Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

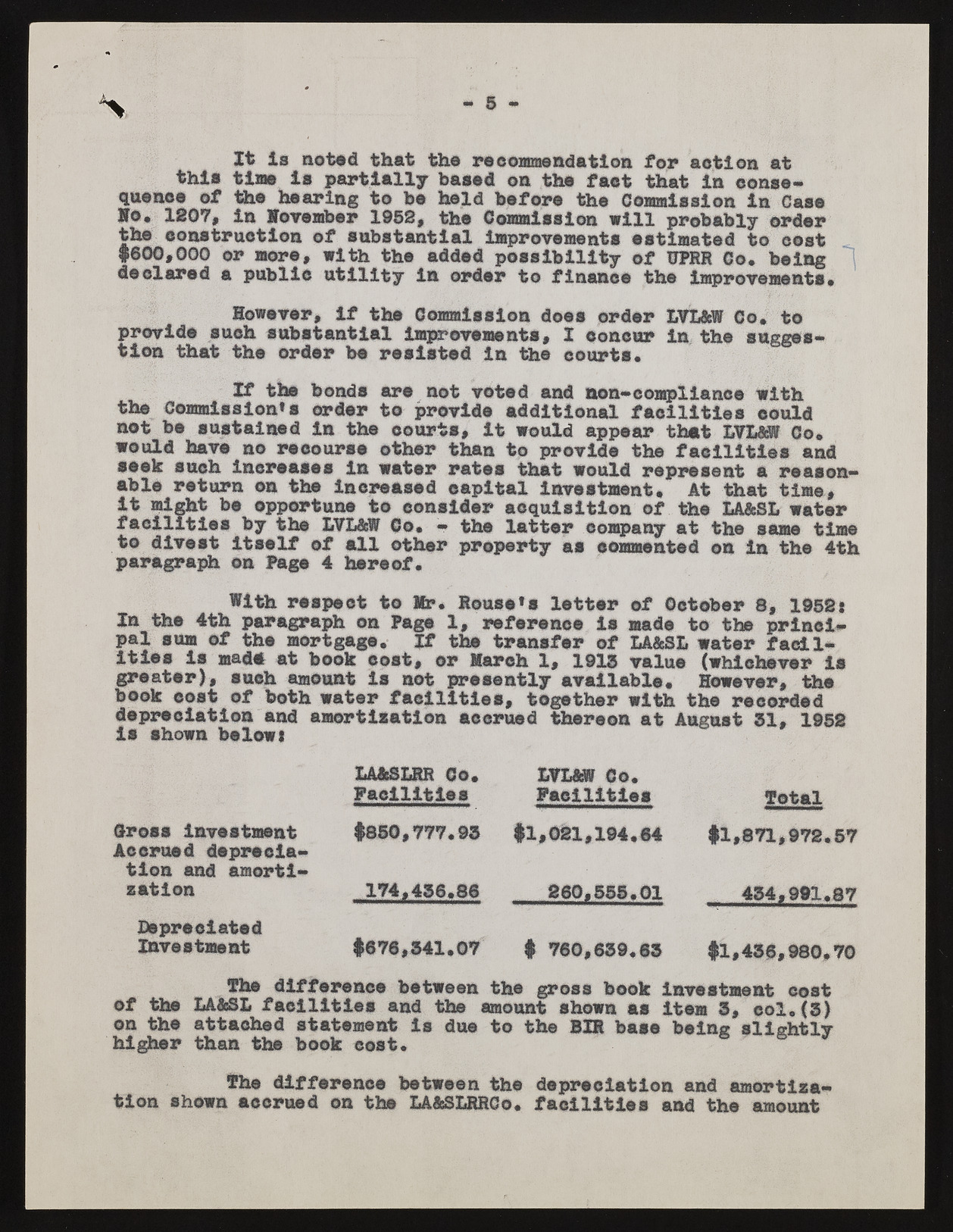

m — 5 — It is noted that the recommendation for action at this time ia partially based on the faet that in consequence of the hearing to be held before the Commission ia Case Ho. 1207, in Hovember 1952, the Commission will probably order the construction of substantial improvements estimated to cost $600,000 or more, with the added possibility of ©PRR Co. being declared a public utility in order to finance the improvements. However, if the Commission does order LVL&W Co. to provide such substantial improvements, X concur la the suggestion that the order be resisted In the courts. If the bonds ars not voted and non—compliance with the Commission*a order to provide additional facilities could not bo sustained ia the courts, it would appear thst LVL&W Co. would have a© recourse other than to provide the facilities and seek such increases in water rates that would represent a reasonable return on the Increased capital investment. At that time, it might be opportune to consider acquisition of the LA&SL water facilities by the LVL&W ©o, - the latter company at the same time to dive at itself of all other property as commented on in the 4th paragraph on Page 4 hereof. With respect to Hr. Rouse’s letter of October 3, 19521 In the 4th paragraph on Page 1, reference is made to the principal sum of the mortgage. If the transfer of LA&SL water facilities Is mad* at book coat, or Mareh 1, 1913 value (whichever Is greater), such amount ia not presently available. However, the book eost of both water facilities, together with the recorded depreciation and amortisation accrued thereon at August 31, 1952 Is shown belowt l a &s l r r ©o . t r u s s Co. Facilities Facilities fetal Cross investment Accrued depreciation and amortisation $850,777.93 $1,021,194.84 $1,871,972.57 174,436.88 260.538.01 434,991.87 Depreciated Investment $676,541.07 $ 760,639.63 $1,436,980.70 The difference between the gross book investment cost of the LA&SL facilities and the amount shown as item 3, col.(3) on the attached statement is due to the BXR base being slightly higher than the book cost. fhe difference between the depreciation and amortisation shown accrued on the LA&SLRRCo. facilities and the amount