Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

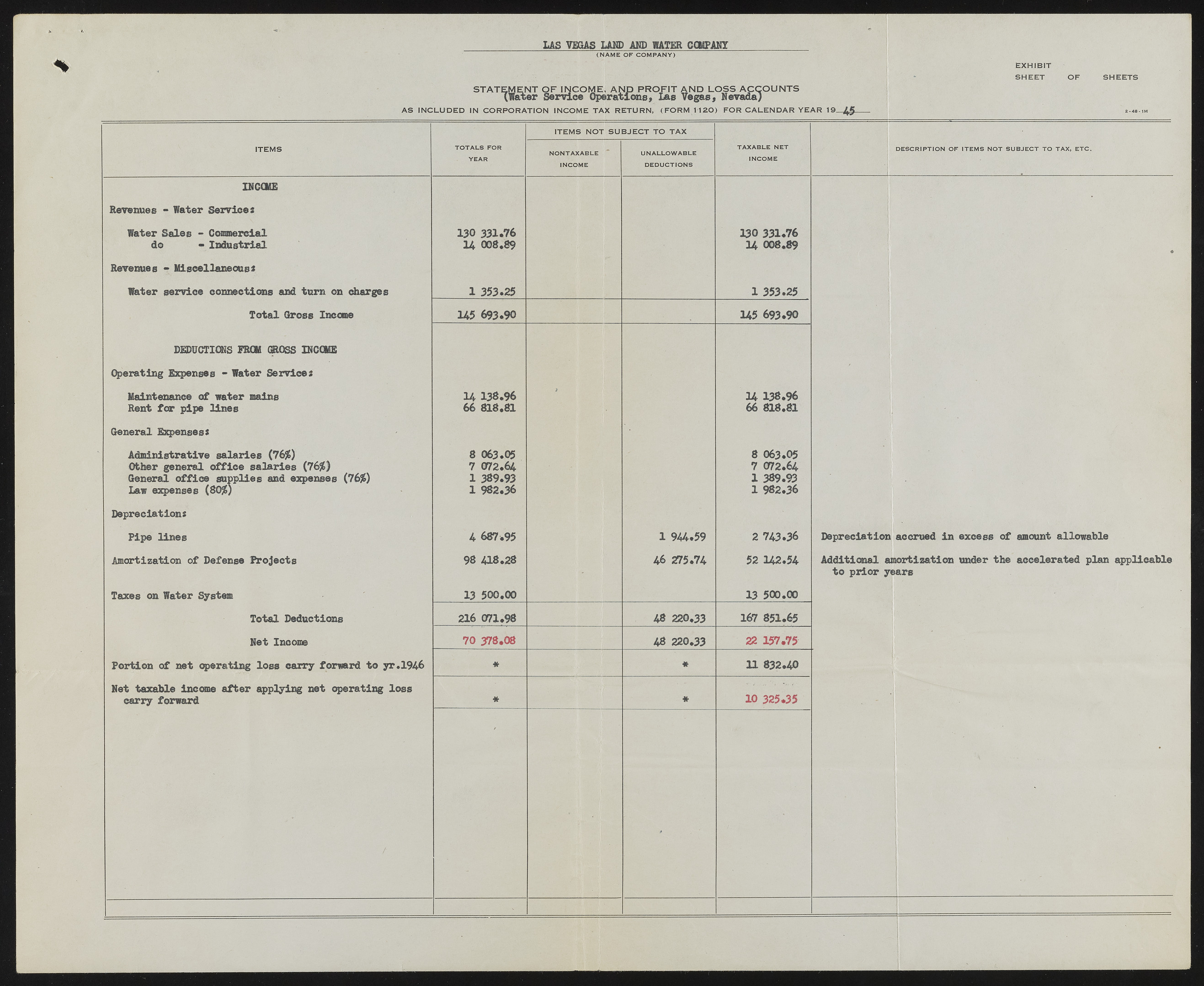

LAS VEGAS LAND AND WATER COMPANY (NAME OF COMPANY) EXHIBIT S H E E T O F S H E E TS STATEM ENT O F INCOM E, A N D PROFIT A N D LO SS A C C O U N T S (Water Service Operations, Las Vegas, Nevada) A S IN C LU D E D IN C O R P O R A T IO N INCOM E T A X R E TU R N , (F O R M 1 1 2 0 ) F O R C A L E N D A R Y E A R 19 ITEM S T O T A L S FO R Y E A R ITEM S N O T S U B JE C T TO T A X N O N T A X A B L E IN CO M E U N A L L O W A B L E D E D U C T IO N S T A X A B L E N E T IN C O M E D E S C R IP T IO N O F IT E M S N O T S U B JE C T T O TA X , E T C . INCCME Revenues - Water Services Water Sales - Commercial do - Industrial Revenues 1 Miscellaneous* Water service connections and turn on charges Total Gross Income DEDUCTIONS FROM CROSS INCOME Operating Expenses • Water Service* Maintenance of water mains Rent far pipe lines General Expenses* Administrative salaries (76$) Other general office salaries (76$) General office supplies and expenses (76$) Law expenses (80$) Depreciations Pipe lines Amortization of Defense Projects Taxes on Water System Total Deductions Net Income Portion of net operating loss carry forward to yr. 194-6 Net taxable income after applying net operating loss carry forward 130 331.76 14 008.89 1 353.25 145 693.90 14 138.96 66 818.81 8 063.05 7 072.64 1 389.93 1 982.36 4 687.95 98 418.28 13 500.00 216 071.98 70 378.08 1 944.59 46 275.74 48 220.33 48 220.33 130 331.76 14 008.89 1 353.25 145 693.90 14 138.96 66 818.81 8 063.05 7 072.64 1 389.93 1 982.36 2 743.36 52 142.54 13 500.00 167 851.65 22 157.75 11 832.40 10 325.35 Depreciation acearned in excess of amount allowable Additional amortization under the accelerated plan applicable to prior years