Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

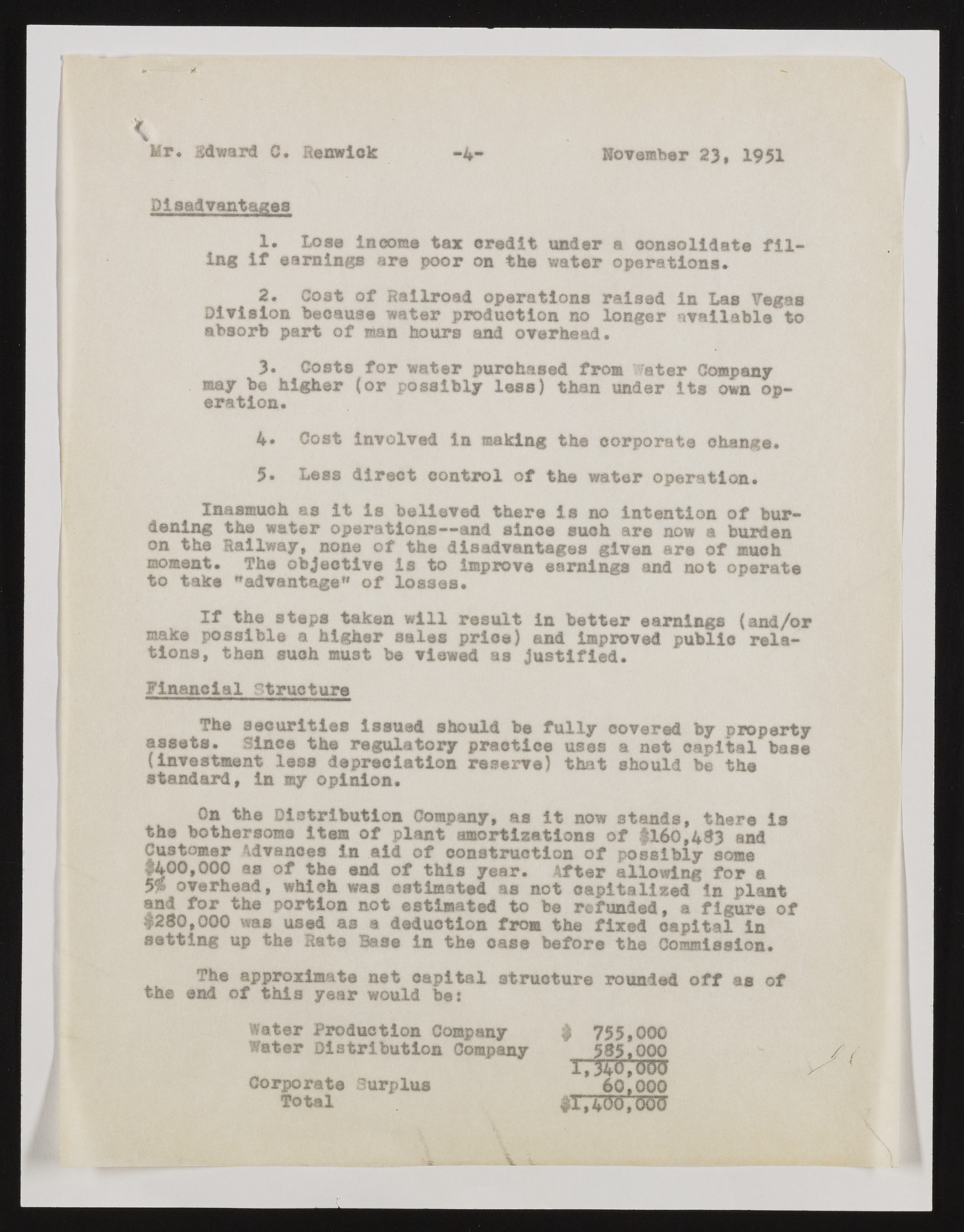

Mr. Edward C. Eenwick - 4 November 23, 1951 S|sadvantages 1. Lose Income tax credit under a consolidate filing if earnings are poor on the water operations. 2. Cost of Railroad operations raised in Las Yegas Division because water production no longer available to absorb part of man hours and overhead. 3. Costs for water purchased from Water Company may be higher (or possibly less) than under its own operation. 4» Cost involved in making the corporate change. 5. Loss direct control of the water operation. Inasmuch as it is believed there is no intention of burdening the water operations— and since such are now a burden on the Railway, none of the disadvantages given are of much moment. The objective is to improve earnings and not operate to take "advantage” of losses* If the steps taken will result in better earnings (and/or make possible a higher sales price) and improved public relations, then suoh must be viewed as justified. Financial Structure The securities issued should be fully covered by property assets. Since the regulatory practice uses a net capital base (investment less depreciation reserve) that should be the standard, in my opinion. On the Distribution Company, as it now stands, there is the bothersome item of plant amortizations of f160,483 and Customer Advances in aid of construction of possibly some 1400,000 as of the end of this year. After allowing for a 5% overhead, which was estimated as not capitalized In plant and for the portion not estimated to be refunded, a figure of #280,000 was used as a deduction from the fixed capital in setting up the Rate Base in the case before the Commission. The approximate net capital structure rounded off as of the and of this year would bet Water Production Company Water Distribution Company 585,000 60,000 # 755,000 Corporate Surplus Total v