Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

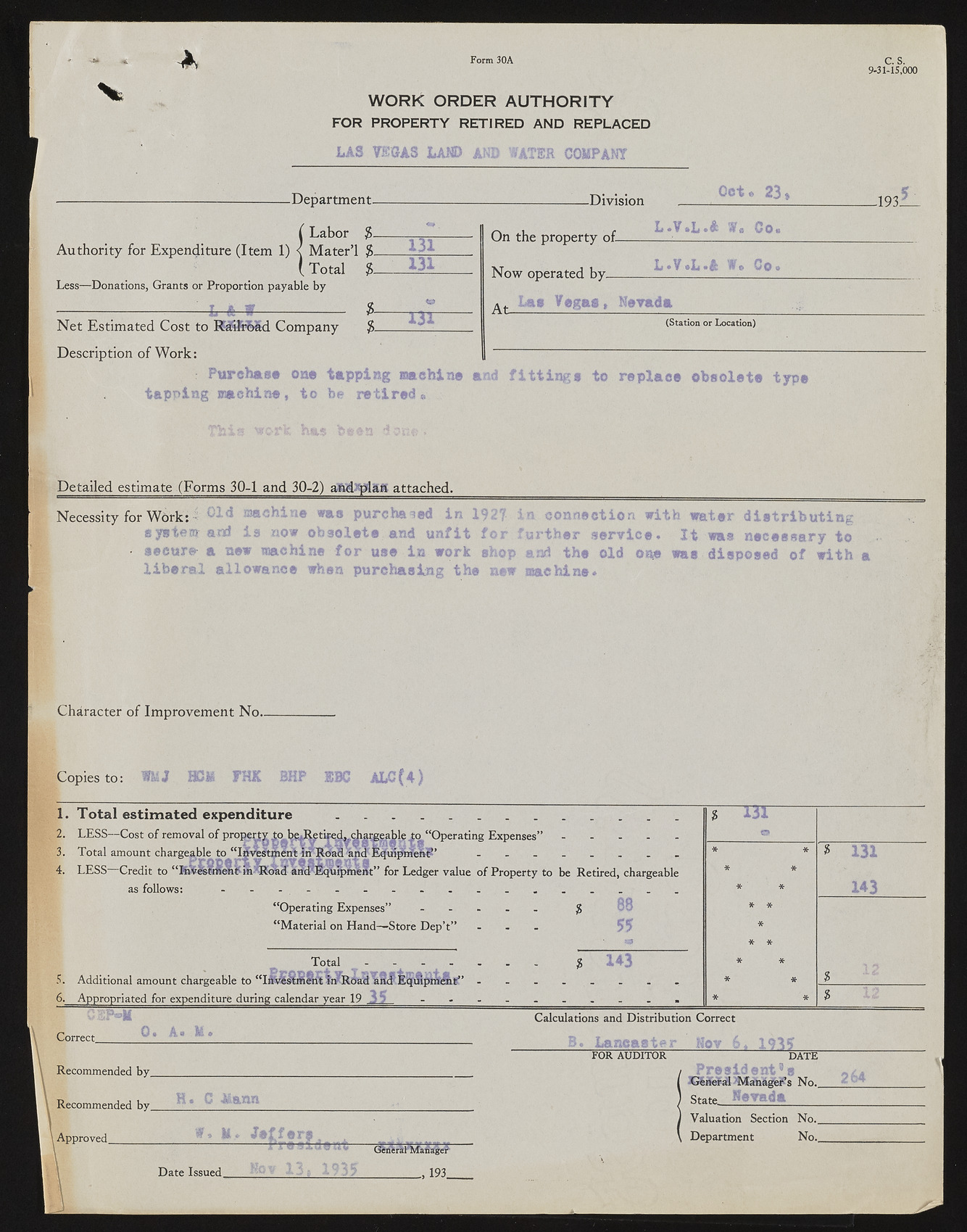

Form 30A C. S. 9-31-is,000 •** * -#» ^ k WORK ORDER AUTHORITY FOR PROPERTY RETIRED AND REPLACED LAS VEGAS LAND AND WATER COMPANY -Department- -Di vision Gets 23* -1931 (Labor #_ Authority for Expenditure (Item 1) < Mater’l $_ (Total $- Less—Donations, Grants or Proportion payable by ----------;----------:------- L A v------------------ 3- Net Estimated Cost to KaS&bSd Company $_ Description of Work: 131 131 <s» 131 On the property of— Now operated by__ A(. Lag Vegas, Nevada L.VaLo® Wc Co. L.VsL.ft Wo So. (Station or Location) : Purchase one tapping machine anc tapping machine, to be retired* lings to replace obsolete type Detailed estimate (Forms 30-1 and 30-2) attached.______________________________ Necessity for Work: • Cld raaohiae was purchaied in 19d'j- )ri connection with water distributing system and is now obsolete and unfit for further service. It was necessary to • secure- a new machine for use in work shop and the old one was disposed of with a liberal allowance when purchasing the new machine. Character of Improvement No.. Copies to: WMJ HCi it nt i 1. Total estimated expenditure . ? . g......................................... 2. LESS—Cost of removal of property to Ijpjtetked^diatogjible to “Operating Expenses” - 3. Total amount chargeable to “l|?W&menL ?ir R<feH fcrfcr ........ 4. LESS—Credit to “Kitlh&neli’f: SaARo&d AfftPEqUipml At’’ for Ledger value of Property to be Retired, chargeable as follows: - . Art “Operating Expenses” ..... $ “Material on Hand—Store Dep’t” ... Total .... 5. Additional amount chargeable to “Investment trvRda’d arid' EqiinpTftQit'’’ 6. Appropriated for expenditure during calendar year 19 35 $ 143 3 I3T * 131 143 Correct Calculations and Distribution Correct Laneastw FOR AUDITOR Recommended by_ Recommended by_ \ Approved_______ DATE Presidents ?GSifeMl ^M^higfeJPs No._ State Nevada Valuation Section No._ Department No._ Date Issued. (3eflc?arMkna£e?" ________, 193_