Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

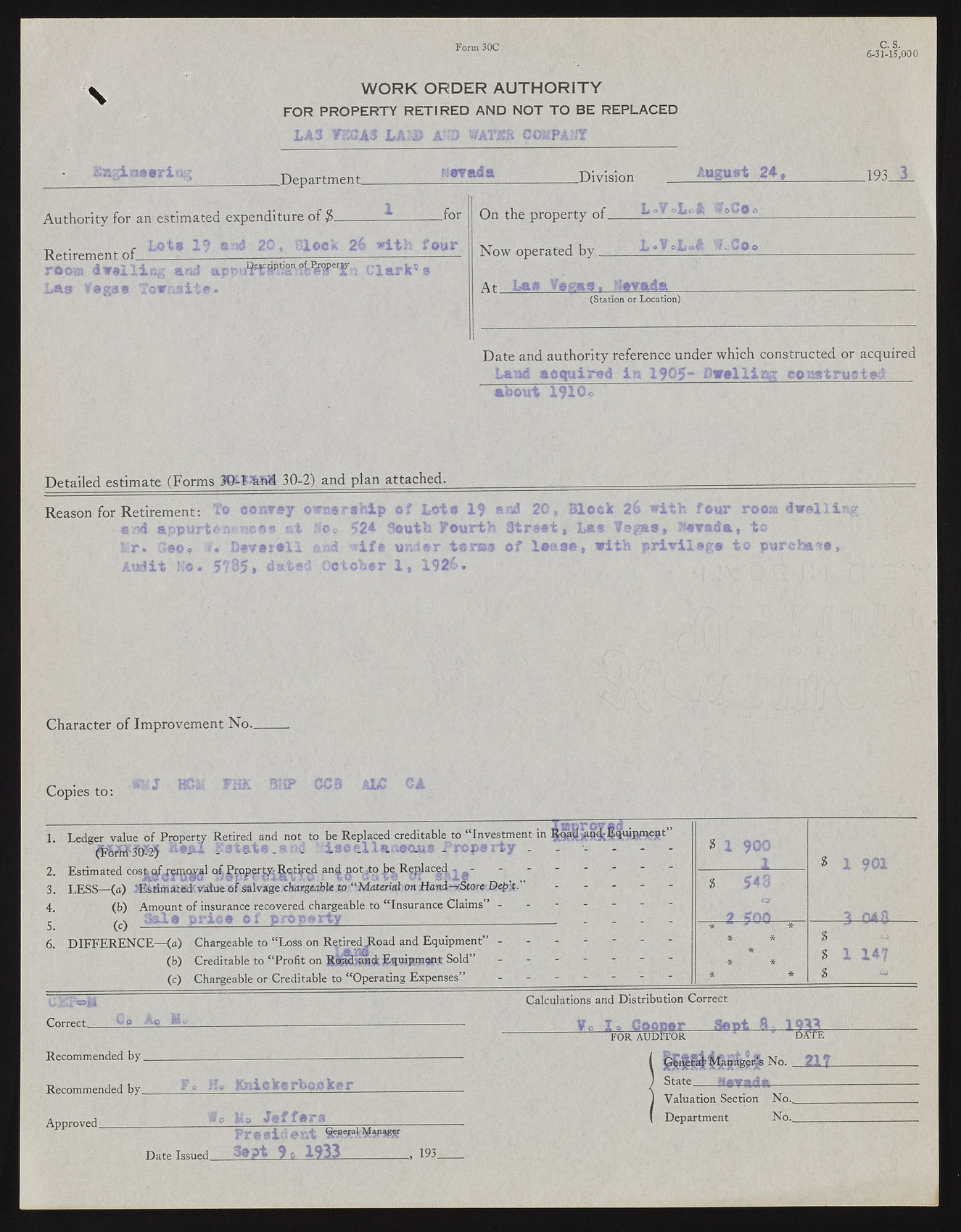

Form 30C C S 6-31-15 joOO y WORK ORDER AUTHORITY FOR PROPERTY RETIRED AND NOT TO BE REPLACED _Department_ Nevada Division August 24. 193 3 Authority for an estimated expenditure of $_ Lots 19 and 20. Slock .for Retirement of_i room dual 11 lAB T with four ,j ^ ^, ^Q&^c^p.tion. 9^.-^<pjperJPr On the property of Now operated by _ At. Las y>gta« Nevada louO o Xji o I oyv (Station or Location) Date and authority reference under which constructed or acquired Laud acquired iu 1905" Swell!gg constructed about 1910c Detailed estimate (Forms IQ-fTiftii 30-2) and plan attached. Reason for Retirement: To convey o $0© 52^ Son" th Four 9 end 20, Block 26 with four room th Street, Lee Fegas* Nevada, to dwell! 1tir. Goo? V. Deveteli Audit No. 5785* dated and tif$ tfjft) 1926. ms of lease, with privilege to pu rchi^i 1 Character of Improvement No. Copies to: 1. Ledger value of Property Retired and not to be Replaced creditable to “Investment in H*** Sst&te.atA iscella seaus Preps rty $ 1 900 1 $ 1 901 3 04 8 2. Estimated cost o/T^moval of Property; ^etife.d and ijotjto b^ Replaced ^ - 3. LESS—(a) JEshmatedCVaiue of salvage -chargeable to “Materiahon HanA-vStore Bepk” - - - - - 4. (b) Amount of insurance recovered chargeable to “Insurance Claims” ------- r* / \ St&Xd price o x prop^i^y . 5. (c) -----------c----------------*7----g------|---------?-------------------------------------- 6. DIFFERENCE—(a) Chargeable to “Loss on RetiredRoad and Equipment” ------- (b) Creditable to “Profit on Rsjlcliaiad; Eapipmijnt Sold” - - - - - - (c) Chargeable or Creditable to “Operating Expenses” - - - - - - . - $ ? i*si% - . 0 dnr) ?4(r': * * * Hal * * * * * $ $ 1147 $ Calculations and Distribution Correct Correct v;» *9 .-----—:—?—:------——- . --------E : . . _ Wa 1 <> Cooper - Sept FOR AUDITOR DATE Recommended by . : ? - V ? . I No. 21? Recommended bv Ay Knickgrbo.okftr------------------------- < ~ Nevada J Valuation Section No. Approved, ? Wo tto JsfftrS_______________. ( Department No.--------- Pr a sii« nt Mwfff Date Issued 9® gt 9 a 1933__________193_______