Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

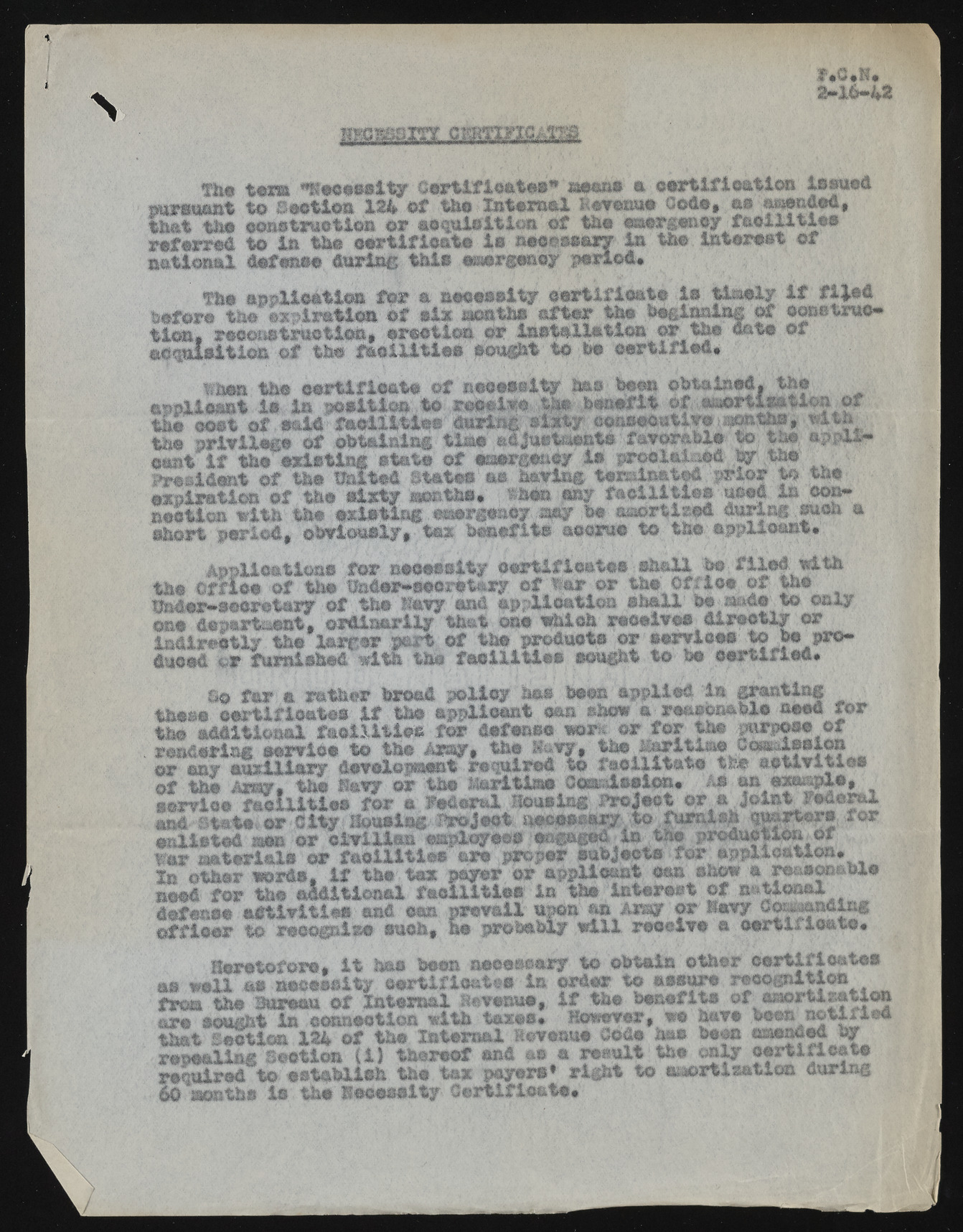

f«o«iu 3-lb—42 t « » ’"tfecesslty1 Certificates" means a certification Issued pursuant to Section 124 of t o Internal Revenue Code* as amended, that #i# construction or acquisition of the esergstaey faoiiltie# referred to la the certificate is n m n m r n m . is t o interest of national defuse# during this emergency poriod* the application for a necessity certificate is timely if filed before the expiration of six months after the beglaa-laf of construction, T w o t m trust ion , erection Or installation or the date of acquisition of the facilities sought to be certified* When the certifleate of necessity has M » obtained, the applicant is in position to receiveJ$p ..benefit of C M t t t M t o j # the cosi of said facilities during eentoutiyettoto, the privilege of obtaining tints' adjustments favorable to. ffef waipptlhicant if the existing state of emergency is proolaiaed .by the President of the Halted States as having laminated prior to the expiration of the sixty months* t o n any fee&llties used in coa^ Section with the exieting ^ergeaey .any be amortised during.juch a short period, obviously, tax benefits soeru© to the applicant* Applications for neeeseity ocrilflectes shall be; filed, elth the Of fine of the ttodsMSOxstary of tar or the Of rise, of the Hndexvseoretary of the levy and application shall be ^*de to only one department, ordinarily that one which receive* directly or Indirectly the larger part of the products or service®' to be produced os furnishedwit&to facilities sought to be certified* Se far a rather bread policy t o been applied In granting these certificates if the applicant M shoe a-reasonable need for the additional facilities for defease or for the priToae of ; orren adneyr ianugx isleiravircye dteov etlhoep mieanmtr «r etquoijrgedt ft#o facilitate the aetlvitiee of the Assy* the Havy or t o Mes&tins Ocwtoelcn* as an eja^Pl®!- service facilities for a federal lousing .Project or a Joint federal to/#bate, ordltyAgbueifcft. Inject ueaesmiuy-to .furnish t o f t t o enlisted m m or civilian eaployees engaged in t o production Of War materials or facilities are proper subjects for application* Ip other words, If t o tax payer of applicant ©an shoe a reneoaable need for t o additional facilities in t o interest of national defense sttivities and ©an prevail upon m Army or Bevy Commanding officer to recognise such, he probably will receive a certificate* Heretofore, it t o been aeeeseayy to obtain other certificates as well m necessity certificates in order to assure reoognition from the Bureau of eternal Bevenue, if the benefits of amortisation are sought in connection with tares* However, we have bees notified t o t Section 124 of t o Internal Revenue Oode t o been amended by repealing Section (1) thereof end as a result t o only certificate required to establish the tax payers* right to amortisation during 60 months is the necessity Certificate*