Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

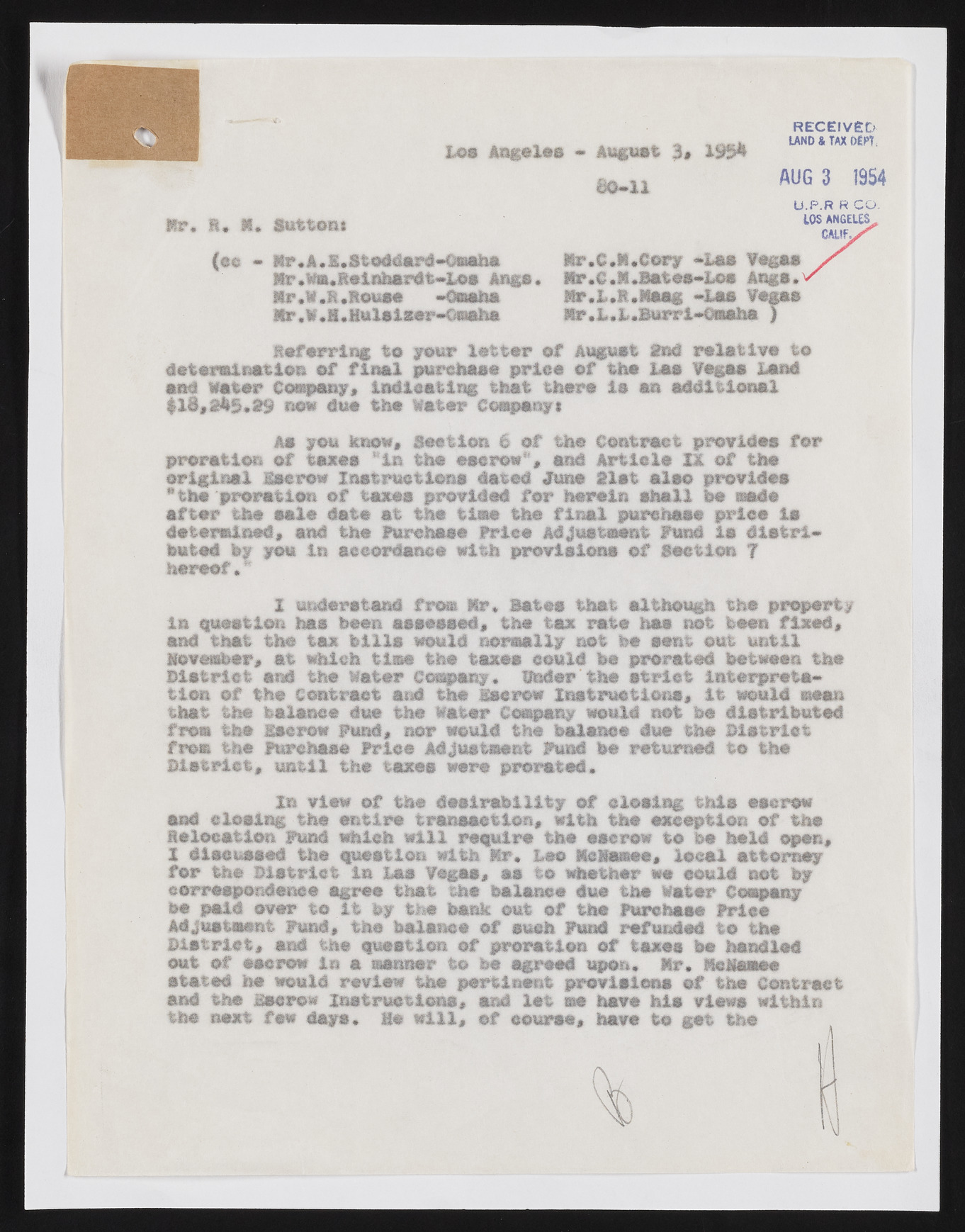

Los Angeles * Almost 3, X9*>* 8 0 -1 1 R E C E IV E D LAND & TAX DEPT. A U G 3 1954 Hr. R. H. Suttont U .P.R R C O . LOS ANGELES (ee - H r •A .S.Stoddard-Omaha Mr.Mm.itelfihardt«Los Angs Hr.c.H.Cory -Las Vegas Hr.C.lt.Bat@s-L©s Aftgs. Mr.Hr.M.R.-Omaha L.R.Maag -Las Vegas Hr.M.H. Hulaiaer-Oiaaha Mr.tt . f t .Rouse -Omaha Mr.L.R.Maag Vegas Hr.V.H.Mulaiser-Cmaha Hr.L.L.Burri-Qmaha ) Referring to your lot tor of August tnd relative to determination of final purchase prieo of the las Vegas land and aster Company, indicating that there Is an additional $l$,2h$.29 now duo tho Motor Companys proration of taxes ‘in the eaerow”, and Artiele IX of the original Escrow Instructions dated June Slat also provides •tho proration of taxes provided for herein shell he made after the sale date at the time the final purchase price la determined, and tho Purchase Price Adjustment Fund is distributed by you In accordance with provisions of Section 7 hereof. 1 in Question has boon assessed, tho tax rate has net toon fixed, and that tho tax bills would normally not bo sent out until November, at which time tho taxes could bo prorated between tho District and tho Mater Company. Under tho strict interpretation of the contract and the Escrow Instructions, it would moan that tho balance due tho water Company would not bo distributed from tho Escrow Fund, nor would tho balance due the District from the Purchase Price Adjustment Fund be returned to the District, until the taxes were prorated. and closing the entire transaction, with the exception of the Relocation Fund which will require the escrow to be held open, X discussed the question with Hr. Leo HcHamee, local attorney for the District in Las Vegas, as to whether we could not by correspondence agree that she balance due the Mater Company be paid over to it by the bank out of the Purchase Price Adjustment Fund, the balance of such Fund refunded to the District, and the question of proration of taxes be handled out of escrow in a manner to be agreed upon. Hr. HcMamee stated he would review the pertinent provisions of the Contract and the Escrow Instructions, and let me have his views within the next few days. Me will, of course, have to get the As you know, Section 6 of the Contract provides for X understand from Hr. Bates that although the property In view of the desirability of closing this escrow