Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

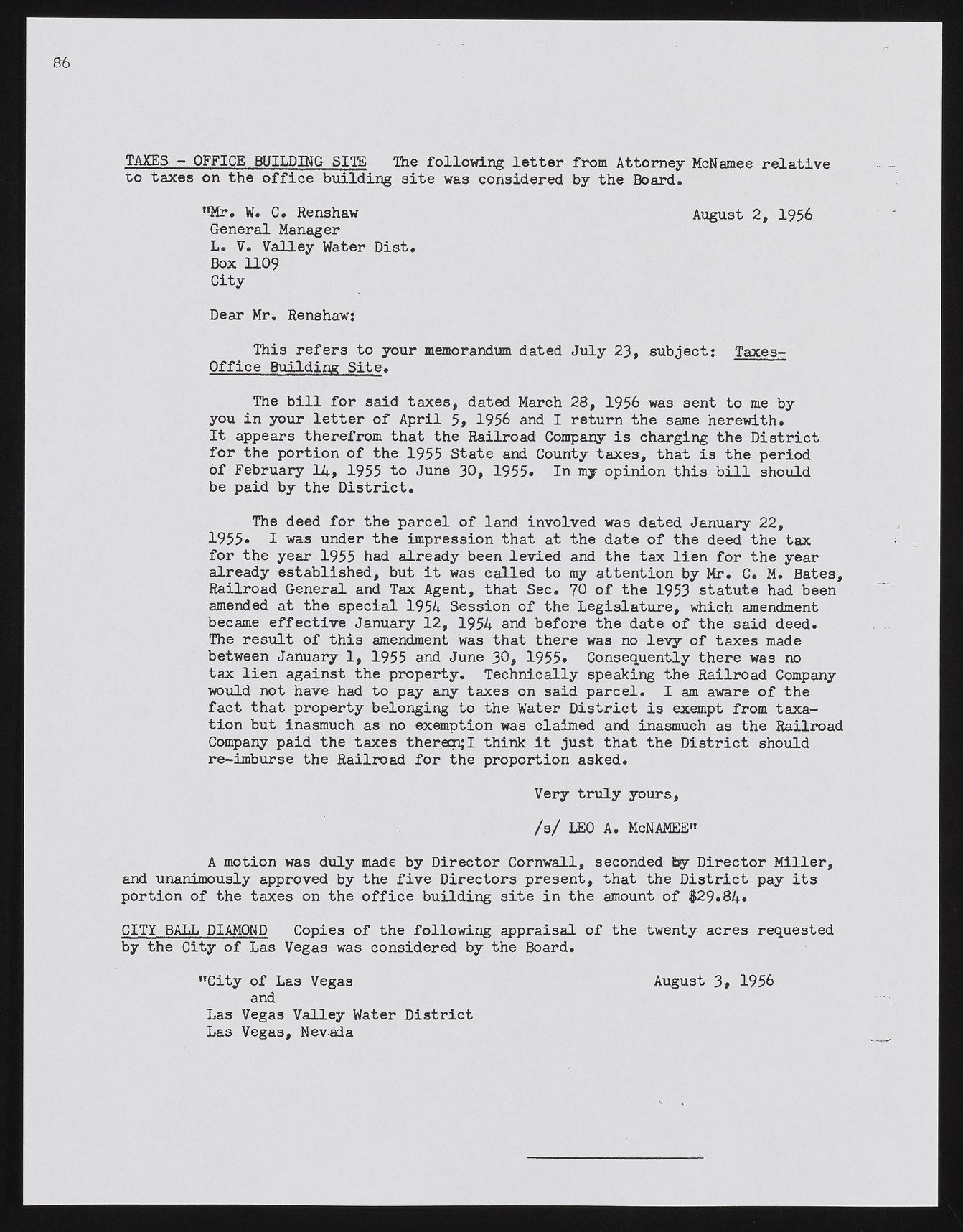

TAXES - OFFICE BUILDING SITE The following letter from Attorney McNamee relative to taxes on the office building site was considered by the Board. "Mr. W. C. Renshaw August 2, 1956 General Manager L. V. Valley Water Dist. Box 1 1 0 9 City Dear Mr. Renshaw: This refers to your memorandum dated July 23, subject: Taxes- Office Building Site. The bill for said taxes, dated March 28, 1956 was sent to me by you in your letter of April 5, 1956 and I return the same herewith. It appears therefrom that the Railroad Company is charging the District for the portion of the 1 9 5 5 State and County taxes, that is the period of February 1 4 , 1 9 5 5 to June 3 0 , 1 9 5 5 * I n m y opinion this bill should be paid by the District. The deed for the parcel of land involved was dated January 22, 1955* I was under the impression that at the date of the deed the tax for the year 1955 had already been levied and the tax lien for the year already established, but it was called to my attention by Mr. C. M. Bates, Railroad General and Tax Agent, that Sec. 70 of the 1953 statute had been amended at the special 1954 Session of the Legislature, which amendment became effective January 12, 1954 and before the date of the said deed. The result of this amendment was that there was no levy of taxes made between January 1, 1955 and June 30, 1955* Consequently there was no tax lien against the property. Technically speaking the Railroad Company would not have had to pay any taxes on said parcel. I am aware of the fact that property belonging to the Water District is exempt from taxation but inasmuch as no exemption was claimed and inasmuch as the Railroad Company paid the taxes therecnjl think it just that the District should re-imburse the Railroad for the proportion asked. Very truly yours, /s/ LEO A. McNAMEE" A motion was duly made by Director Cornwall, seconded by Director Miller, and unanimously approved by the five Directors present, that the District pay its portion of the taxes on the office building site in the amount of $29.84» CITY BALL DIAMOND Copies of the following appraisal of the twenty acres requested by the City of Las Vegas was considered by the Board. •’City of Las Vegas and Las Vegas Valley Water District Las Vegas, Nevada August 3, 1956