Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

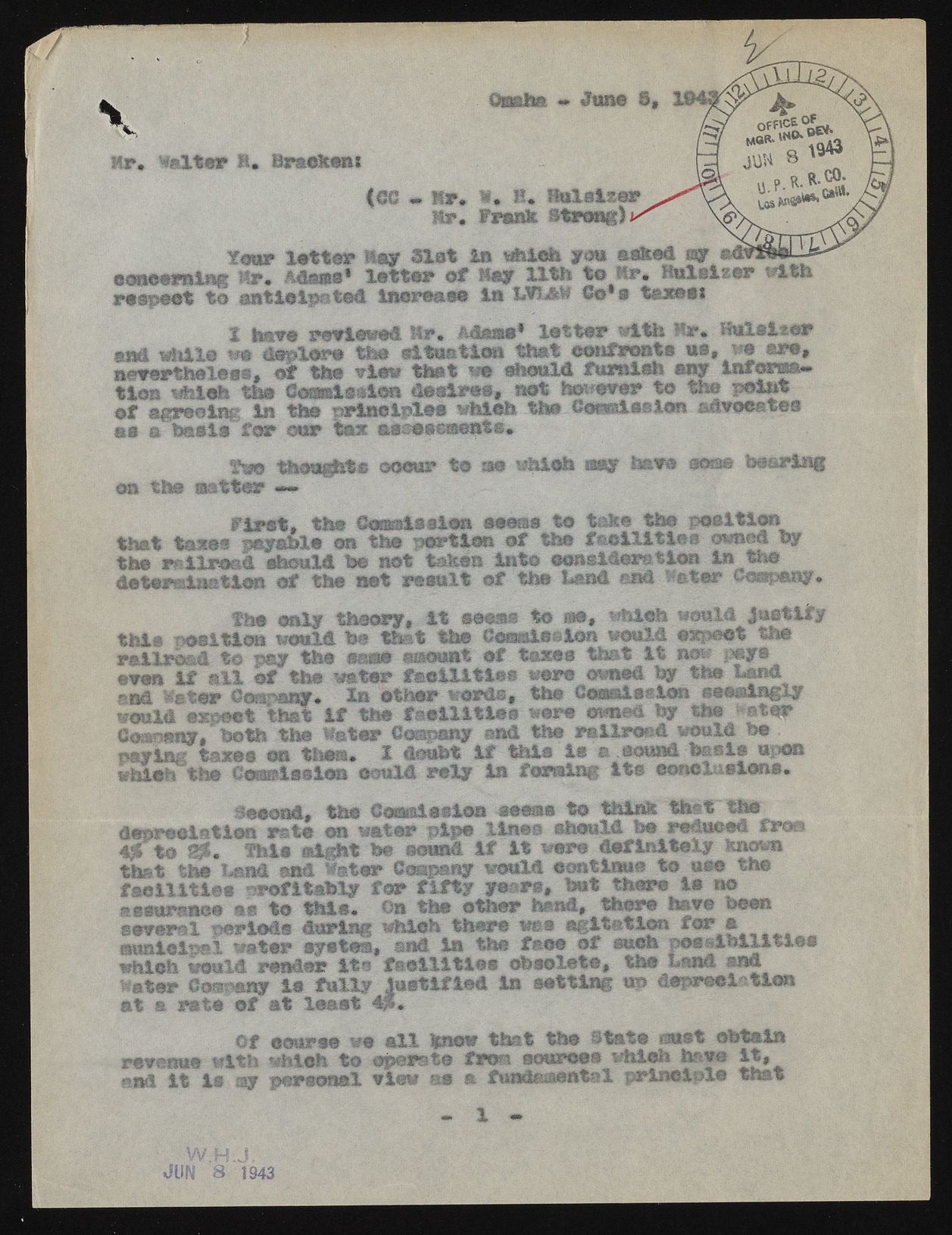

\2, %lter E. Brackent <00 » Mr, Omaha & June t>, If b . K* H u ls ir e r Frank Stron g) ? O f f » c 6 MSR' in0> JUN 8 u.P-R of B©fc R. CO-msfonSP'* ®’c«ut. Y ear l a t t e r May S la t is which yen e sk ^ i * * . * • > concerning Mr* Adame* l a t t e r oaf May XI th to fir* HuXsiser re sp e c t to e a t ie lp s ie d in crease in %MM$ So’ s taxes* X Mara review ed Mr* Adam#* l e t t e r w ith M r. H u ls lt o r y*yt w h ile we d e p lo re the s it u a t io n th at confront® ue# we a r e* n s e s rth e le a s , o f the view th e t no should W inform s^ t i e s M e l s the demadssXCR d e s ir e s , not bsp eeer to tw * ip®^p o f a gre e in g in the p r in c ip le s which the C o h e s i o n advocates s s a b a s is f o r ou r ttax assessm ents. fee thoughts occur tie. me which jfp here m m bearisg on the m etier **•>* F i r s t , the demmisslen seetas to take the p o s itio n th at t a le s payable on the p o rtio n o f the f e e iX lt i e s w o o d by the r a i lr o a d be not taken In to con sid ers tlo n in the determ ination o f the net re s a l t o f the Issnd is®*! Meter Company* fhe only theory, i t seejas to me, which weald Justify this position would be that the Cesjaiesilon would expect the railroad to pay the seas eaeuat o f taxes that it now fttfft even i f a ll of the water fa c ilitie s were owned by the b p d aoQ, Water Oosipany. In other words, the demmissieii seemingly would expect that i f the fa c ilitie s were owned by the £*HP both the Mater Company end the f ilm e d would be ? paying taxes on them* I doubt i f this is a sound basis upon which the Commission emild rely in forming its eonclieions. Second, the Commission seem® to think th at the d ep re c ia tio n r a t e on w ater p ip e lin e s should be reduced from i j t e f h i s e ig h t be i f i t were d e f in it e ly known th a t the la n d end M ater Company would con tin ue to,.use the f a e i l i t l e s p r o fit a b ly f o r f i f t y y e a rs , b a t there I s no assurance as to M s . On the o th e r hand, th ere hare been s e v e ra l p erio d s d urin g which th ere % * a g it a t io n f o r w ater system, end- In the fa c e o f such p o s s i b i l i t i e s which would fen d er i t s f a e i l i t l e s o b s o le te , the band end w ater Sospany i s f u l l y J u s t ifie d In s e ttin g up d e p re c iatio n a t a r a t e o f a t le a s t dp* O f course we a l l know th at the S tate mast o b tain revenue K ith which to op erate from sources which have i t , end i t i s sy p erso n a l slew as a fundamental p r in c ip le th at - 1 - W.H:J. JUN 8 1943