Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

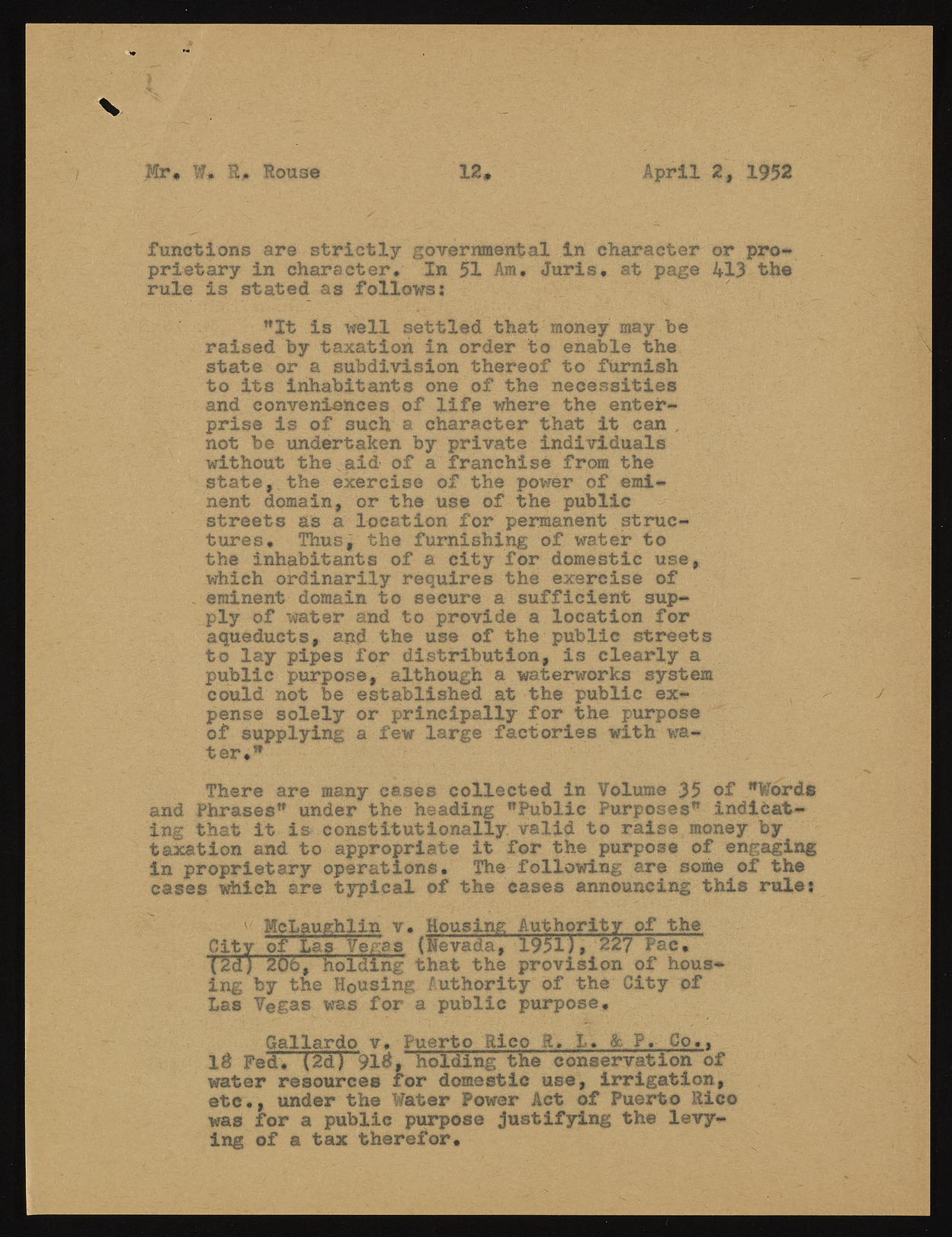

Mr* W* R* Rouse II* April 2, 1952 functions are strictly governmental in character or proprietary in character* In 51 Am, Juris, at page 413 the rule is stated as f o llo w s : "It is well settled that money may be raised by taxation in order to enable the state or a subdivision thereof to furnish to Its inhabitants one of the necessities and conveniences of life where the enterprise is of such a character that it can , not be undertaken by private individuals without the aid of a franchise from the state, the exercise of the power of eminent domain, or the use of the public streets as a location for permanent structures, Thus, the furnishing of water to the inhabitants of a city for domestic use, which ordinarily requires the exercise of . eminent domain to secure a sufficient supply of water and to provide a location for aqueducts, and the use of the public streets to lay pipes for distribution, is clearly a public purpose, although a waterworks system could not be established at the public expense solely or principally for the purpose of supplying a few large factories with water *" There are many cases collected in Volume 35 of "Word* and Phrases" under the heading "Public Purposes" indlOat—• ing that it is constitutionally, valid to raise money by taxation and to appropriate it for the purpose of engaging in proprietary operations. The following are some of the cases which are typical of the eases announcing this rule: K McLaughlin v. Housing Authority of the City of Las Vegas {Nevada, {2dj 206| noising that the p1r9o51v)i»s io22n7 oPfa ch*ousing by the Housing Authority of the City of Las Vegas was for a public purpose* Gallardo v. Puerto Rico K, 3U & P, Co,, 13 Fed, (2d) 91#, holding the conservation of water resources for domestic use, irrigation, etc*, under the Water Power Act of Puerto Rico was for a public purpose Justifying the levying of a tax therefor.