Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

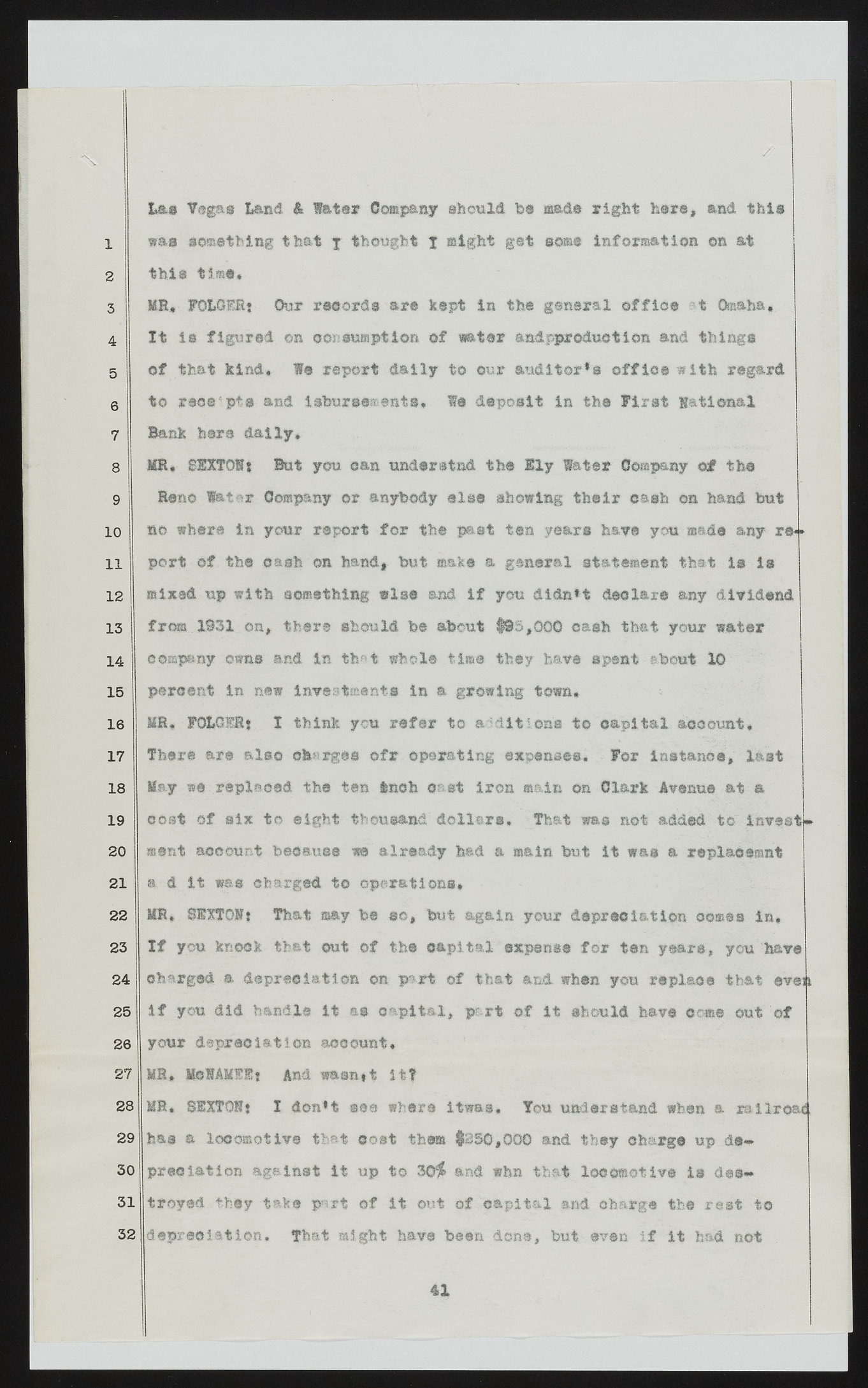

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 22 2i 2( O' M I m f#fgsg Land. & la tar Company should be mad® right her#, and I M s was something that f thought j might get torn® information on at this time# El*- FOtOSE? Our rewords are kept la the general office srt Omaha* It is figured cm ©onsumption of water andopr©duotion and things of that kind* fe report dally to our auditor*a office with regard to r»@e,ph« and isfeursemeats* f# deposit in the Firat gatiea&l Bank here daily* MB* SUfOSi But you e&n understud the Ely later Company of the Reno later Company or anybody else ah ©wing their east fa on hand hut no where in your report for the peat ten year® haw® you made any re** port of the oath on hand-* hut make a general statement that is is mixed up with something else and if you dld&H declare any dividend from. 1931 on, there should fee about t®S ,000 cash that your water company owns mud in ths-t whole time they haw® spent about 10 percent in new investments in & growing tern# Ml* FOIiOMf 1 think j m refer t© additions to capital aooeuat* there are also efcerges ofr.operating expenses. For instance, last Say as replaced the ten Inch oast iron main on Clark Avenue at a eost of six to eight thousand dollar®. That was not added' to' Invest' sent account because we already feed a main but it was a replaoemnt a d it was charged to operations* MB* SEXTONf That may fee so* feut again your dsprsoiation ©owes in. If you knock that out of the capital expense for tea years, you have Charged a depreciation on part of that and when you replace that even if you did handle it as capital, p&rt of it should have pome out of your dspreoittion account, Ml* McIAMSl? And was®.it itt Ml* illfOS? I &on*t see where it was, Tou understand when a ra llro&c. has a locomotive that cost them $330,000 and they charge up depreciation against It up to 30# and whm that locomotive it dee*, troyed they take pert o f it out of capital and charge the rest to depreciation. That might have fee#® done, feut even if it had not 41