Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

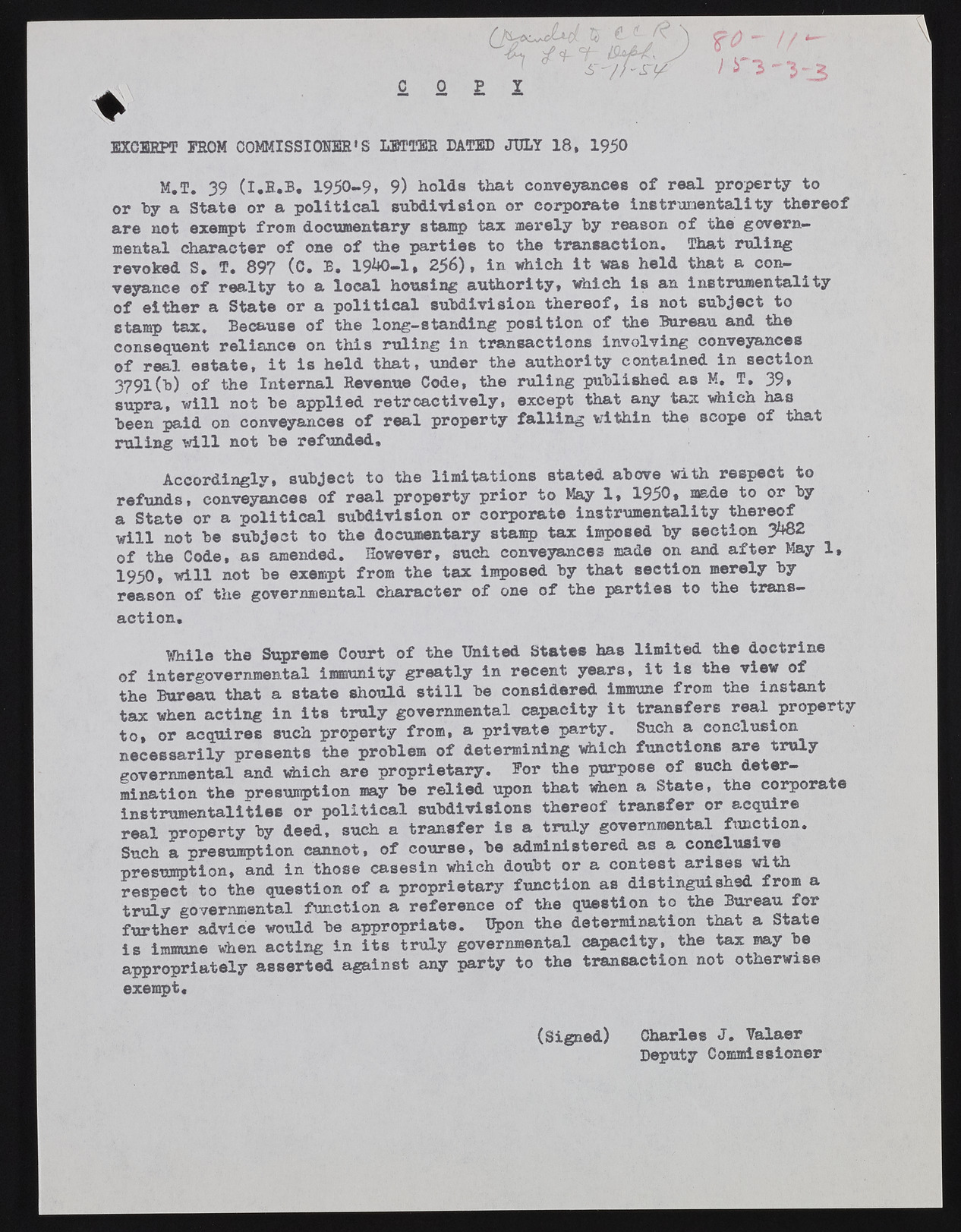

f o - I f 1 '&I /<*- jf UU^f, C O P Y EXCERPT PROM COMMISSIONER'S LETTER DATED JULY 18, 1950 M.T. 39 (I.R.B. 1950-9, 9) holds that conveyances of real property to or by a State or a political subdivision or corporate instrumentality thereof are not exempt from documentary stamp tax merely by reason of the governmental character of one of the parties to the transaction. That ruling revoked S. T. 897 (C. B. 19^-1, 256), in which it was held that a conveyance of realty to a local housing authority, which is an instrumentality of either a State or a political subdivision thereof, is not subject to stamp tax. Because of the long-standing position of the Bureau and the consequent reliance on this ruling in transactions involving conveyances of real estate, it is held that, under the authority contained in section 3791(b) of the Internal Revenue Code, the ruling published as M. T. 39* supra, will not be applied retroactively, except that any tax which has been paid on conveyances of real property falling within the scope of that ruling will not be refunded. Accordingly, subject to the limitations stated above with respect to refunds, conveyances of real property prior to May 1, 1950, made to or by a State or a political subdivision or corporate instrumentality thereof will not be subject to the documentary stamp tax imposed by section 3^2 of the Code, as amended. However, such conveyances made on and after May 1, 1950, will not be exempt from the tax imposed by that section merely by reason of the governmental character of one of the parties to the transWhile the Supreme Court of the United States has limited the doctrine of intergovernmental immunity greatly in recent years, it is the view of the Bureau that a state should still be considered immune from the instant tax when acting in its truly governmental capacity it transfers real property to, or acquires such property from, a private party. Such a conclusion necessarily presents the problem of determining which functions are truly governmental and which are proprietary. For the purpose of such determination the presumption may be relied upon that when a State, the corporate instrumentalities or political subdivisions thereof transfer or acquire real property by deed, such a transfer is a truly governmental function. Such a presumption cannot, of course, be administered as a conclusive presumption, and in those casesin which doubt or a contest arises with respect to the question of a proprietary function as distinguished from a truly governmental function a reference of the question to the Bureau for further advice would be appropriate. Upon the determination that a State is immune when acting in its truly governmental capacity, the tax may be appropriately asserted against any party to the transaction not otherwise action exempt (Signed) Charles J. Valaer Deputy Commissioner