Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

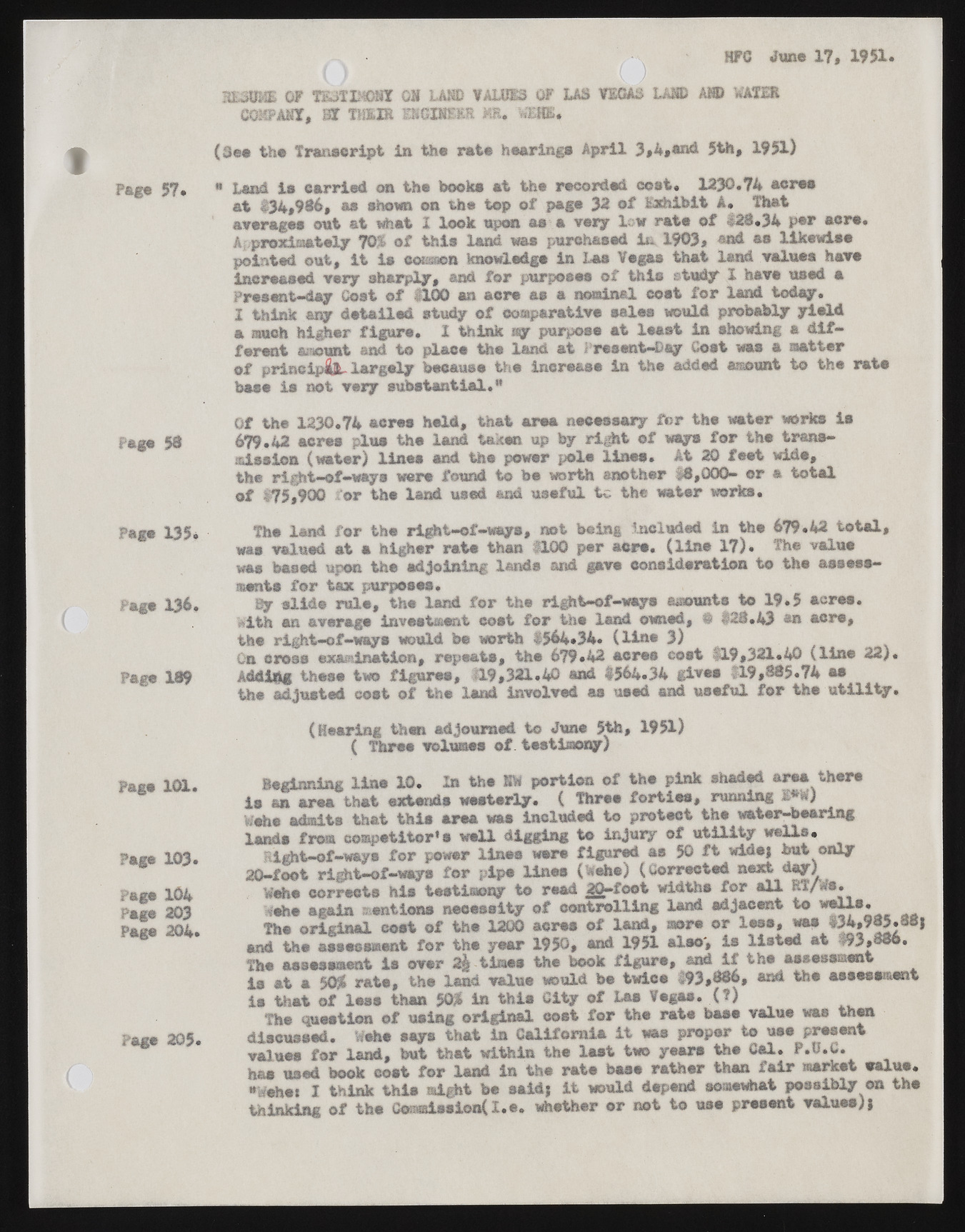

HTG June 17, 1951* Page 57. Page 58 Page 135. Page 136. Page 189 Page 101. Page 103. Page 104 Page 203 Page 204. Page 205* l o S l S E S i ^ O 3E30MS OF TEJT1CHI OK L A W VAWM3 OF U S VISAS LAUD At© WATER COMPACT, M m m EHOIKE-ER MR* WERE. (See the Transcript in the rate hearings April 3»4,*nd 5th, 1951) » land la carried on the books at the recorded cost. 1230.74 acres at #34,984, as shown on the top of page 32 of Exhibit A. That averages oat at what I look upon as a very low rate of <£28*34 per aore. Approximately 70S of this land was purchased in 1903* ®ad as likewiss pointed out, It is coi«©n knowlsdgs in Las Vsgas that land values have increased very aherply, and for purpose# of this study I have used a Present-day Cost of 1100 an aero as a nominal cost for land today. I think ary detailed study of comparative sales would probably yield a much higher figure. I think ay purpose at least in showing a different amount and to place the land at J resent—Day Cost was a matter of principle largely because the increase in the added amount to the rate base is not very substantial.** Of the 1230.74 acres held, that area necessary for the water works is 679.42 acres plus the land taken up by right of ways for the transmission (water) lines end the power pole lines. At 20 feet wide, the right-of-ways were found to be worth another 18,000- or a total of 175,900 for the land used and useful te the water works. The land for the right-of-ways, not being included in the 679.42 total, was valued at a higher rate than 1100 per acre, (line 17). The value was based upon the edjoining lands and gave consideration to the assessments for tax purposes. gy slide rule, the land for the right-of-ways amounts to 19.5 acres, kith an average investment cost for the land owned, # #28.43 ®s acre, the right-of-ways would be worth $564.34. (line 3) On cross examination, repeats, the 679.42 acres eoet 119,321.40 (line 22). Adding these two figures, <‘19,321.40 and $564.34 fc$v** 119,885.74 ss the adjusted cost of the lend involved as used and useful for the utility. (Hearing then adjourned to June 5th, 1951) ( Three volumes of testimony) Beginning line 10. In the Sb portion of the pink shaded area there is an area that extends westerly. ( Throe forties, running !**’) behe admits that this area was included to protect the water-bearing lands from competitor’s well digging to injury of utility wells. Right-of-ways for power lines were figured as 50 ft wids| but only 20-foot right-of-ways for pips lines (behe) (Corrected next day) Wehe corrects his testimony to read 20-foot widths for all RT/Ws. lehe again mentions necessity of controlling land adjacent to well*._ The original cost of the 1200 acres of land, more or less, was #34,985.38j and the assessment for the year 1950, and 1951 also', is listed at #93,886. The assessment is over 2^ times the book figure, and if the assessment is at a 50$ rats, the land value would be twice 193*886, and the assessment i# that of less than 50$ in this City of U s Vegas. (?) The question of using original cost for the rate base value was then discussed. Wehe says that in California it was proper to use present values for land, but that within the last two years the Cal. P.D.C. has used book cost for land in the rate bates rather than fair market value. *kehe» I think this might be said; it would depend somewhat possibly on the thinking of the CommissionX.e• whether cr not to use present values){