Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

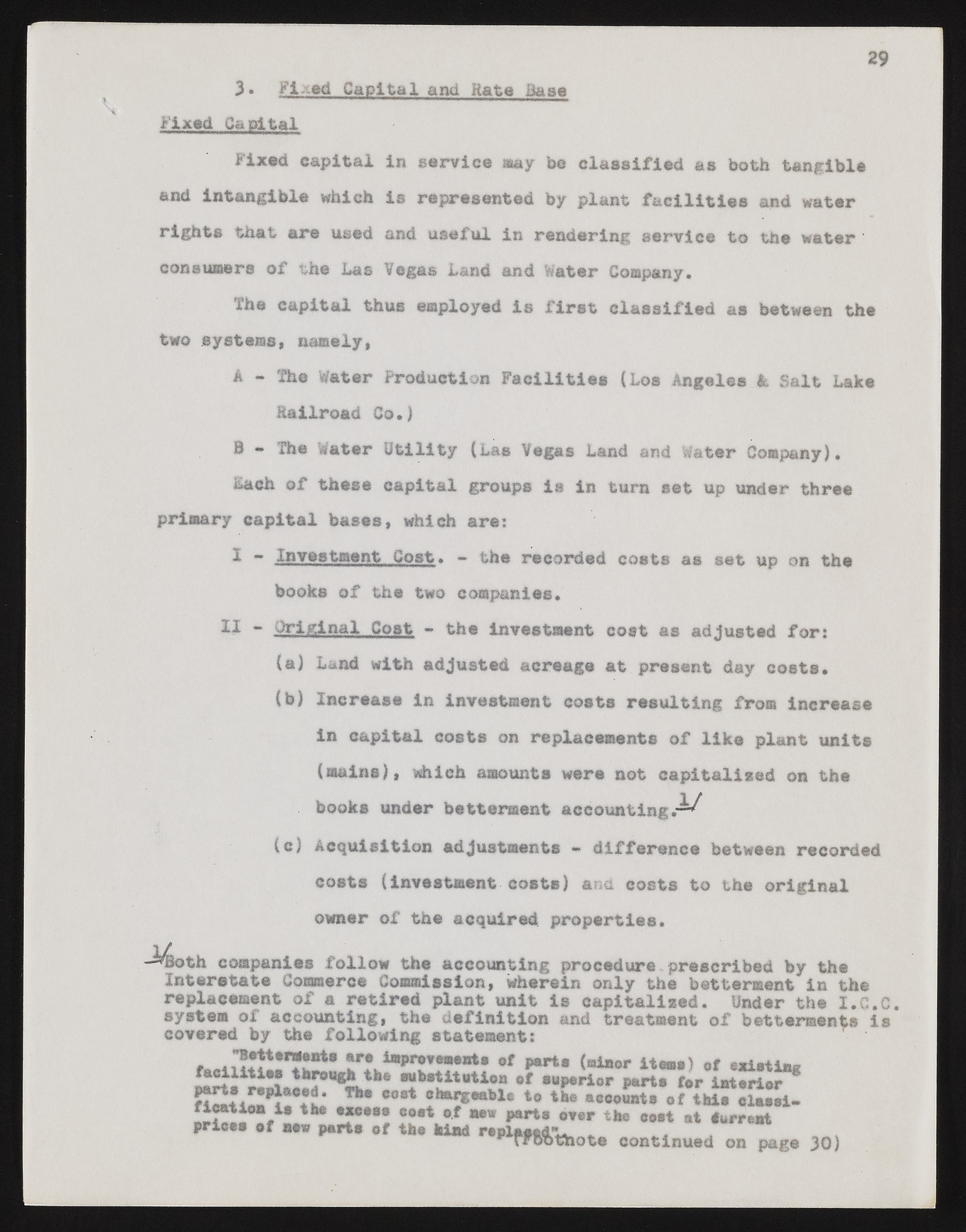

29 3• Fixed Capital and Rata Base Fixed Qa M&»i Fixed capital in service may be classified as both tangible and intangible which is represented by plant facilities and water rights that are used and useful in rendering service to the water consumers of the Las Vegas Land and Water Company. the capital thus employed is first classified as between the two systems! namely, A - the Water Production Facilities (Los Angeles k Salt Lake Railroad Co.) B • The Water Utility (Las Vegas Land and Water Company). Each of these capital groups is in turn set up under three primary capital bases, which are; I ** Investment Cost* - the recorded costs as set up on the books of the two companies. II - Original Cost - the investment cost as adjusted for: (a) Land with adjusted acreage at present day costs* (b) Increase in investment costs resulting from increase in capital costs on replacement© of like plant units (mains), which amounts were not capitalised on the books under betterment accounting.-^ (c) Acquisition adjustments - difference between recorded costs (Investment costs) and costs to the original -^4>th owner of the acquired properties. companies follow the accounting procedure prescribed by the Interstate Commerce Commission, wherein only the betterment in the replacement of a retired plant unit is capitalized. Under the I.C.C. system oi accounting, the definition and treatment of betterments is covered by the following statement: ?r* ^wemeot# of parts (aiaor items) 0f existing l1?? tterel^ibe 8ttb®titaU<m ®f superior parts for interior * Th* ®est changeable to the accounts of ibis class!- fication is the excess cost of now parts ever the cost at iurrent prices of new parte of the kind reBlaoedi*. ^ fFoothote continued on page 30)