Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

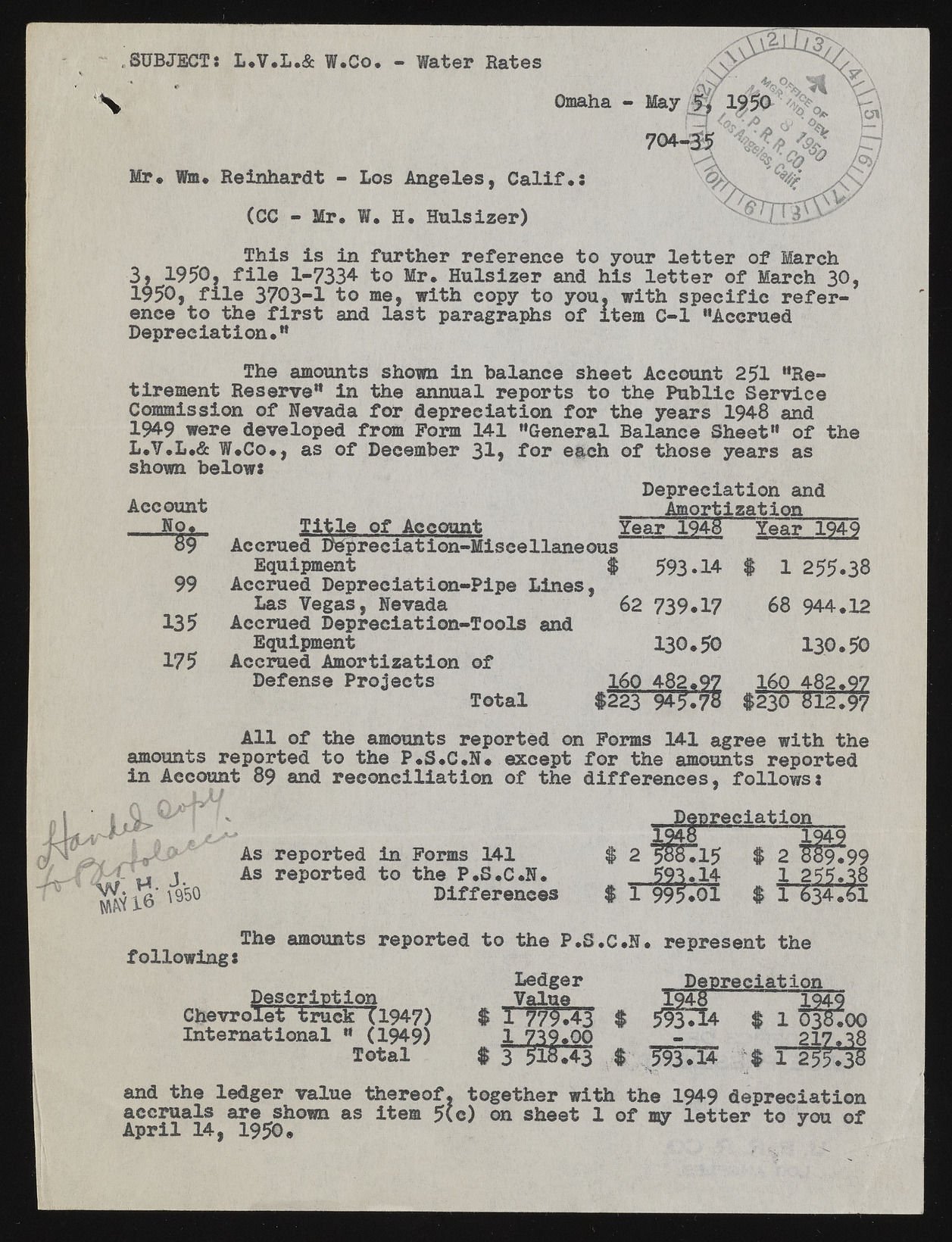

Omaha - .SUBJECT* L*V.L.& W.Co. - Water Rates N Mr* Win* Reinhardt - Los Angeles, Calif.s (CC - Mr. W. E. Hulsizer) This is in further reference to your letter of March 3, 1950, file 1-7334- to Mr. Hulsizer and his letter of March 30, 19 50, file 3 7 0 3 -1 to me, with copy to you, with specific reference to the first and last paragraphs of Item G-l ‘•Accrued Depreciation•” The amounts shown in balance sheet Account 251 "Re-tirement Reserve1* in the annual reports to the Public Service Commission of Nevada for depreciation for the years 194-8 and 1949 were developed from Form 141 “General Balance Sheet” of the L.Y.L.& W*Co*, as of December 3 1 , for each of those years as shown below: Account No. 59 99 135 175 Depreciation and Amortization Title of Account Year 1948 Acerued IMpreciatidn-Miscellaneous Equipment Accrued Depreciation-Pipe Lines, Las Vegas, Nevada 62 739*17 Accrued Depreciation-Tools and Equipment 130*5© Accrued Amortization of Defense Projects 160 482.97 Total $223 94^.78 Year 1949 593.14 $ 1 255.38 68 944*12 130.50 160 482.97 $230 812.97 All of the amounts reported on Forms 141 agree with the amounts reported to the P.S.C.N* except for the amounts reported in Account 89 and reconciliation of the differences, follows: As reported in Forms 141 As reported to the P.S.C.N. Differences Depreciation 1948 T85715 593.14 995.01 2 S&9.99 1 255.^8 1 634.6 1 The amounts reported to the P.S.C.N. represent the following: Description Chevrolet truck (19 47) International ” (1949) Total Ledger Value 1 77^.43 1 739*00 3 518.43 Depreciation 1948 5 ^ 1 4 1 CJ38T00 - 217.88 593.14 ? $ 1 2?5.38 and the ledger value thereof, together with the 1949 depreciation accruals are shown as item 5(c) on sheet 1 of my letter to you of April 14, 1950.