Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

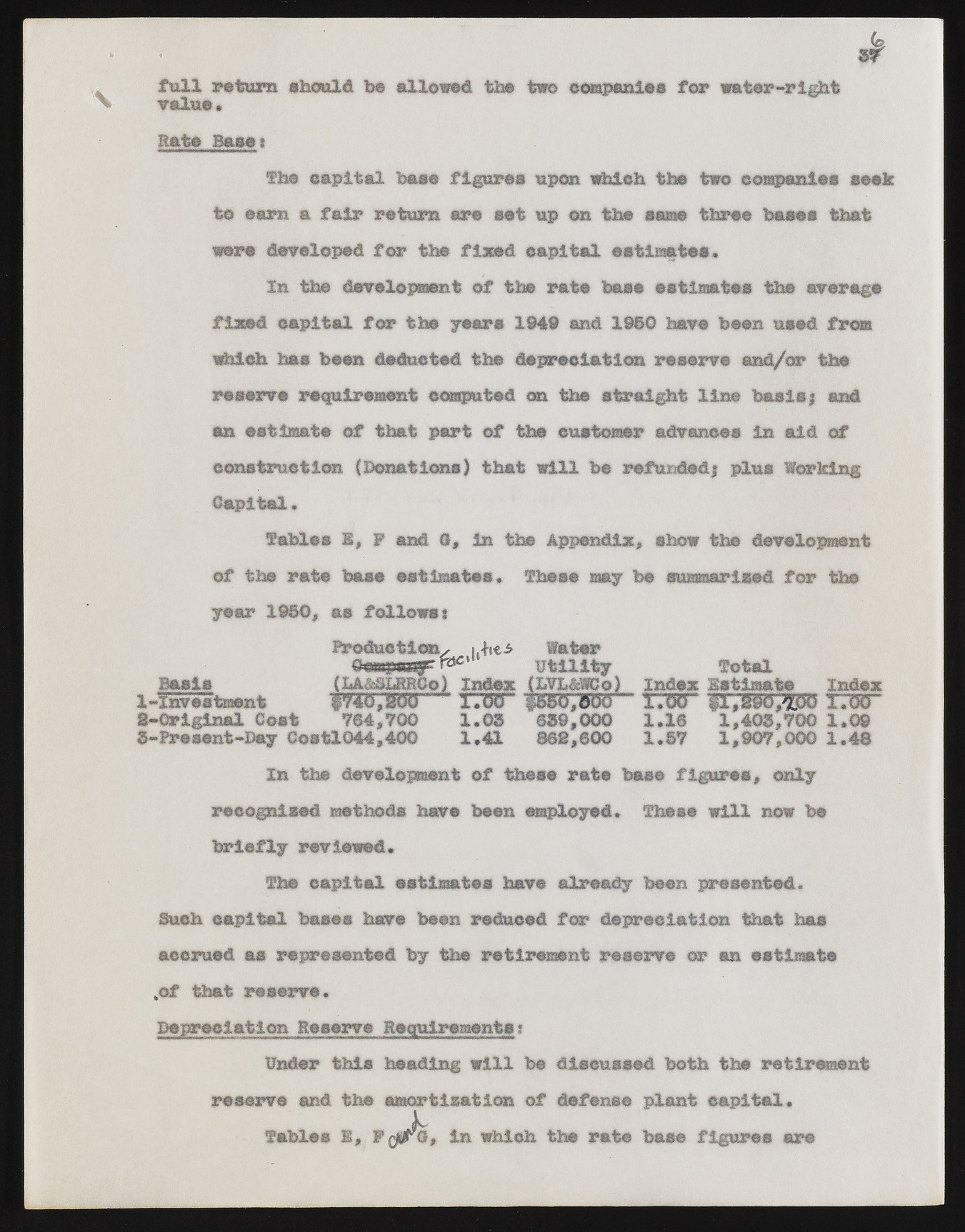

full return should be allowed tbe two companies for water-right value* Rate Baaei The capital base figures upon which the two companies seek to earn a fair return are set up on the seme three bases that were developed for the fixed capital estimates. In the development of the rate base estimates the average fixed capital for the years 1949 and 1950 have been used from which has been deducted the depreciation reserve and/or the reserve requirement computed on the straight line basis; and an estimate of that part of the customer advances in aid of construction (Donations) that will be refunded; plus Working Capital. Tables E, P and 3, in the Appendix* show the development of the rate base estimates. These may be summarised for the year 1950, as follows; Production, \.ht± Water Scwpasgp roc‘ Utility Total Baals (hA&SLRRCo) Index (LVL&WCo) index Estimate index 1- Inrestment f » 7 W T O T ~ fEOT/fiERT" T O T ” I T O T ^ O T T O T T 2- Orlginal Cost 764,700 1.05 659,000 1,16 1,405,700 1.09 5-Present-Day CostlG44,400 1.41 862,600 1.57 1,907,000 1.48 In the development of these rate base figures, only recognised methods have been employed. These will now be briefly reviewed. The capital estimates have already been presented. Such capital bases have been reduced for depreciation that has accrued as represented by the retirement reserve or an estimate .of that reserve. Depreciation Reserve Requirements t Under this heading will be discussed both the retirement reserve and the amortisation of defense plant capital* tables 1, Fc/®» in which the rate base figures are