Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

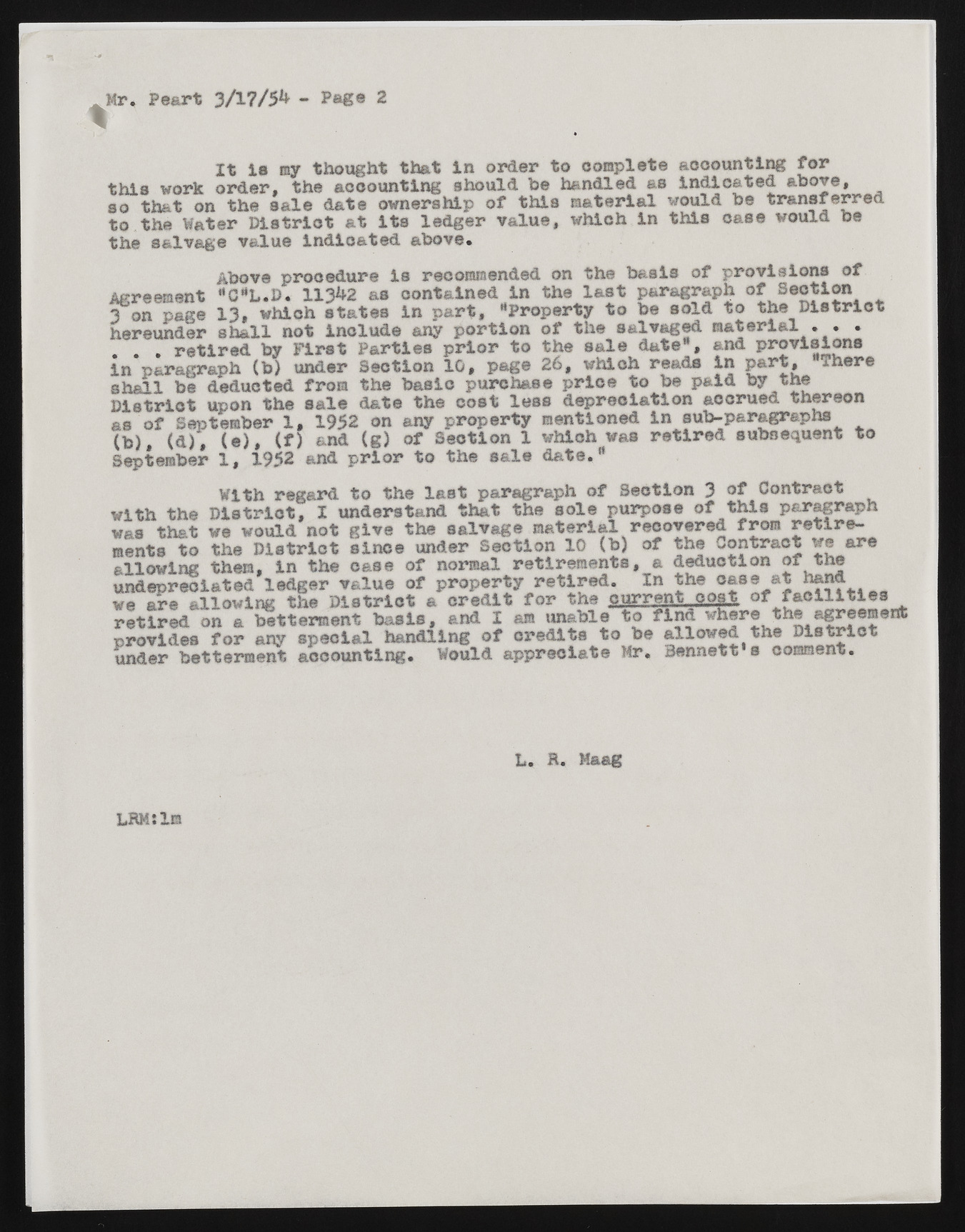

* Mr. Peart 3/17/5** - Page 2 It la my thought that in order to complete accounting for this work order, the accounting should be handled as indicated above, so that on the sale date ownership of this material would be transferred to the Water District at its ledger value, which in this case would be the salvage value indicated above. Above procedure is recommended on the basis of provisions of Agreement “G “L.D. 113**2 as contained in the last paragraph of Section 3 on page 13, which states in part, “Property to be sold to the District hereunder shall not include any portion of the salvaged material . . * . . . retired by First Parties prior to the sale date*, and provisions in paragraph (b) under Section 10, page 26, whioh reads in part. There shall be deducted from the basic purchase price to be paid by the Distrlot upon the sale date the cost less depreciation accrued thereon as of September 1, 1952 on any property mentioned in sub-paragraphs (b), (d), (e), (f) and (g) of Section 1 which was retired subsequent to September 1, 1952 and prior to the sale date." With regard to the last paragraph of Section 3 ®f Contract with the Distrlot, I understand that the sole purpose of this paragraph was that we would not give the salvage material recovered from retirements to the District since under Section 10 (b) of the Contract we are allowing them, in the case of normal retirements, a deduction or tne undepreciated ledger value of property retired. In the ease at hand we are allowing the District a credit for the fl,urrent ops* of facilities retired on a betterment basis, and I am unable to find where the agreement provides for any special handling of credits to be allowed the District under betterment accounting. Would appreciate Mr. Bennett s comment. L. R. Haag LRMJlm