Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

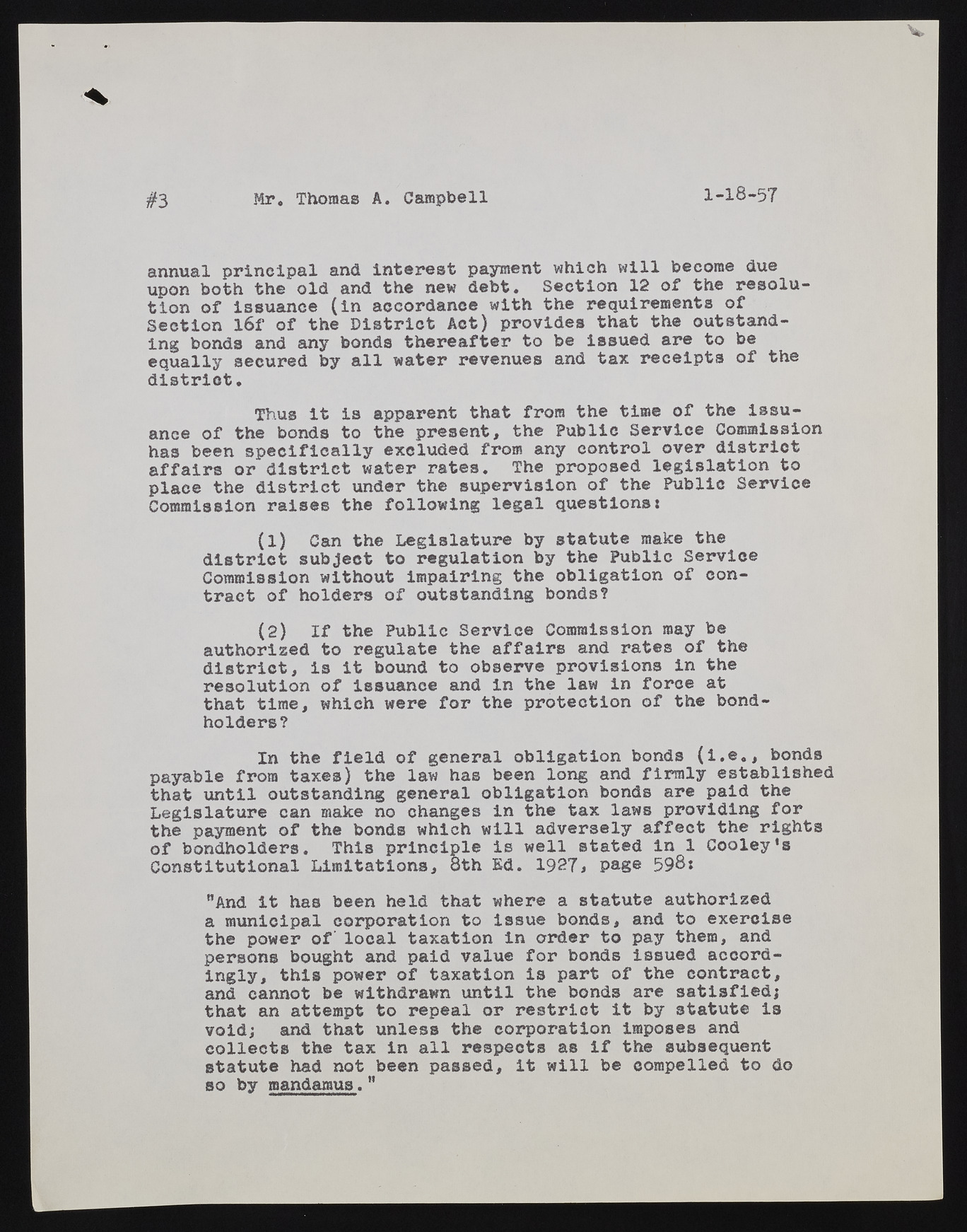

#3 Mr, Thomas A. Campbell 1-18-57 annual principal and interest payment which will become due upon both the old and the new debt. Section 12 of the resolution of issuance (in accordance with the requirements of Section l6f of the District Act) provides that the outstanding bonds and any bonds thereafter to be issued are to be equally secured by all water revenues and tax receipts of the district. Thus it is apparent that from the time of the issuance of the bonds to the present, the Public Service Commission has been specifically excluded from any control over district affairs or district water rates. The proposed legislation to place the district under the supervision of the Public Service Commission raises the following legal questions: (1) Can the Legislature by statute make the district subject to regulation by the Public Service Commission without impairing the obligation of contract of holders of outstanding bonds? (2) If the Public Service Commission may be authorized to regulate the affairs and rates of the district, Is it bound to observe provisions in the resolution of issuance and in the law in force at that time, which were for the protection of the bondholders? In the field of general obligation bonds (i.e., bonds payable from taxes) the law has been long and firmly established that until outstanding general obligation bonds are paid the Legislature can make no changes in the tax laws providing for the payment of the bonds which will adversely affect the rights of bondholders. This principle is well stated In 1 Cooley’s Constitutional Limitations, oth Ed. 1927# page 598* "And it has been held that where a statute authorized a municipal corporation to issue bonds, and to exercise the power o f local taxation In order to pay them, and persons bought and paid value for bonds issued accordingly, this power of taxation is part of the contract, and cannot be withdrawn until the bonds are satisfied; that an attempt to repeal or restrict it by statute is void; and that unless the corporation imposes and collects the tax in all respects as if the subsequent statute had not been passed, It will be compelled to do so by mandamus."