Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

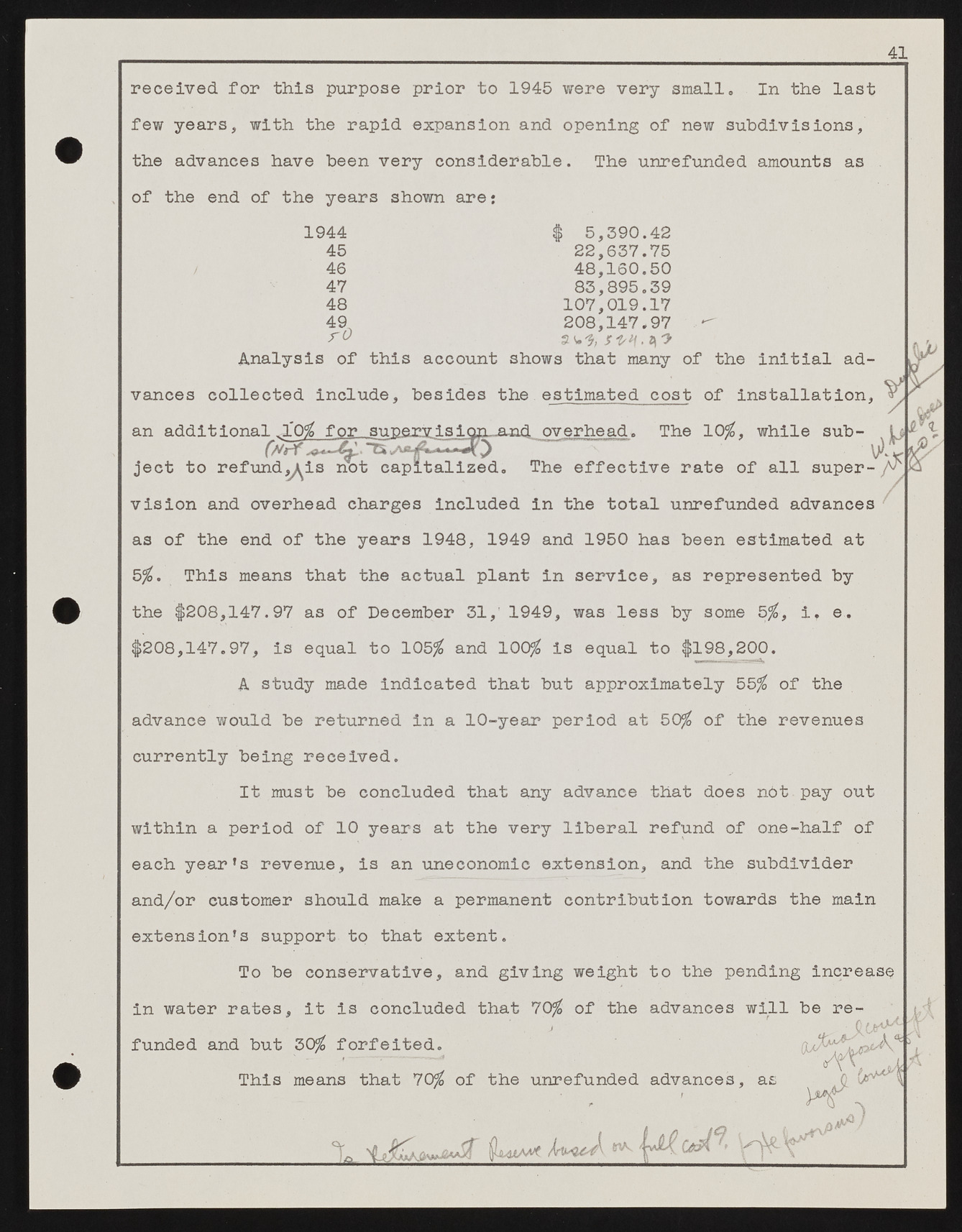

41 received for this purpose prior to 1945 were very small. In the last few years, with the rapid expansion and opening of new subdivisions, the advances have been very considerable. The unrefunded amounts as of the end of the years shown are: 1944 $ 5,390.42 45 22,637.75 46 48,160.50 47 83,895.39 48 107,019.17 4r90 208,147.97 av. % ject to refund^is Analysis of this account shows that many of the initial advances collected include, besides the estimated cost of installation, an additional 10$ for supervising and overhead. The 10$, while sub- JU (/ t & nd,Ais not capitalized. The effective rate of all super-vision and overhead charges included in the total unrefunded advances as of the end of the years 1948, 1949 and 1950 has been estimated at 5$. This means that the actual plant in service, as represented by the $208,147.97 as of December 31,' 1949, was less by some 5$, it e. $208,147.97, is equal to 105$ and 100$ is equal to $198,200. A study made indicated that but approximately 55$ of the advance would be returned in a 10-year period at 50$ of the revenues currently being received. It must be concluded that any advance that does nbt pay out within a period of 1 0 years at the very liberal refund of one-half of each year’s revenue, is an uneconomic extension, and the subdivider and/or customer should make a permanent contribution towards the main extension’s support to that extent. To be conservative, and giving weight to the pending increase in water rates, it is concluded that 70$ of the advances will be re-j ' ? Q funded and but 30$ forfeited. ' f* \ This means that 70$ of the unrefunded advances, as 0 - j . ? JL