Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

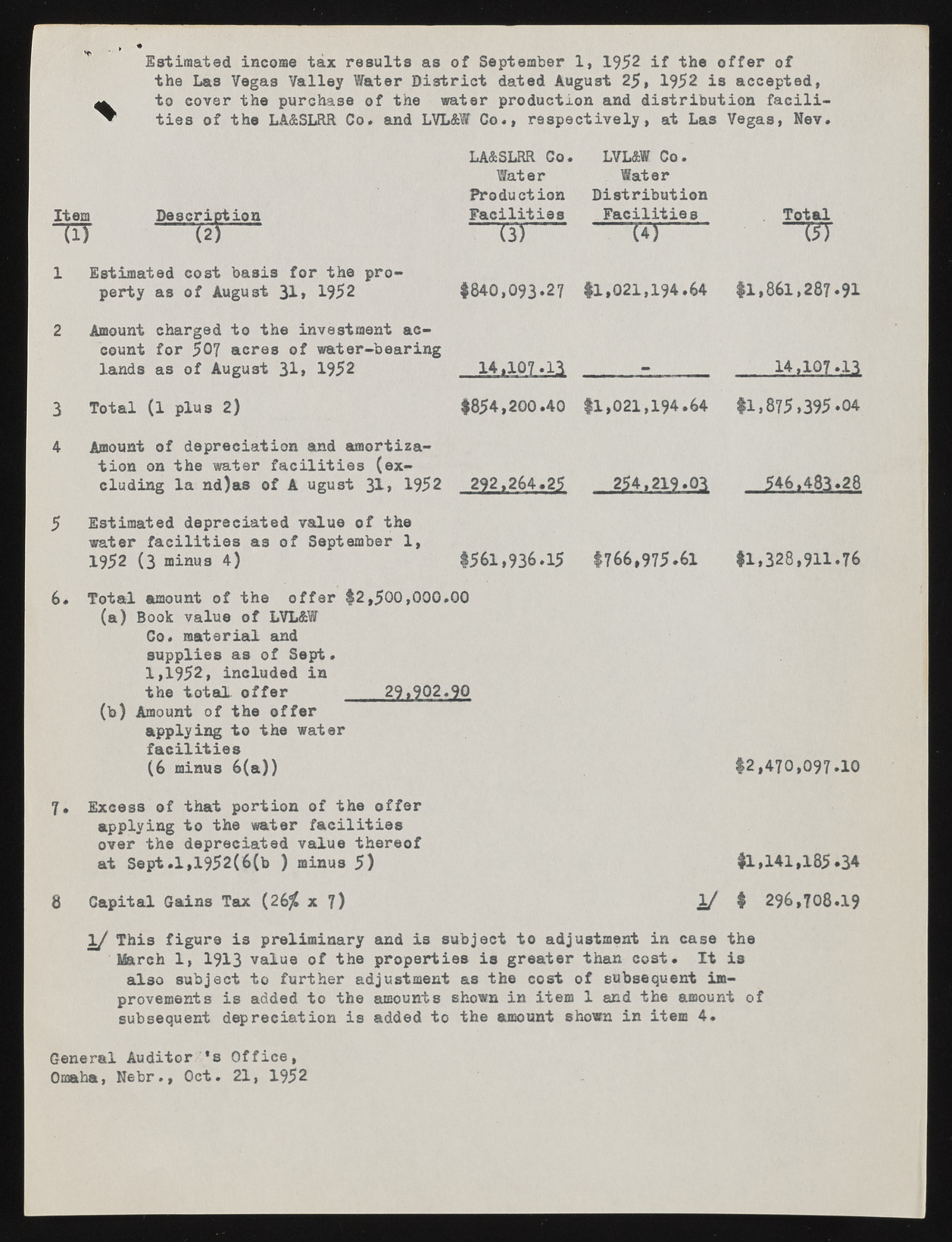

Item H T Estimated income tax results as of September 1, 1952 if the offer of the Las Vegas Valley Water District dated August 25, 1952 is accepted, to cover the purchase of the water production and distribution facilities of the LA&SLRR Co. and LVL&W Co., respectively, at Las Vegas, Nev. Description LA&SLRR Co. Water Production Facilities LVL&W Co. Water Distribution Facilitie s (4) Total 1 Estimated cost basis for the property as of August 31» 1952 2 Amount charged to the investment account for 507 acres of water-bearing lands as of August 31» 1952 3 Total (l plus 2) 4 Amount of depreciation and amortization on the water facilities (excluding la nd)as of A ugust 31, 1952 5 Estimated depreciated value of the water facilities as of September 1, 1952 (3 minus 4) $840,093.27 $1,021,194.64 $1,861,287.91 14,107.13 14,107.13 $854,200.40 $1,021,194.64 $1,875,395.04 292,264.25 214,219.^5 546,483.28 $561,936.15 $766,975.61 $1,328,911.76 6. Total amount of the offer $2,500,000.00 (a) Book value of LVL&W Co. material and supplies as of Sept. 1 ,1 9 5 2 , included in the total, offer 29,902.90 (b) Amount of the offer applying to the water facilities (6 minus 6(a)) 7. Excess of that portion of the offer applying to the water facilities over the depreciated value thereof at Sept.l,1952(6(b ) minus 5) 8 Capital Cains Tax (26^ x 7) $2,470,097.10 $1,141 1/ $ 296 ,185.34 ,708.19 1/ This figure is preliminary and is subject to adjustment in case the March 1, 1913 value of the properties is greater than cost. It is also subject to further adjustment as the cost of subsequent improvements is added to the amounts shown in item 1 and the amount of subsequent depreciation is added to the amount shown in item 4. General Auditor 's Office, Omaha, Nebr., Oct. 21, 1952