Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

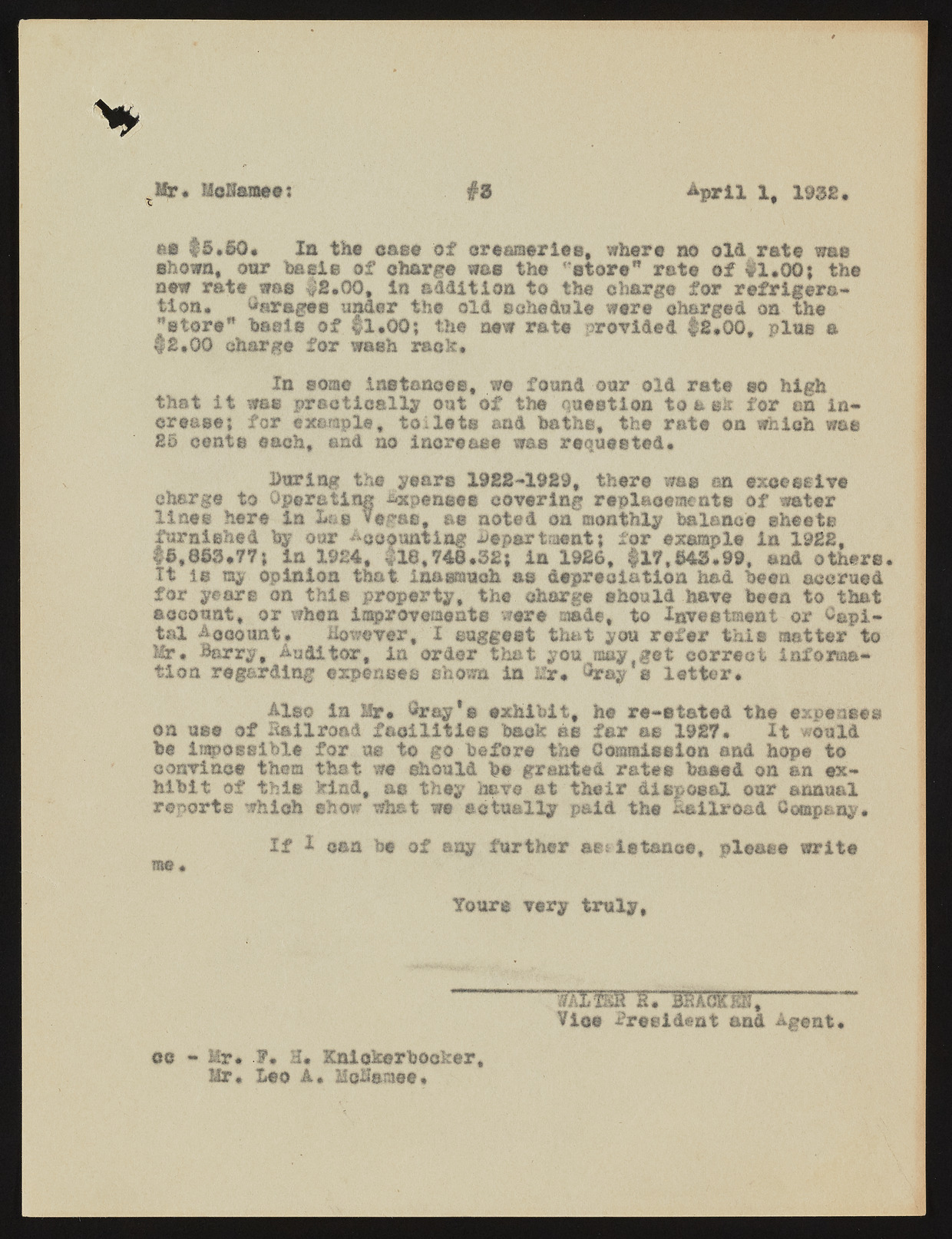

tMr. Mol&mee; . # 1 April 1, 1 9 3 2 . rb f6.60* 2a the ©see of creameries, where no old rate wee shown, our basis of charge was the ‘store* rate of %1*00; the sew rate was #£*00, In addition to the obarge for refrigeration* Garages under the old schedule were charged on the *store” basis of #1*00; the new rate provided fS.GO. pine a f£*00 charge for wash rack* In some instances, we found oar old rate so high that it was practically oat of the Question to a ek for on increase; for example, toilets and baths, the rate on which was E5 cents each, and no increase was requested* Boring the years 1922-1929, there was an excessive charge to Operating expenses covering replacements of water lines here in Las Vegas# as noted on monthly balance sheets furnished by our Accounting Bepartmentj for example la 1922. £6,863.77; in 1924, #18.748*32; in 1926, #17,643*99, and others. It is ray opinion that inasmuch as depreciation had been accrued for yeart on this property, the charge should have been to that account, or when Improvements were made, to Investment or Capital Aooount. However, X suggest that you refer this matter to Mr* Barry, auditor, in order that you may get correct Infomotion regarding expenses shown in 1r* Cray a letter* Also in Mr. Cray * a exhibit, he re-stated the expenses on use of Hail road facilities back as far as 1927* it would be impossible for as to go before the Commission and hope to convince them that we should be granted rates based on an exhibit of this kind, as they have at their disposal our annual reports which ©how what we actually paid the Hailroad Company* If X can be of any further astistanoe, please write me* Tours very truly, ea - Mr* .f* 8* Knickerbocker, Mr* Leo A* MoBsmee* HTfSITSbM.ce mt Vice 2resident and Agent*