Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

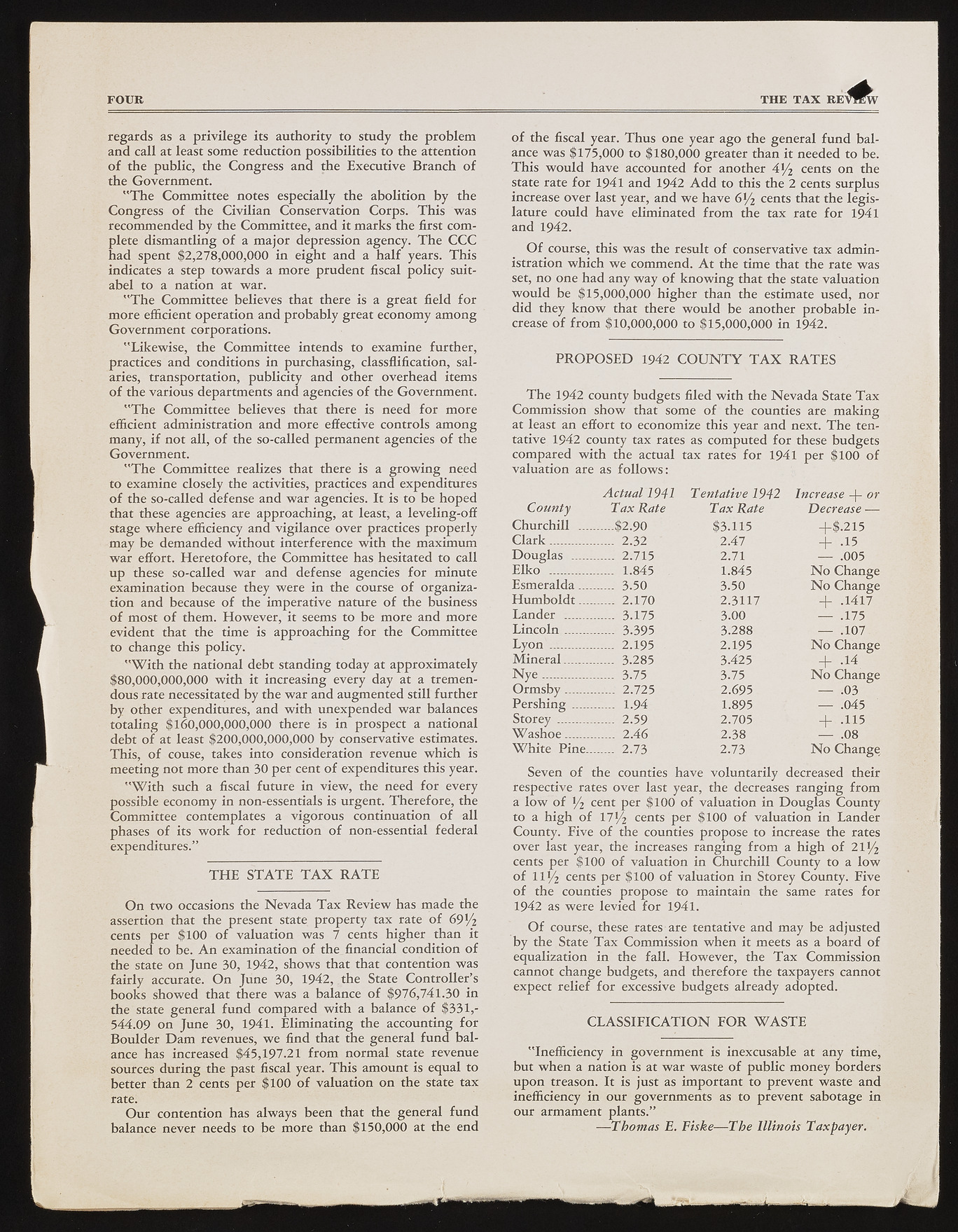

FOUR THE TAX REVIEW regards as a privilege its authority to study the problem and call at least some reduction possibilities to the attention o f the public, the Congress and the Executive Branch o f the Governm ent. "T h e Committee notes especially the abolition by the Congress o f the Civilian Conservation Corps. T h is was recom m ended by the Committee, and it marks the first com plete dism antling o f a m ajor depression agency. T h e C C C had spent $2,278,000,000 in eight and a h a lf years. T h is indicates a step tow ards a m ore prudent fiscal policy suit-abel to a nation at war. " T h e Committee believes that there is a great field fo r m ore efficient operation and p ro b ab ly great economy am ong G overnm ent corporations. "Lik ew ise, the Committee intends to examine further, practices and conditions in purchasing, classflification, salaries, transportation, publicity and other overhead items o f the various departments and agencies o f the Governm ent. "T h e Committee believes that there is need fo r m ore efficient administration and m ore effective controls am ong many, if not all, o f the so-called perm anent agencies o f the G overnm ent. "T h e Committee realizes that there is a g ro w in g need to examine closely the activities, practices and expenditures o f the so-called defense and w a r agencies. It is to be hoped that these agencies are approaching, at least, a leveling-off stage w h ere efficiency and vigilance over practices properly may be dem anded w ithout interference w ith the m axim um w a r effort. H eretofore, the Committee has hesitated to call u p these so-called w a r and defense agencies fo r minute exam ination because they w ere in the course o f organization and because o f the imperative nature o f the business o f most o f them. H o w ev er, it seems to be m ore and m ore evident that the time is approaching fo r the Committee to change this policy. " W i t h the national debt standing today at approxim ately $80,000,000,000 w ith it increasing every day at a tremendous rate necessitated by the w a r and augm ented still further by other expenditures, and w ith unexpended w a r balances totaling $160,000,000,000 there is in prospect a national debt o f at least $200,000,000,000 by conservative estimates. This, o f couse, takes into consideration revenue w hich is m eeting not m ore than 30 per cent o f expenditures this year. " W i t h such a fiscal future in view , the need fo r every possible economy in non-essentials is urgent. T h erefore, the Committee contemplates a vigorous continuation o f all phases o f its w o rk fo r reduction o f non-essential federal expenditures.” T H E S T A T E T A X R A T E O n tw o occasions the N e v a d a T a x R eview has m ade the assertion that the present state property tax rate o f 69*/2 cents per $100 o f valuation was 7 cents higher than it needed to be. A n exam ination o f the financial condition o f the state on June 30, 1942, shows that that contention w as fa irly accurate. O n June 30, 1942, the State C on troller’s books show ed that there w as a balance o f $976,741.30 in the state general fu n d com pared w ith a balance o f $331,- 544.09 on June 30, 1941. Elim inating the accounting fo r B o u ld er D a m revenues, w e find that the general fu n d b a lance has increased $45,197.21 fro m norm al state revenue sources du rin g the past fiscal year. T h is amount is equal to better than 2 cents per $100 o f valuation on the state tax rate. O u r contention has always been that the general fu n d balance never needs to be m ore than $150,000 at the end o f the fiscal year. T h u s one year ago the general fu n d b a lance w as $175,000 to $180,000 greater than it needed to be. T h is w o u ld have accounted fo r another 4l/2 cents on the state rate fo r 1941 and 1942 A d d to this the 2 cents surplus increase over last year, and w e have 65/2 cents that the legislature could have eliminated from the tax rate fo r 1941 and 1942. O f course, this w as the result o f conservative tax adm inistration w hich w e commend. A t the time that the rate was set, no one had any w ay o f k n o w in g that the state valuation w o u ld be $15,000,000 h igher than the estimate used, nor did they k n o w that there w o u ld be another p ro bable in crease o f fro m $10,000,000 to $15,000,000 in 1942. P R O P O S E D 1942 C O U N T Y T A X R A T E S T h e 1942 county budgets filed w ith the N e v a d a State T a x Com m ission sh ow that some o f the counties are m aking at least an effort to economize this year and next. T h e tentative 1942 county tax rates as com puted fo r these budgets com pared w ith the actual tax rates fo r 1941 per $100 o f valuation are as fo llo w s : C ounty A ctu a l 1941 T a x Rate T en ta tive 1942 T a x Rate Increase -M o r Decrease -— • Churchill ......... $2.90 $3,115 +$•215 C la r k ............ ..... 2.32 2.47 + -15 D o u g la s ...... ..... 2.715 2.71 — .005 E lk o .................. 1.845 1.845 N o Change E sm e ra ld a .... ..... 3.50 3.50 N o Change H u m b o ld t .......... 2.170 2.3117 I H .1417 Lander ........ ..... 3.175 3.00 — .175 L in c o ln ........ ..... 3.395 3.288 — .107 L yon ............ ...... 2.195 2.195 N o Change M in e r a l.............. 3.285 3.425 N y e .............. ....... 3.75 3.75 KNlo 'Ch1a4nge O r m s b y ........ .... . 2.725 2.695 K 9 0 3 Pershing ..... ..... 1.94 1.895 — .045 Storey .......... ..... 2.59 2.705 ? J - 1 , 1 5 W a s h o e ...... , ..... 2.46 2.38 — -,.08 W h it e Pine.. ..... 2.73 2.73 N o Change Seven o f the counties have voluntarily decreased their respective rates over last year, the decreases ran gin g from a lo w o f I/2 cent per $100 o f valuation in D o u g la s County to a h igh o f 171/2 cents per $100 o f valuation in Lander County. Five o f the counties propose to increase the rates over last year, the increases ran gin g from a h igh o f 2 iy 2 cents per $100 o f valuation in Churchill County to a lo w o f l l !/2 cents per $100 o f valuation in Storey County. Five o f the counties propose to maintain the same rates fo r 1942 as w ere levied fo r 1941. O f course, these rates are tentative and may be adjusted by the State T a x Com m ission w h en it meets as a board o f equalization in the fall. H ow ever, the T a x Com m ission cannot change budgets, and therefore the taxpayers cannot expect relief fo r excessive budgets already adopted. C L A S S I F I C A T I O N F O R W A S T E "Inefficiency in governm ent is inexcusable at any time, but w h en a nation is at w a r waste o f public m oney borders upon treason. It is just as im portant to prevent waste and inefficiency in our governm ents as to prevent sabotage in our armament plants.” — Thom as E. Fiske— T h e Illin o is Taxpayer.