Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

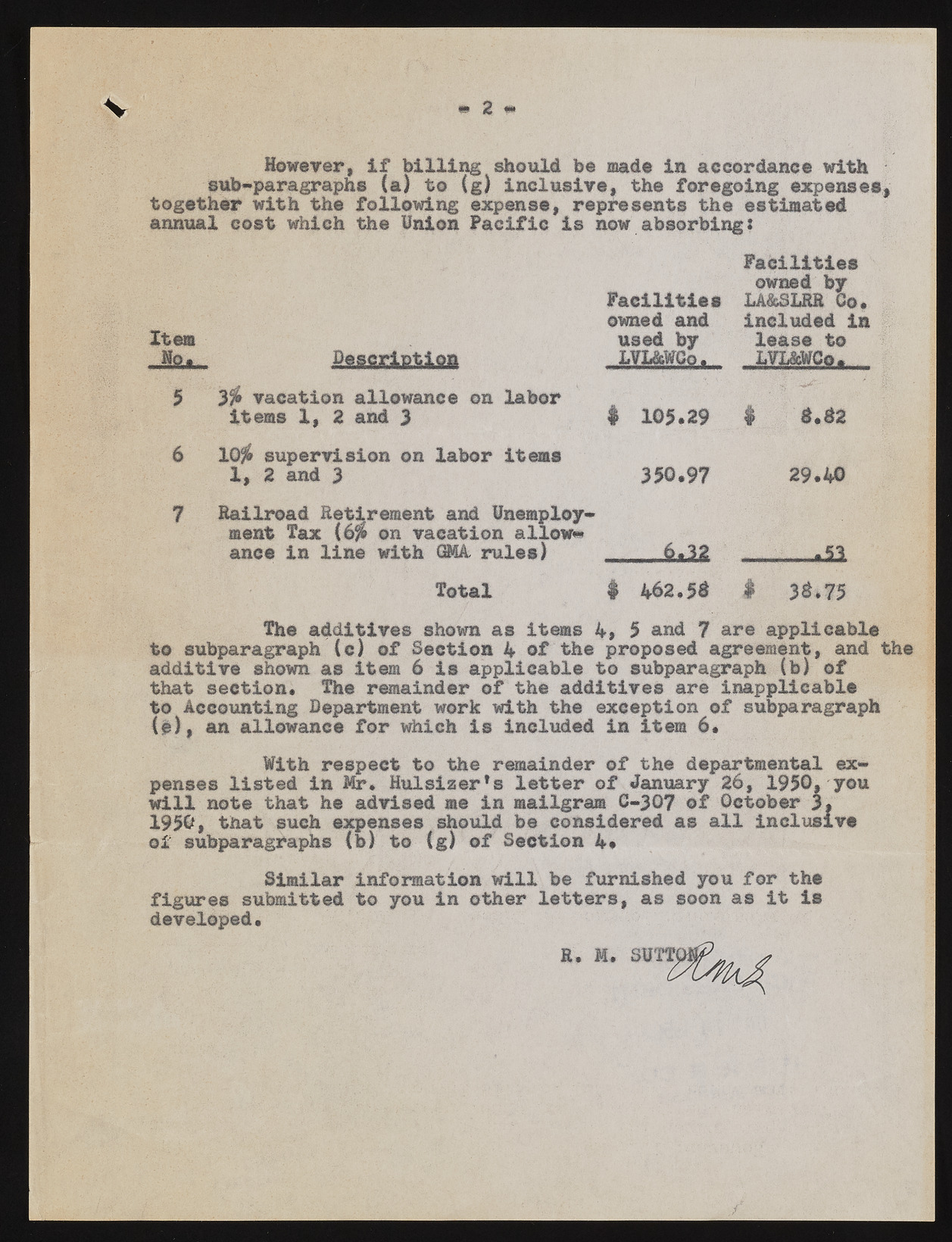

V m % m However, If billing should be made in accordance with sub-paragraphs (a) to (g) inclusive, the foregoing expenses, together with the following expense, represents the estimated annual cost which the Hnion Pacific is now absorbing: Item Ho. Description Facilities owned and used by LVL&WCo. Facilities owned by LA&SLRR Co. Included in lease to LVL&WCo. 5 3$» vacation allowance on labor items 1, 2 and 3 # 105.29 # £.62 6 1 Q$> supervision on labor items 1, 2 and 3 350.97 29.40 7 Railroad Retirement and Unemployment Tax (6$ on vacation allow* ance in line with GMA, rules) _______a a Total # 462.5S # 3S .75 the additives shown as items 4, 5 and 7 are applicable to subparagraph (e) of Section 4 of the proposed agreement, and the additive shown as item 6 is applicable to subparagraph (b) of that section* the remainder of the additives are inapplicable to Accounting Department work with the exception of subparagraph (e), an allowance for which is included in item 6* With respect to the remainder of the departmental expenses listed in Mr. Hulsizer's letter of January 26, 1950, you will note that he advised me in mailgram G-307 of October 3* 1950, that such expenses should be considered as all inclusive of subparagraphs (b) to (g) of Section 4* Similar information will be furnished you for the figures submitted to you in other letters, as soon as it is developed• S. M. SUTTi