Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

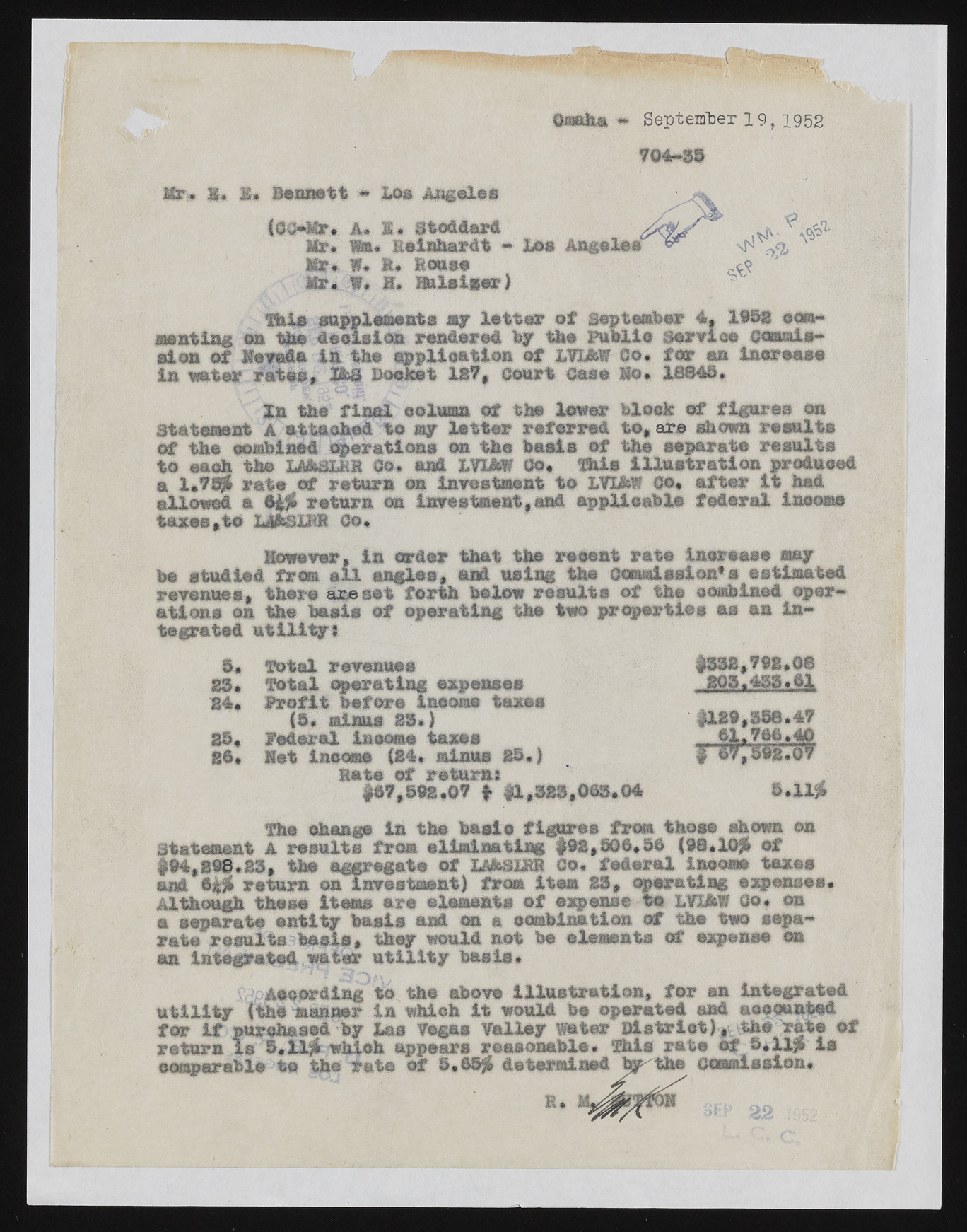

M O m aha m September 19,1952 704-35 Mr* M» B* Bennett * Los Angeles (OC-MMrr** AW.m . XR«e iSnthodadradrtd - Los Angeles Mr« W* R* Rouse Mr* 9# H* Mulsiger} eg. masting on the deoision rendered by the PubXlo servioo caataia- el on of Nevada In the application of 1VX&W Oo* for an Increase in enter rates* 3&S Docket 187, Court Case Mo* 16843. Statement A attaohed to my letter referred to, are ah own results of the combined operations on the basis of the separate results to each the LAA3LRR Co. and LVLfcW Co, this illustration produced a 1*75$ rate of return on investment to LVE&W Co* after it had allseed a § | f t return cm investment,and applicable federal income taxes*to XJ&31MR Co* be studied from all angles* and using the Commission* s estimated revenues* there are set forth below results of the combined operations on the basis of operating the two properties as an integrated utility 8 The change in the basic figures from those shown on Statement A results from eliminating #95*306.56 (93.10$ of #94,898.33* the aggregate of LA&Slim Co. federal income taxes and 6*$ return on investment) from item 83* operating expenses* Although these items are elements of expense to LVX&W Co* on a separate entity basis and on & combination of the two separate results basis* they would not be elements of expense on an Integrated water utility basis* According to the above illustration, for an integrated utility (the manner in which it would be operated and accounted for if purchased by Las Vegas Valley Water District) * the'rate o; return is 5,11$ which appears reasonable# This rate of 6.11$ is comparable to the fate of 5*65$ determl Commission. In the final column of the lower block of figures on However. In order that the recent rate increase may 5* Total revenues 83* expenses 84* ? M H . neoms taxes #338*798*06 805.433,61 85, Federal income taxes 86* Met income (84. minus 85*) (5* a i m s 83*) f If,698*07 #129,350.47 6ll766.40 Rat#e6 7o,f5 9r8e*t0u7r nfs #1,383,063*04 5.11$ R*