Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

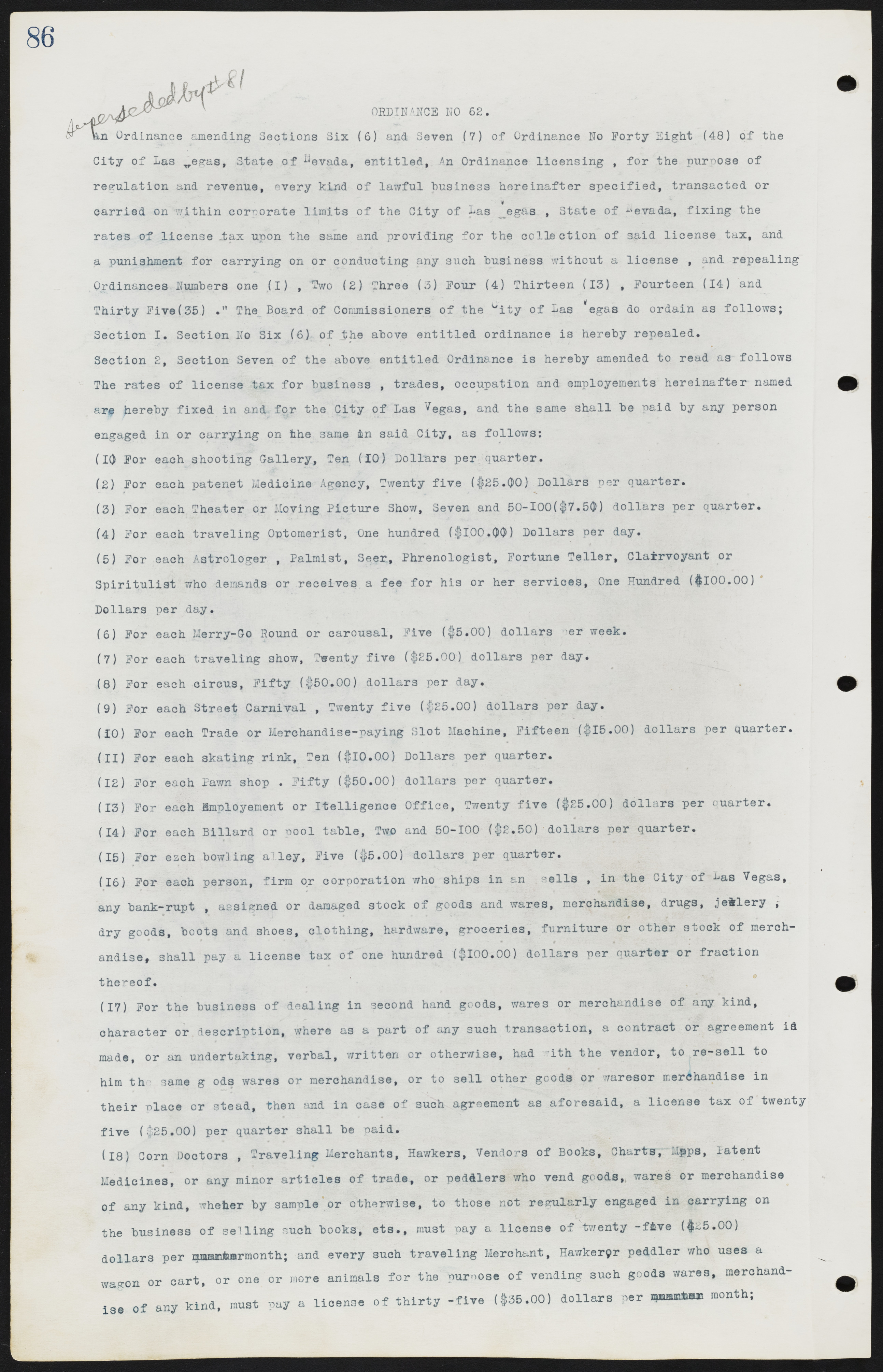

ORDINANCE NO 62. An Ordinance amending Sections Six (6) and Seven (7) of Ordinance No Forty Eight (48) of the City of Las Vegas, State of Nevada, entitled, An Ordinance licensing, for the purpose of regulation and revenue, every kind of lawful business hereinafter specified, transacted or carried on within corporate limits of the City of Las Vegas, State of Nevada, fixing the rates of license tax upon the same and providing for the collection of said license tax, and a punishment for carrying on or conducting any such business without a license, and repealing Ordinances Numbers one (1), Two (2) Three (3) Four (4) Thirteen (13), Fourteen (14) and Thirty Five (35) The Board of Commissioners of the City of Las egas do ordain as follows; Section 1. Section No Six (6) of the above entitled ordinance is hereby repealed. Section 2, Section Seven of the above entitled Ordinance is hereby amended to read as follows The rates of license tax for business, trades, occupation and employments hereinafter named are hereby fixed in and for the City of Las Vegas, and the same shall be paid by any person engaged in or carrying on the same in said City, as follows: (1) For each shooting Gallery, Ten (10) Dollars per quarter. (2) For each patent Medicine Agency, Twenty five ($25.00) Dollars per quarter. (3) For each Theater or Moving Picture Show, Seven and 50-100($7.50) dollars per quarter. (4) For each traveling Optometrist, One hundred ($100.00) Dollars per day. (5) For each Astrologer, Palmist, Seer, Phrenologist, Fortune Teller, Clairvoyant or Spiritualist who demands or receives a fee for his or her services, One Hundred ($100.00) Dollars per day. (6) For each Merry-Go Round or carousal, Five ($5.00) dollars per week. (7) For each traveling show, Twenty five ($25.00) dollars per day. (8) For each circus, Fifty ($50.00) dollars per day. (9) For each Street Carnival, Twenty five ($25.00) dollars per day. (10) For each Trade or Merchandise-paying Slot Machine, Fifteen ($15.00) dollars per quarter. (11) For each skating rink, Ten ($10.00) Dollars per quarter. (12) For each Pawn shop, Fifty ($50.00) dollars per quarter. (13) For each Employment or Intelligence Office, Twenty five ($25.00) dollars per quarter. (14) For each Billiard or pool table, Two and 50-100 ($2.50) dollars per quarter. (15) For each bowling alley, Five ($5.00) dollars per quarter. (16) For each person, firm or corporation who ships in an sells, in the City of Las Vegas, any bankrupt, assigned or damaged stock of goods and wares, merchandise, drugs, jewelry, dry goods, boots and shoes, clothing, hardware, groceries, furniture or other stock of merchandise, shall pay a license tax of one hundred ($100.00) dollars per quarter or fraction thereof. (17) For the business of dealing in second hand goods, wares or merchandise of any kind, character or description, where as a part of any such transaction, a contract or agreement id made, or an undertaking, verbal, written or otherwise, had with the vendor, to re-sell to him the same goods, wares or merchandise, or to sell other goods or wares or merchandise in their place or stead, then and in case of such agreement as aforesaid, a license tax of twenty five ($25.00) per quarter shall be paid. (18) Corn Doctors, Traveling Merchants, Hawkers, Vendors of Books, Charts, Maps, Patent Medicines, or any minor articles of trade, or peddlers who vend goods, wares or merchandise of any kind, whether by sample or otherwise, to those not regularly engaged in carrying on the business of selling such books, etc., must pay a license of twenty-five ($25.00) dollars per month; and every such traveling Merchant, Hawker or peddler who uses a wagon or cart, or one or more animals for the purpose of vending such goods wares, merchandise of any kind, must pay a license of thirty-five ($35.00) dollars per month;