Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

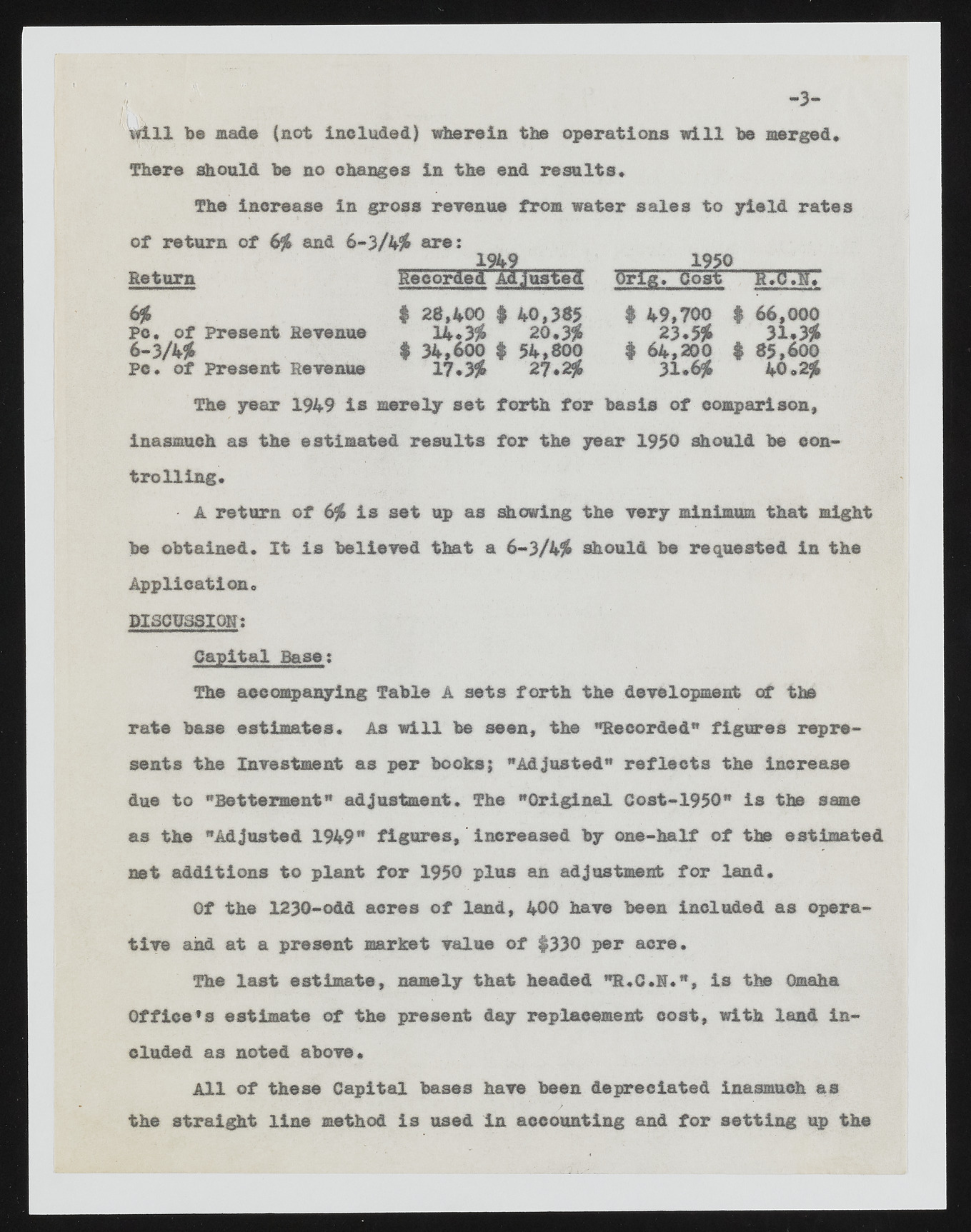

will be made (not included) wherein the operations will be merged* There should be no changes in the end results. The increase in gross revenue from water sales to yield rates of return of 6# and 6-3/4# are: The year 1949 la merely set forth, for basis of comparison, inasmuch as the estimated results for the year 1950 should be eon-trolling. A return of 6# Is set up as showing the very minimum that might be obtained. It is believed that a 6-3/4# should be requested in the Application. DISCUSSION: Capital Base: The accompanying Table A sets forth the development of the rate base estimates. As will be seen, the "Recorded" figures represents the Investment as per books; "Adjusted" reflects the increase due to "Betterment" adjustment. The "Original Cost-1950" is the same as the "Adjusted 1949" figures,' increased by one-half of the estimated net additions to plant for 1950 plus an adjustment for land. Of the 1230-odd acres of land, 400 have been included as operative and at a present market value of $330 per acre. The last estimate, namely that headed "R.C.N.", is the Omaha Office*s estimate of the present day replacement cost, with land included as noted above. 1949 1950 Return Recorded Ad justed recr:.gost-— w :g’:#: — — — lm Mil Ml .? 6# # 28,400 $ 40,385 14.3# 20.3# I I A I W M * d-£. A A A Pc. of Present Revenue 6-3/4# Pc. of Present Revenue 31.6# 40.2# All of these Capital bases have been depreciated inasmuch as the straight line method is used in accounting and for setting up the