Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

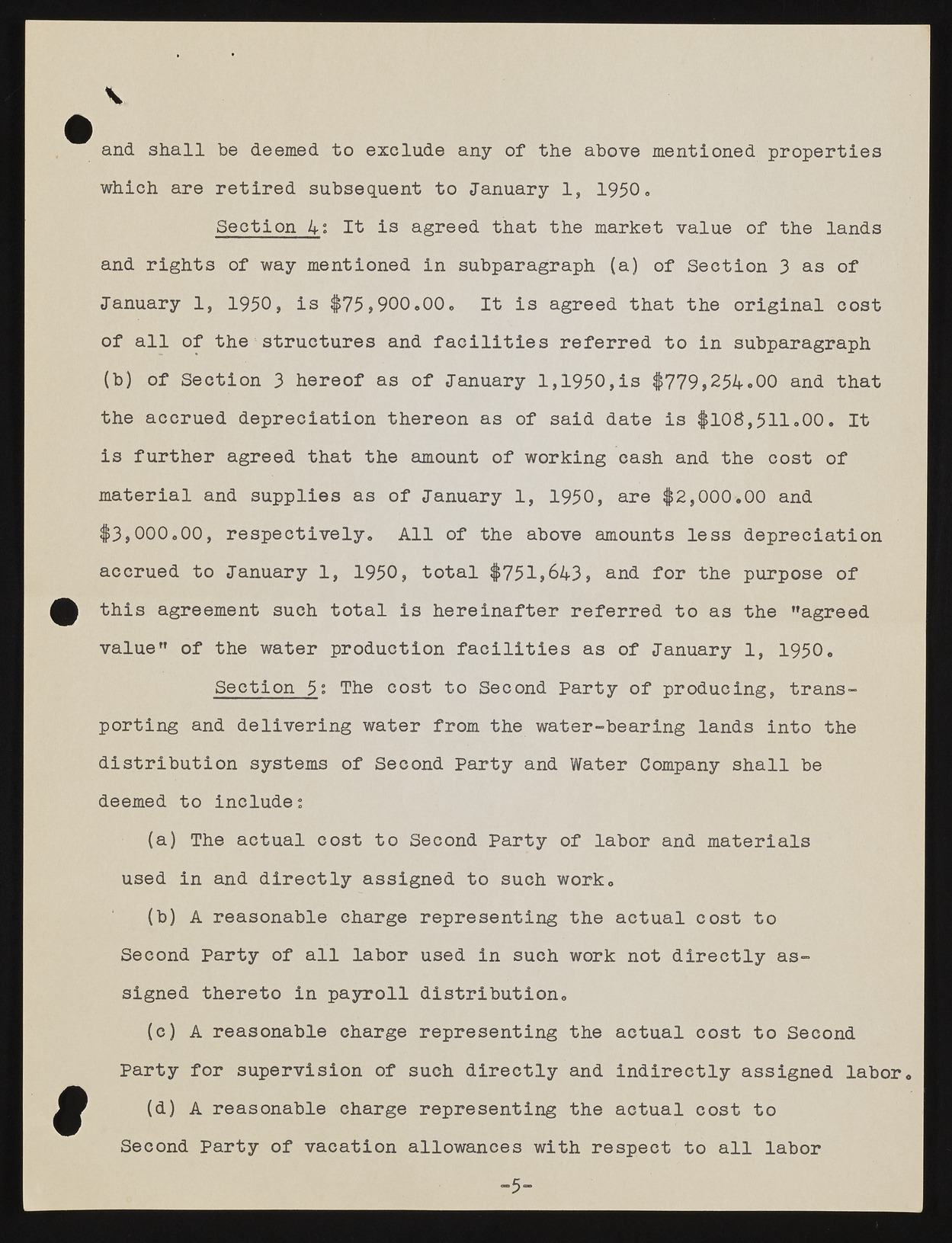

V and shall be deemed to exclude any of the above mentioned properties which are retired subsequent to January 1 , 1 9 5 0 , Section 4 s It is agreed that the market value of the lands and rights of way mentioned in subparagraph (a) of Section 3 as of January 1, 1950, is $75,900.00. It is agreed that the original cost of all of the structures and facilities referred to in subparagraph (b) of Section 3 hereof as of January 1,1950,is $779,254.00 and that the accrued depreciation thereon as of said date is $108,511.00. It is further agreed that the amount of working cash and the cost of material and supplies as of January 1, 1950, are $2,000.00 and $3,000.00, respectively. All of the above amounts less depreciation accrued to January 1, 1950, total $751,643, and for the purpose of this agreement such total is hereinafter referred to as the "agreed value" of the water production facilities as of January 1, 1950. Section 5? The cost to Second Party of producing, transporting and delivering water from the water-bearing lands into the distribution systems of Second Party and Water Company shall be deemed to includes (a) The actual cost to Second Party of labor and materials used in and directly assigned to such work. (b) A reasonable charge representing the actual cost to Second Party of all labor used in such work not directly assigned thereto in payroll distribution. (c) A reasonable charge representing the actual cost to Second Party for supervision of such directly and indirectly assigned labor. (d) A reasonable charge representing the actual cost to Second Party of vacation allowances with respect to all labor ~5“