Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

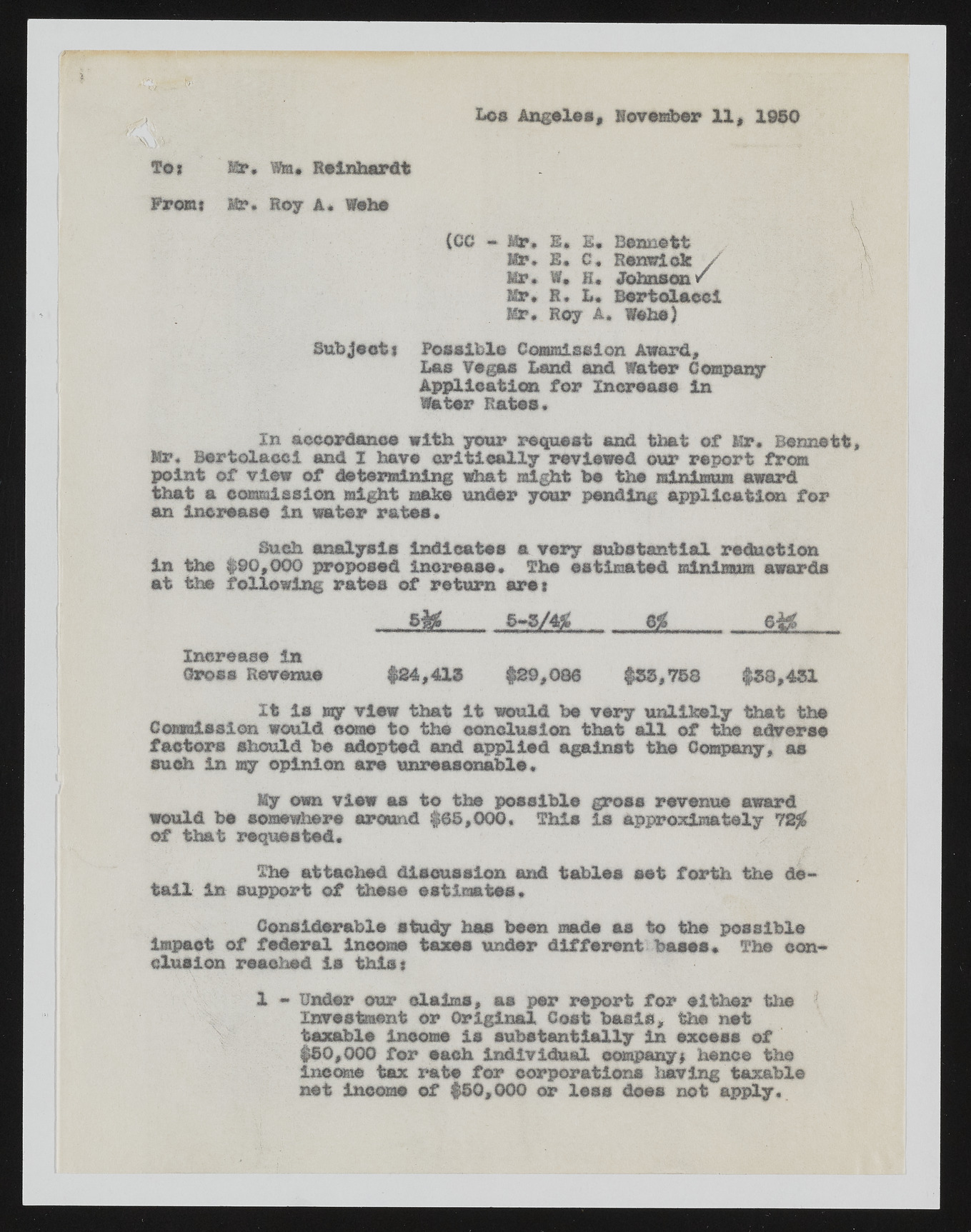

£*08 Angeles, Hovesber 11, 1950 wWS To* Mr, fe* Reinhardt From* ife*. Roy A* Wehe (CC - lip, E, I. Bennett HP. E, 0, Rend ok / Mp* W. H« Johnson/ Mr. ft. I*. Bortolaeci Hr. Roy A. Wehe) Subject i Possible CosBoission Award, Las Vegas Land and Water Company Application for Increase in Water Hates. In accordance with your request and that of Mr, Bennett, Mr* Bertolacel and I have critically reviewed our report from point of view of determining What might be the minimum award that a commission sight make under your pending application for an Increase in water rates. Such analysis indicates a very substantial reduction in the #90,000 proposed increase* The estimated minimum awards at the following rates of return aret S U 5-3/4# Hi________6& Increase in Gross Revenue #94,413 #29,086 #33,758 #38,431 It is my view that it would be very unlikely that the Commission would come to the conclusion that all of the adverse factors should be adopted and applied against the Company, as such in my opinion are unreasonable. My own view as to the possible ^css revenue award would be somewhere around $65,000. This Is approximately 72# of that requested. The attached discussion and tables set forth the detail in support of these estimates. Considerable study has been made as to the possible impact of federal Income taxes under different bases. The conclusion reached is this* 1 ~ Under our claims, as per report for either the Investment or Original Cost basis, the net taxable income is substantially in excess of #50,000 for each individual company* hence the income tax rate for corporations having taxable net income of #50,000 or less does not apply.