Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

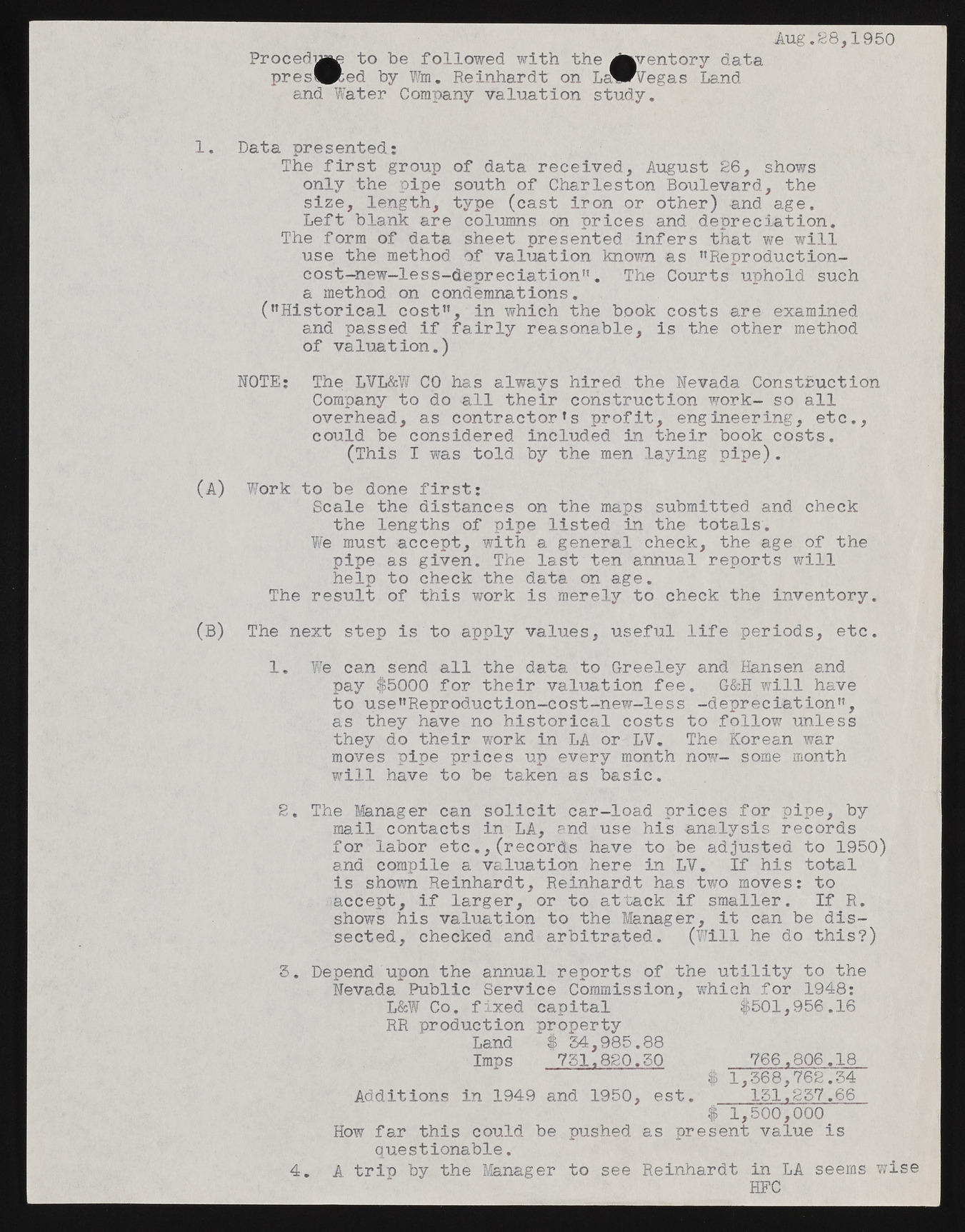

A u g .28,1950 Procedu^ to be followed with the A^rentory data pres^ted by Wm. Reinhardt on LaWVegas Land and Water Company valuation study. 1. Data presented: The first group of data received, August 26, shows only the pipe south of Charleston Boulevard, the size, length, type (cast iron or other) and age. Left blank are columns on prices and depreciation. The form of data sheet presented infers that we will use the method of valuation known as ’’Reproduction-eost- new-less-depreciation”. The Courts uphold such a method on condemnations. (’’Historical cost”, in which the book costs are examined and passed if fairly reasonable, is the other method of valuation.) NOTE: The LVL&W CO has always hired the Nevada Construction Company to do all their construction work- so all overhead, as contractor’s profit, engineering, etc., could be considered included in their book costs. (This I was told by the men laying pipe). (A) Work to be done first; Scale the distances on the maps submitted and check the lengths of pipe listed in the totals. We must accept, with a general check, the age of the pipe as given. The last ten annual reports will help to check the data on age. The result of this work is merely to check the inventory. (B) The next step is to apply values, useful life periods, etc. 1. We can send all the data to Greeley and Hansen and pay $5000 for their valuation fee. G&H will have to use’’Reproduct ion-cost-new-less -depreciation”, as they have no historical costs to follow unless they do their work in LA or LV. The Korean war moves pipe prices up every month now- some month will have to be taken as basic. 2. The Manager can solicit car-load prices for pipe, by mail contacts in LA, and use his analysis records for labor etc.,(records have to be adjusted to 1950) and compile a valuation here in LV. If his total is shown Reinhardt, Reinhardt has two moves: to accept, if larger, or to attack if smaller. If R. shows his valuation to the Manager, it can be dissected, checked and arbitrated. (Will he do this?) 5. Depend upon the annual reports of the utility to the Nevada Public Service Commission, which for 1948: L&W Co. fixed capital $501,956.16 RR production property Land $ 54,985.88 Imps 751.820.50 766.806.18 $ 1,568,762.54 Additions in 1949 and 1950, est. 151,257.66 $ 1,500,000 How far this could be pushed as present value is questionable. . A trip by the Manager to see Reinhardt in LA seems wise HFC 4