Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

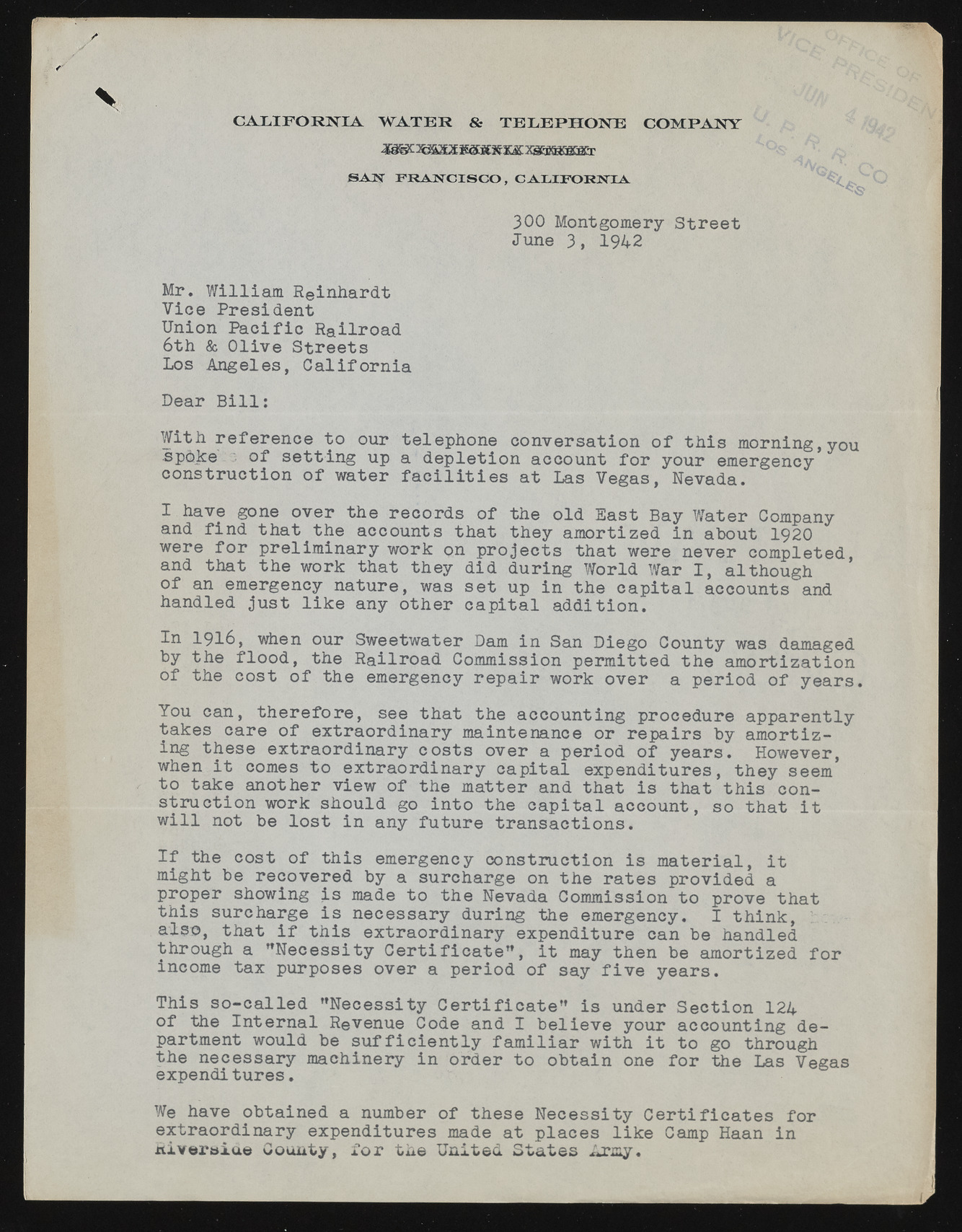

C A L I F O R N I A W A T E R & T E L E P H O N E C O M P A N Y I&s-js: H«iC XX& X3$S5ffijSer SAN FRANCISCO, CALIFORNIA 300 Montgomery Street June 3, 1942 Mr. William Reinhardt Vice President Union Pacific Railroad 6th & Olive Streets Los Angeles, California Dear Bill: With reference to our telephone conversation of this morning,you ?spoke of setting up a depletion account for your emergency construction of water facilities at Las Vegas, Nevada. I have gone over the records of the old East Bay Water Company and find that the accounts that they amortized in about 1920 were for preliminary work on projects that were never completed, and that the work that they did during World War I, although of an emergency nature, was set up in the capital accounts and handled just like any other capital addition. In 1916, when our Sweetwater Dam in San Diego County was damaged by the flood, the Railroad Commission permitted the amortization of the cost of the emergency repair work over a period of years. You can, therefore, see that the accounting procedure apparently takes care of extraordinary maintenance or repairs by amortizing these extraordinary costs over a period of years. However, when it comes to extraordinary capital expenditures, they seem to take another view of the matter and that is that this construction work should go into the capital account, so that it will not be lost in any future transactions. If the cost of this emergency construction is material, it might be recovered by a surcharge on the rates provided a proper showing is made to the Nevada Commission to prove that this surcharge is necessary during the emergency. I think, also, that if this extraordinary expenditure can be handled through a "Necessity Certificate", it may then be amortized for income tax purposes over a period of say five years. This so-called "Necessity Certificate" is under Section 124 of the Internal Revenue Code and I believe your accounting department would be sufficiently familiar with it to go through the necessary machinery in order to obtain expendi tures. one for the Las Vegas We have obtained a number of these Necessity Certificates for extraordinary expenditures made at places like Camp Haan in Riveraiae County, for the United States Army.