Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

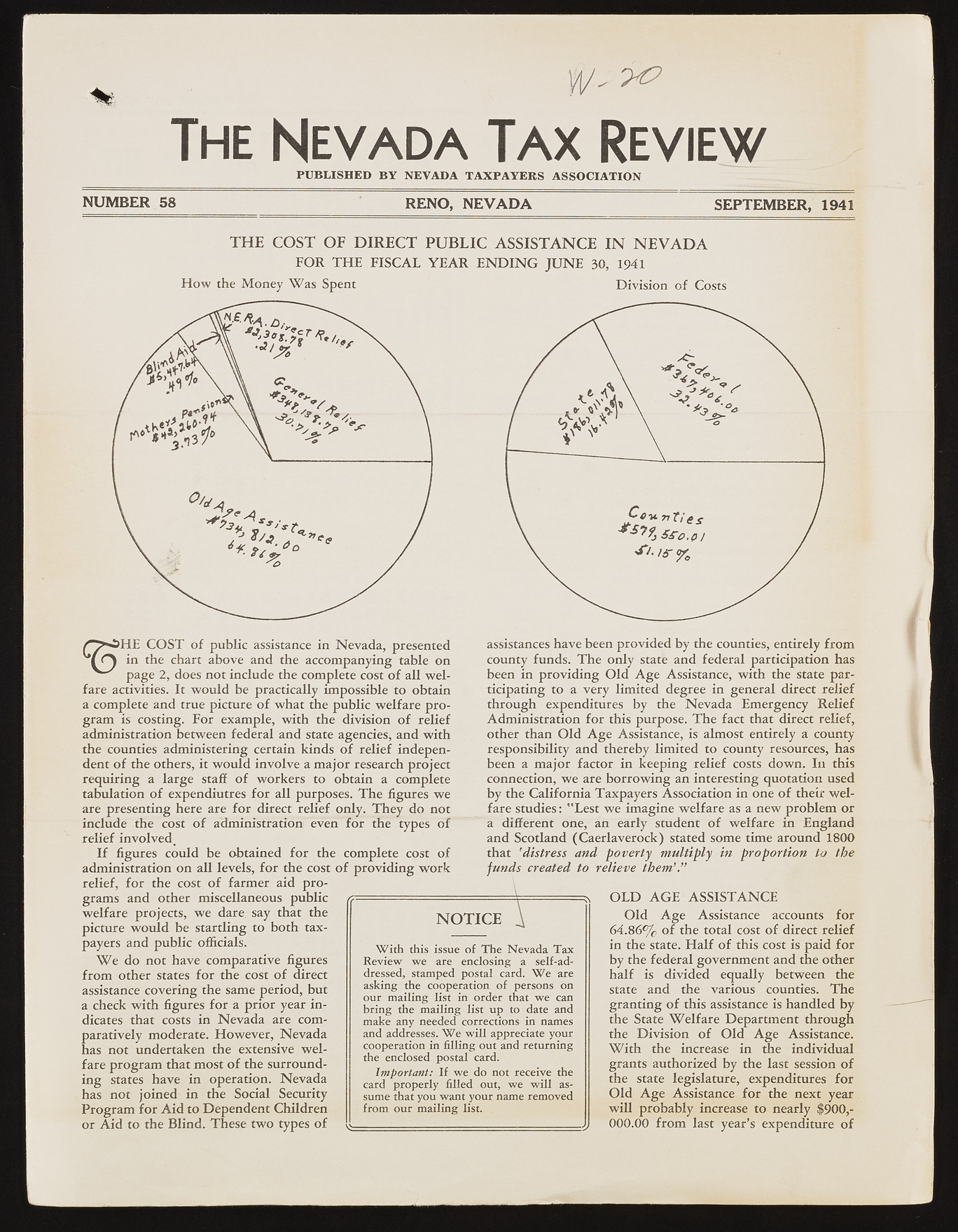

v I P ? ? The Nevada Tax Review PUBLISHED BY NEVADA TAXPAYERS ASSOCIATION NUMBER 58 RENO, NEVADA SEPTEMBER, 1941 TH E COST OF D IR E C T P U B L IC ASSISTANCE I N N E V A D A F O R T H E F IS C A L Y E A R E N D I N G J U N E 30, 1941 H o w the M o n e y W a s Spent D ivision o f Costs H E C O S T o f public assistance in N e v a d a , presented in the chart above and the accom panying table on page 2, does not include the complete cost o f all w e lfare activities. It w o u ld be practically im possible to obtain a complete and true picture o f w hat the public w elfare p ro gram is costing. F or exam ple, w ith the division o f relief adm inistration between federal and state agencies, and w ith the counties adm inistering certain kinds o f relief independent o f the others, it w o u ld involve a m ajor research project requirin g a large staff o f w orkers to obtain a complete tabulation o f expendiutres fo r all purposes. T h e figures w e are presenting here are fo r direct relief only. T h ey d o not include the cost o f administration even fo r the types o f relief involved _ I f figures could be obtained fo r the complete cost o f administration on a ll levels, fo r the cost o f p ro v id in g w o rk relief, fo r the cost o f farm er aid p ro gram s and other m iscellaneous public w elfare projects, w e dare say that the picture w o u ld be startling to both taxpayers and public officials. W e do not have com parative figures from other states fo r the cost o f direct assistance covering the same period, but a check w ith figures fo r a p rio r year in dicates that costs in N e v a d a are comparatively moderate. H o w e v e r, N e v a d a has not undertaken the extensive w e lfare p rogram that m ost o f the surroundin g states have in operation. N e v a d a has not join ed in the Social Security P ro gram fo r A id to D epen den t Children o r A id to the B lin d . These tw o types o f assistances have been provided by the counties, entirely from county funds. T h e only state and federal participation has been in p ro v id in g O ld A g e Assistance, w ith the state p a rticipating to a very lim ited degree in general direct relief through expenditures by the N e v a d a Em ergency R elief A dm inistration fo r this purpose. T h e fact that direct relief, other than O ld A g e Assistance, is almost entirely a county-responsibility and thereby lim ited to county resources, has been a m ajor factor in keeping relief costs d ow n . In this connection, w e are b o rro w in g an interesting quotation used by the C aliforn ia T axpayers Association in one o f their w e lfare studies: "L e st w e im agine w elfare as a n ew problem o r a different one, an early student o f w elfare in E n glan d and Scotland (C a e rla v e ro c k ) stated some time around 1800 that 'distress and p ov erty m u ltip ly in p ro p o rtio n to th e funds created to relieve th em ’.” O L D A G E A S S I S T A N C E O ld A g e Assistance accounts fo r 6 4.86% o f the total cost o f direct relief in the state. H a lf o f this cost is paid fo r by the federal governm ent and the other h a lf is divided equally between the state and the various counties. T h e gran tin g o f this assistance is handled by the State W e lfa r e Departm ent through the D ivisio n o f O ld A g e Assistance. W it h the increase in the individual grants authorized by the last session o f the state legislature, expenditures fo r O ld A g e Assistance fo r the next year w ill p robably increase to nearly $900,- 000.00 from last year’s expenditure o f N O T IC E \ With this issue of The Nevada Tax Review we are enclosing a self-addressed, stamped postal card. We are asking the cooperation of persons on our mailing list in order that we can bring the mailing list up to date and make any needed corrections in names and addresses. We will appreciate your cooperation in filling out and returning the enclosed postal card. Important: If we do not receive the card properly filled out, we will assume that you want your name removed from our mailing list. ,