Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

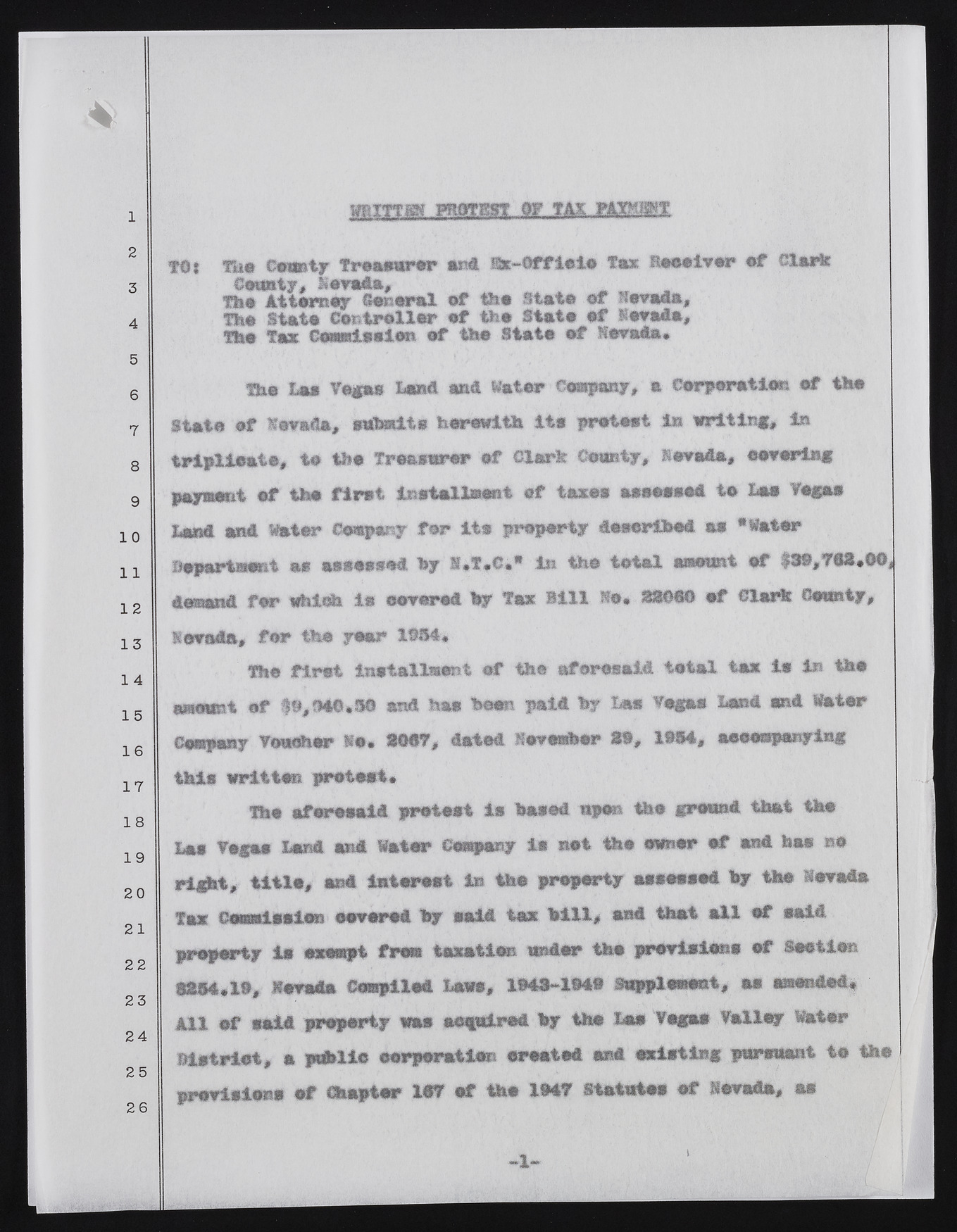

1 2 3 4 5 6 7 8 9 10 11 12 13 1 4 1 5 16 17 16 IS 2 C 2 ] 2J 2 ; 2t 2 i 2 ( WRITTBK PROTEST OF TAX PATENT TOj tlie County Treasurer and Sr-Offieio Tax Beeeiver of CJlark ThCosu nAttyt,o rNneevya dCao,r oral of ths statt e of _Nevada, The State Controller of toe State of Nevada, The T«« Commission of to© Stato of Nevada* m o Las Vegas Land and Water company, a Corporation of the State of Nevada, submits herewith Its protest in w r i t i n g , In triplicate, to tho Treasurer of Clark County, Nevada, covering payment of tho flrot Installment of taxes assessed to Las togas Land and water Company for its proporty described as "Water Bepartment as assessed by S*f*C." in the total amount of > 3 9 , 762*0© „ demand for which is covered fey Tax Bill No. 22060 of Clark Comity, Nevada, for the year 1954, The first installment of the aforesaid total tax is in m o amount of $0,B4©*3© and has keen paid by Las togas 'Land snd Water Company Vouchor So. 3067, dated November 20, 1054, aeoespanying this written pretest. The aferesald pretest is based upon the ground that tho Las togas Land aid Water Company is not the owner of and has no right, title, and interest to to© property assessed % toe Nevada Tax Cemmlaalon severed by said tax bill* and that all of said property Is exsmpt from taxation under too previsions of Section 3204*10, Nevada Compiled Laws, 1043*1040 supplement, as amended* All of said property was acquired by toe lee togas Valley Water District, a public corporation ereated and exist tog pursuant to toe provisions of Chapter 157 of toe 1047 Statutes of Nevada, as 1**