Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

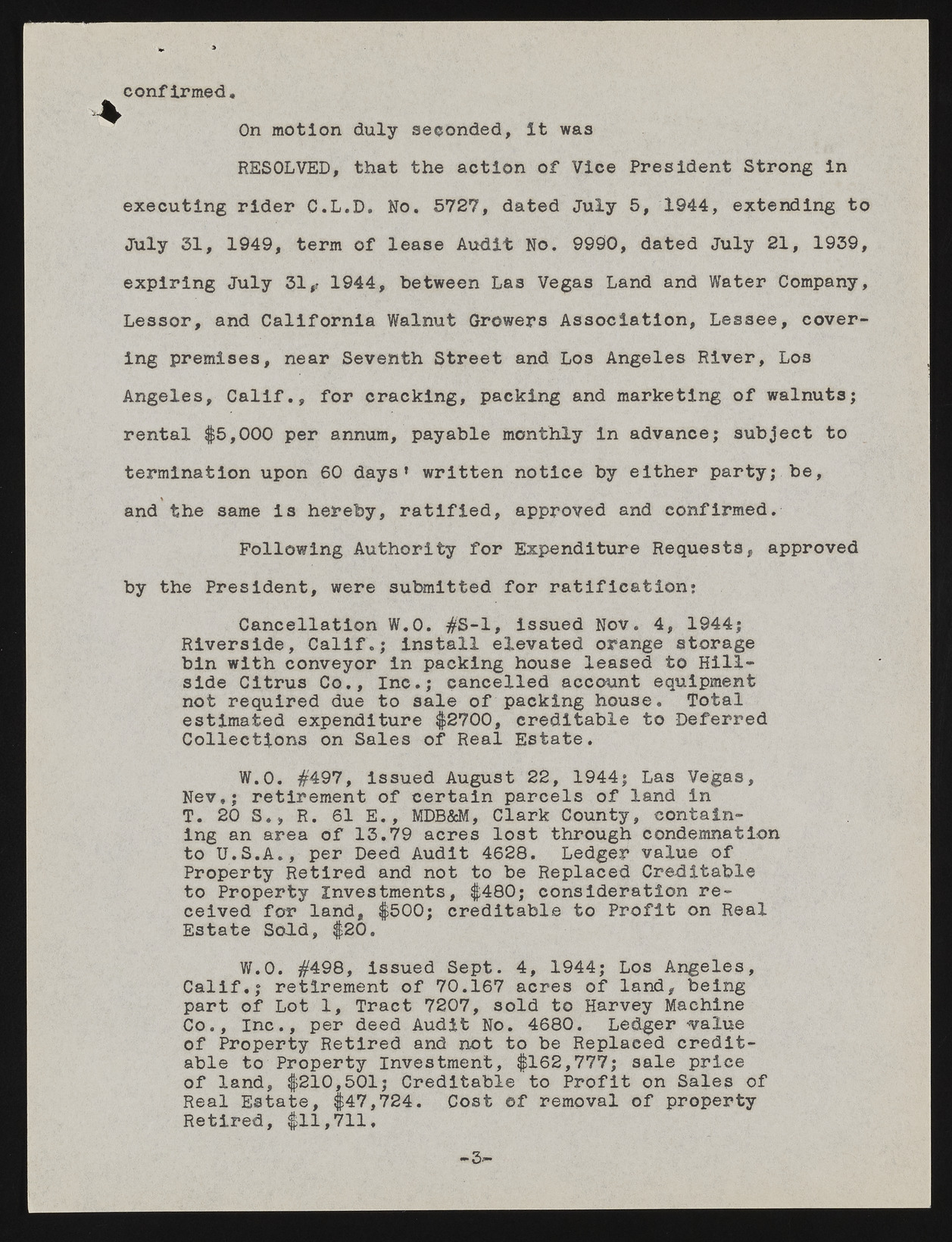

confirmed On motion duly seconded, it was RESOLVED, that the action of Vice President Strong in executing rider C.L.D. No, 5727, dated July 5, 1944, extending to July 31, 1949, term of lease Audit No. 9990, dated July 21, 1939, expiring July 31,? 1944, between Las Vegas Land and Water Company, Lessor, and California Walnut Growers Association, Lessee, covering premises, near Seventh Street and Los Angeles River, Los Angeles, Calif,, for cracking, packing and marketing of walnuts; rental $5,000 per annum, payable monthly in advance; subject to termination upon 60 days’ written notice by either party; be, and the same is hereby, ratified, approved and confirmed. Following Authority for Expenditure Requests, approved by the President, were submitted for ratification: Cancellation W.O. #S-1, issued Nov. 4, 1944; Riverside, Calif.; install elevated orange storage bin with conveyor in packing house leased to Hillside Citrus Co., Inc.; cancelled account equipment not required due to sale of packing house. Total estimated expenditure $2700, creditable to Deferred Collections on Sales of Real Estate. W.O. #497, issued August 22, 1944; Las Vegas, Nev,; retirement of certain parcels of land in T. 20 S., R. 61 E., MDB&M, Clark County, containing an area of 13.79 acres lost through condemnation to U.S.A., per Deed Audit 4628. Ledger value of Property Retired and not to be Replaced Creditable to Property Investments, $480; consideration received for land, $500; creditable to Profit on Real Estate Sold, $20. W.O. #498, issued Sept. 4, 1944; Los Angeles, Calif.; retirement of 70.167 acres of land, being part of Lot 1, Tract 7207, sold to Harvey Machine Co., Inc., per deed Audit No. 4680. Ledger -value of Property Retired and not to be Replaced creditable to Property Investment, $162,777; sale price of land, $210,501; Creditable to Profit on Sales of Real Estate, $47,724. Cost Of removal of property Retired, $11,711, -3-