Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

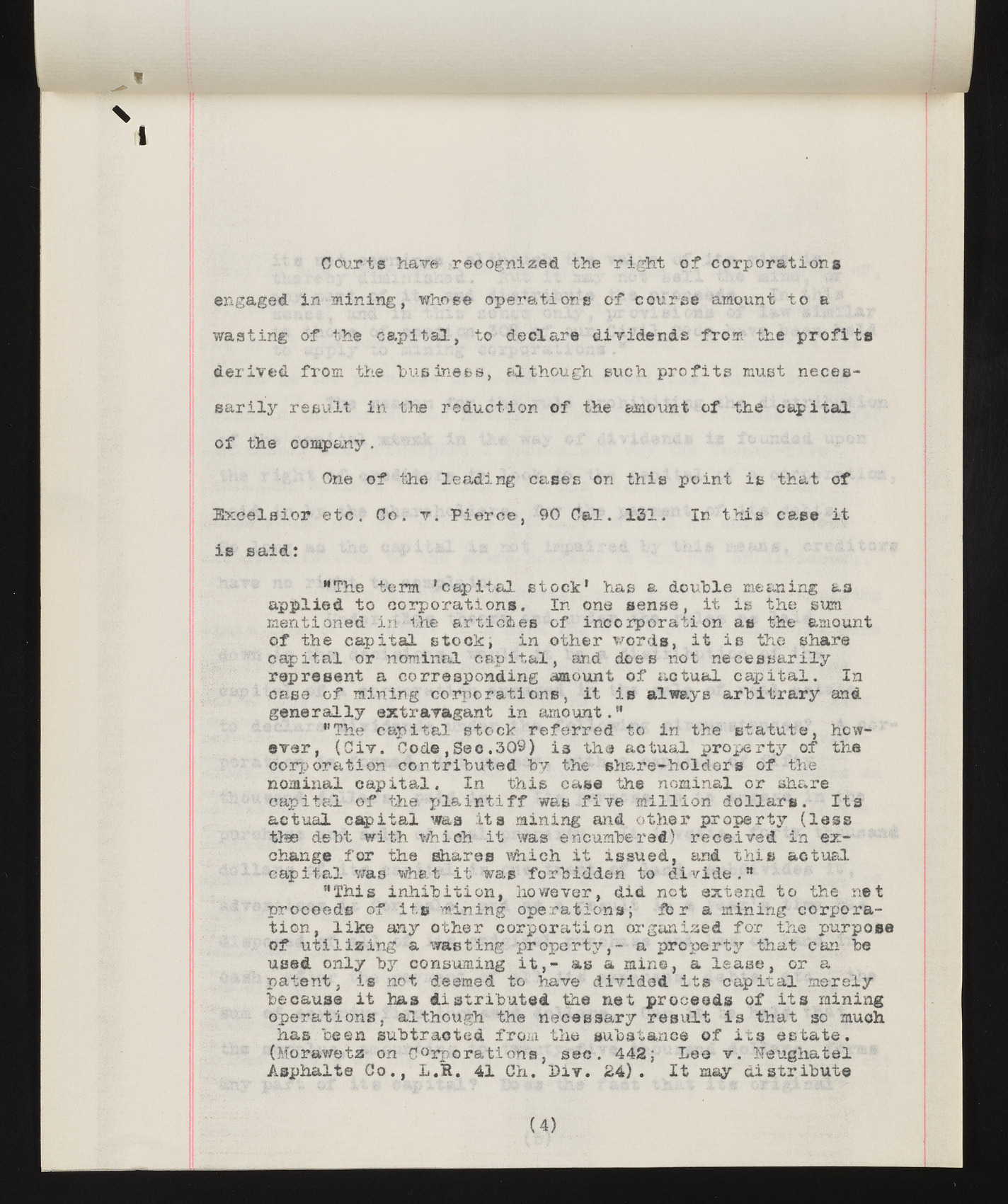

Courts have recognized the right of corporation# engaged in mining, whose operations of course amount to a wasting of the capital, to declare dividends from the profits derived from the business, although such profits must necessarily result in the reduction of the amount of the capital of the company. One of the leading cases on this point is that of Excelsior etc. G o . vi Pierce, 90 Cal. 131. In this case it is said: “The t o m 'capital stock* has a double meaning as applied to corporations. In one sense, it is the sum mentioned in the articles of incorporation as the amount of the capital stock; in other words, it is the share capital or nominal capital, and does iiot necessarily represent a corresponding amount of aotual capital. In case of mining corporations, it is always arbitrary and generally extravagant in amount." "The capital stock referred to in the statute, however, (Civ. Code,Seo.309) is the actual property of the corporation contributed by the share-holders of the nominal capital. In this case the nominal or share capital of the plaintiff was five million dollars. Its actual capital was its mining and other property (less the debt with which it was encumbered) received in exchange for the shares which it issued, and this actual capital was what it was forbidden to divide." "This inhibition, however, did net extend to the net proceeds of its mining operations; ib r a mining corporation, like any other corporation organized for the purpose of utilizing a wasting' property,- a property that can be used only by consuming it,- as a mins, a lease, or a patent, is not deemed to have divided its capital merely because it has distributed the net proceeds of its mining operations, although the necessary result is that so much has been subtracted from the substance of its estate. (Morawetz on corporations, sec. 442; Lee v. ITeughatel Asphalts Co., L.B. 41 Ch. Div. 24). It may distribute (4)