Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

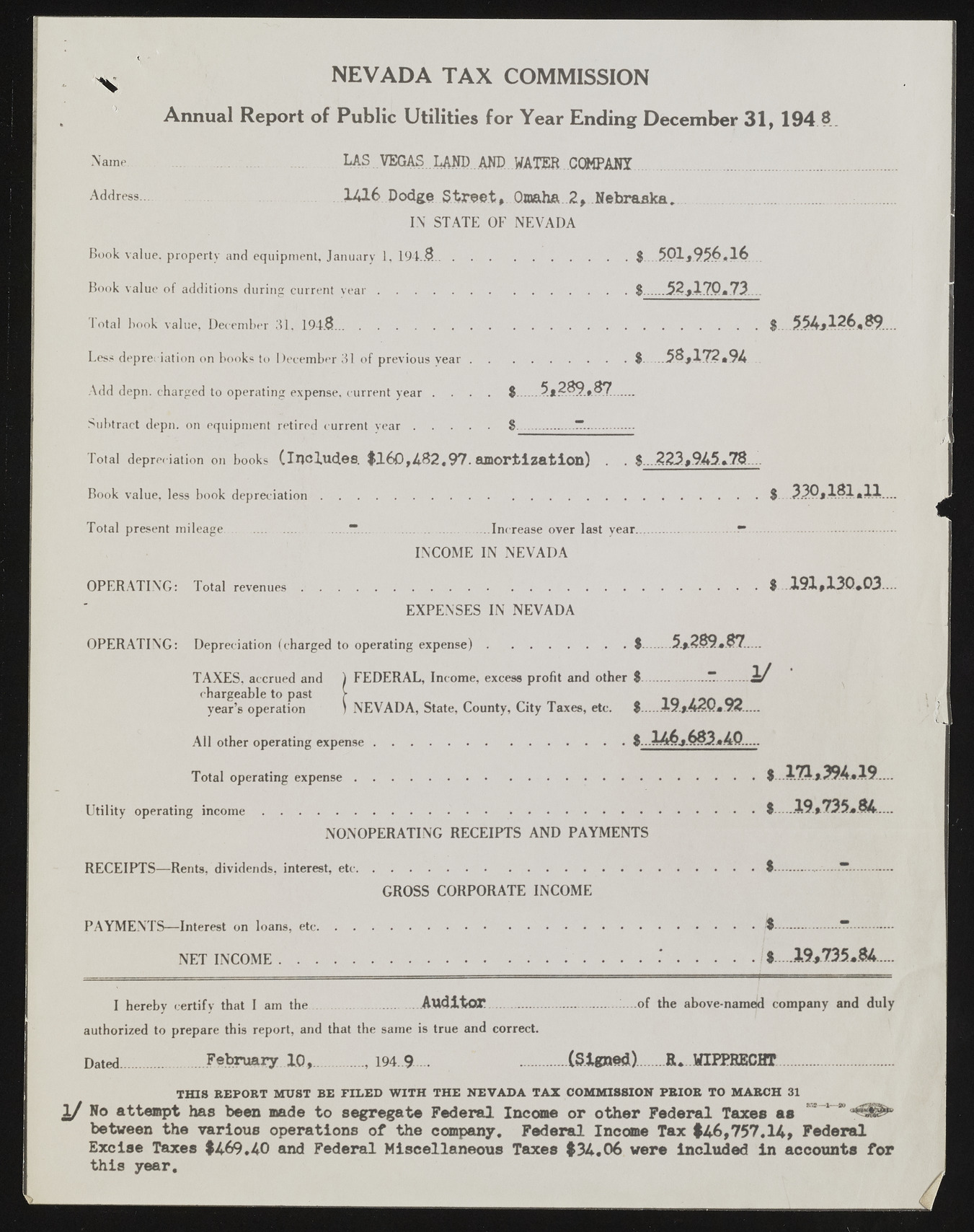

Name............................................. L A S V E G A S LAND.. AND WATER COMPANY Address.................. 1 4 1 6 D o d g e Street, Omaha 2 , N e b r a s k a . ........................ ................. IN STATE OF N E V AD A Book value, property and equipment, January 1, 194.5..................................................$....5.01,95.6,16 . Book value of additions during current y e a r .................................................. .... . . $..... 5 2 , 1 7 0 . 7 3 Total book value, December 31. 194.8................................... .............................................* ........................ $.. 5 -5 4 ,1 2 6 *8 9 .... Less depreciation on books to December 31 of previous vear . ........................ $ 5 8 , 1 7 2 . 9 4 Add depn. charged to operating expense, current year . . . . $......5 * 2 8 5 ,8 7 ..... Subtract depn. on equipment retired current v e a r ................... $................... ” ............. Total depreciation on books ( I n c l u d e s . $ 1 6 0 ,4 8 2 .9 7 . a m o r t i z a t i o n ) . . .2 2 3 ,9 4 5 ,7 8 ... Book value, less book d e p re c ia tio n ........................................................................................................ . . $ 3 3 Q j l 8 1 . l l . . . . Total present mileage................... ....“ ................................. Increase over last year........... .............. SS .................................... INCOM E IN N E V A D A x NEVADA T A X COMMISSION Annual Report of Public Utilities for Year Ending December 31, 194.8. O P E R A T IN G : Total r e v e n u e s .................................. ................................................................................ $ 191,130.03... EXPENSES IN N E V A D A O P E R A T IN G : Depreciation (charged to operating e x p e n s e ).................................... $......... 5.j2.89,.87..... TAXES, accrued and ) FEDERAL, Income, excess profit and other $.................” ........ i / chargeable to past > i n / _ _ year’s operation ) N E V AD A , State, County, City Taxes, etc. $....19.j42v.92..... A ll other operating e x p en se................................................................. $ ..146,-683.40..... Total operating e x p e n s e ........................................................................................................ $ 1 7 1 ,3 9 4 ,1 9 .... Utility operating i n c o m e .......................................................... ...... ..................................................... .... • $.... 19.,735,.84— N O N O PE R A TIN G REC EIPTS A N D P A Y M E N T S REC EIPTS— Rents, dividends, interest, etc....................................................................................................... $............ ................ — GROSS CO R PO R ATE INCOM E P A Y M E N T S — Interest on loans, etc..................................................................................................................j$.................. “ ............ N E T IN C O M E ............. ......................................if 19,735*84..... I I hereby certify that I am th e ...................... Auditor .................... .......... .of the above-named company and duly authorized to prepare this report, and that the same is true and correct. Dated..................... February 10,............. , 194. 9 ... ............ (Signed)....... R. WIPPRECHT..................... . THIS REPORT MUST RE FILED WITH THE NEVADA TAX COMMISSION PRIOR TO MARCH 31 1/ No attempt has been made to segregate Federal Income or other Federal Taxes as between the various operations of the company. Federal Income Tax $46,757.14, Federal Excise Taxes $469.40 and Federal Miscellaneous Taxes $34,06 were included in accounts for this year.