Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

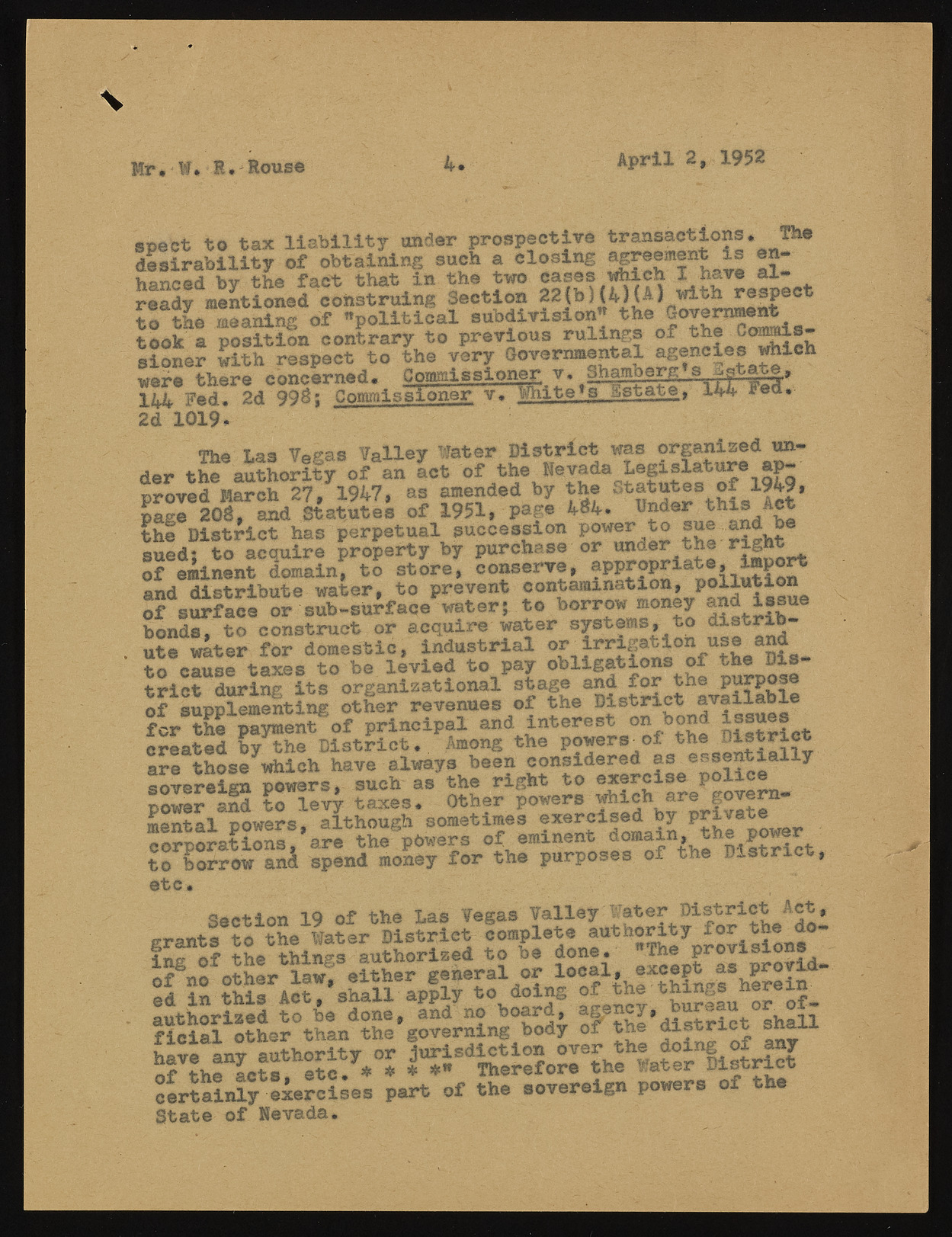

Mr, W. E, House 4. April 2, 1952 spect to tax liability under prospective transact±0ns. The desirability of obtaining such a closing agpesjna:nt is enhanced by the fact that in the two eases which I hsive al- ready mentioned construing Section 22(b)(4)(A) with respect to the meaning of Apolitical subdivision” the took a position contrary to previous rulings of the sioner with respect to the very Governmental agencies which were there concerned* Commissioner v» Shamberg s .d>gta^e, 144 Fed. 2d 99$; Commissioner v. White * a Estate, 144 Fed. 2d 1019* The Las Vegas Valley Water District was organised under the authority of an act of .proved March 27, 1947, as amendte5de ^bNye ^thedaqtatuttstof81949 ptaheg e Di2s0$t,r icatn d haSst apteurtpeest uoafl 1 9s5u1c,c epssaipo n 4$p4o.wer to sue sued: to acquire property by purchase or under the of eminent domain, to store, conserve, a n d distribute water, to prevent contamination, pollution 0? sSlaoe or sSbl^ f a o e V t e r ; to borrow money and issue bonds, to construct or acquire water systems, to distribute water for domestic, industrial or i r r i g ? to cause taxes to be levied to pay obligaoions of the Dis torfl catti rdmulreimnegn tiitnsg ootrhgearn izraetvieonnuaels osft atghee iD^i strict avgajiiiaabolxee fcrTte p a F e * of principal and interest on bond issues carree attheods eb yw hthiec hD ihsatvrei catl.w aysA mobnege nt hceo npsiodwereerd saJs *e®v isSennttiiaallllvy Sovereign cowers, such as the right to exercise police S t o la w - taxes. Other powers which are govern-mceonrtpaorla tpioowenrss,, aarle thtoheu gpho wseormse tiomfeesm ienxeenrtcidsoemdabiyn .ptrhiveaptoew er to borrow and spend money for the purposes of the District, etc. Section 19 of the Las Vegas Valley Water piprict J.ct* grants to the Water District complete authority for the do- +ws things authorized to be done. ”The provisions ^ n f o t h e r ^ w f elthe? general or aeudt hionr tihziesd tAcot ,b e sdhoanlel, apapnldy ntoo bodaoridn,g aogfe ntchye * km.au1 c r^ of- ficial other than the governing body of the district snan h»ve anv authority or jurisdiction over the doing of any Of J h l LtS! etc. * * * *« Therefore the Water District certainly exercises part of the sovereign powers of the State of Nevada.