p a id In s te a d o f 8 $ , then 5 .6 $ would be ea rn ed and i f o n ly 6$ i s p a id , but 5.1$ w ould be earned o v e r a l l . I n our E x h ib it ” S " under in t e g r a t e d o p e r a t io n s , a 6£$ r e t u r n c a lle d f o r n e t reven u e o f #86,837 on an in v e s tm e n t base o f #1,3& 9»400. I f n e t a d d it io n s t o p la n t w ere e q u a l t o o r exceed ed th e g row th in th e d e p r e c ia t io n r e s e r v e , t h e r e would be no le s s e n in g in th e n e t p la n t v a lu e u n d e r ly in g th e bonds. To th e e x t e n t t h a t e a r n in g s exceed ed d iv id e n d s p a id , th e n e t w o rth would in c r e a s e and th e e a rn in g s in d o l l a r s on th e common s to c k e q u it y would in c r e a s e from y e a r t o y e a r . On any r e o r g a n iz a t io n in th e c a p i t a l s t r u c tu r e and th e b r in g in g in o f th e P r o d u c tio n Company, th e a c c o u n tin g p r a c t ic e would u n d o u b te d ly be changed to " r e t ir e m e n t a c c o u n tin g ” . T h is would mean t h a t upon re p la c em e n t o f a 4 -in o h main t h a t s to o d on th e books a t , s a y , #1.50 p e r f o o t , th e new 4 -in o h main would be c a p i t a l i z e d a t i t s p r e s e n t day c o s t o f , sa y , # 3 .0 0 p e r f o o t . U nder p r e s e n t ICC r a ilr o a d req u irem e n ts t h e # 1 .5 0 p e r f o o t i n c r e a s e i s an expen se c h a r g e . S im i l a r l y under group d e p r e c ia t io n p r a c t ic e s , th e w h ole o r i g i n a l c o s t i s ch arged t o th e r e s -