Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

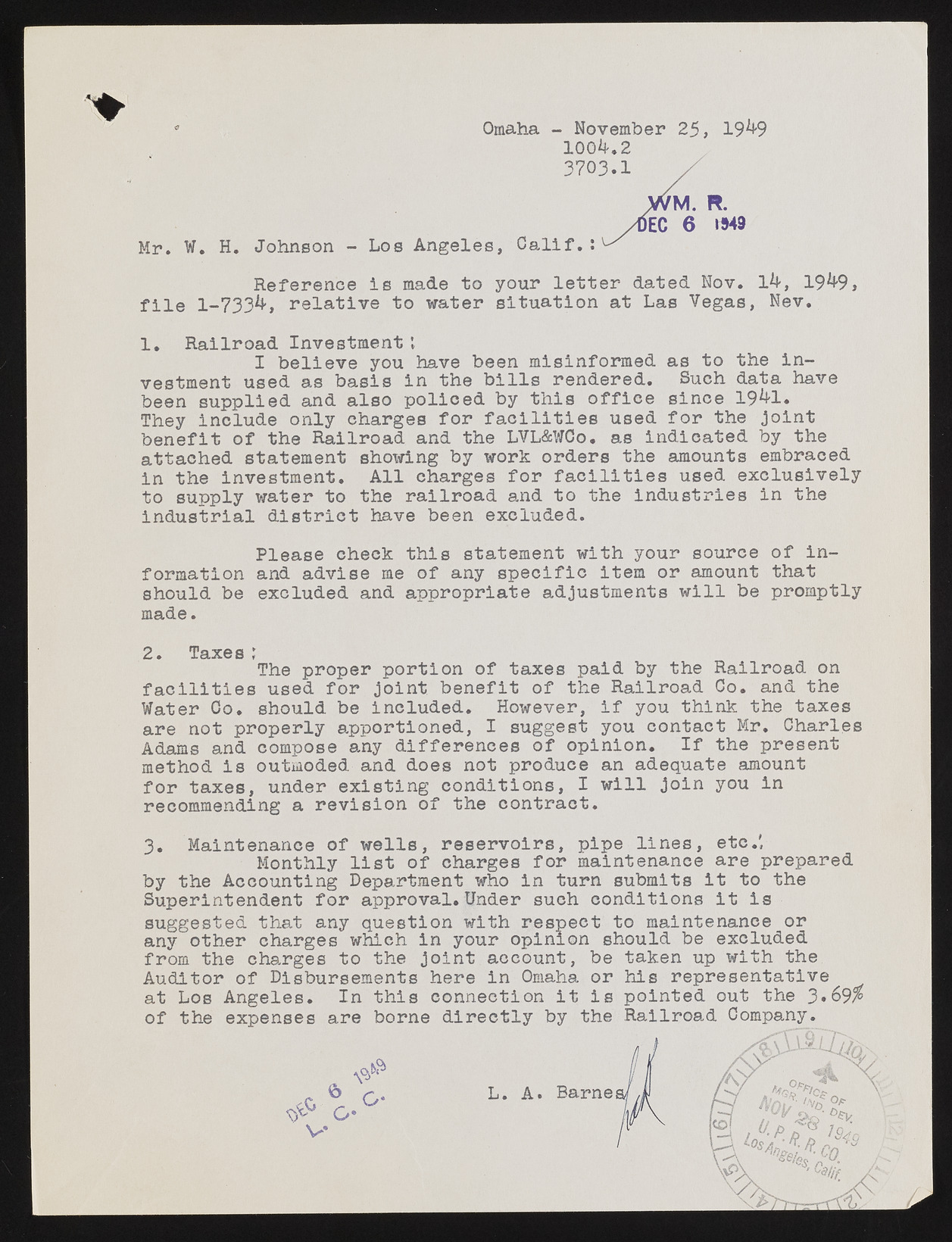

Omaha - November 25, 19^9 100^.2 3703 n? w m . n . EC 6 iM9 Reference is made to your letter dated Nov. 1^, 19^9, file 1-733^, relative to water situation at Las Vegas, Nev. 1. RailroIa db eIlniveevset meynotu lhave been misinformed as to the investment used as basis in the bills rendered. Such data have been supplied and also policed by this office since 19^1« They include only charges for facilities used for the joint benefit of the Railroad and the LVL&WCo. as Indicated by the attached statement showing by work orders the amounts embraced in the investment. All charges for facilities used exclusively to supply water to the railroad and to the industries in the industrial district have been excluded. formation and advise me of any specific item or amount that should be excluded and appropriate adjustments will be promptly made. 2. Taxes The proper portion of taxes paid by the Railroad on facilities used for joint benefit of the Railroad Co. and the Water Co. should be included. However, if you think the taxes are not properly apportioned, I suggest you contact Mr. Charles Adams and compose any differences of opinion. If the present method is outmoded and does not produce an adequate amount for taxes, under existing conditions, I will join you in recommending a revision of the contract. 3. MaintenMoanntchel yo f lwiesltl so,f rcehsaerrgveosi rfso,r mpaipien telniannesc,e aetrce. 'prepared by the Accounting Department who in turn submits it to the Superintendent for approval. Under such conditions it is asnuyg goetshteerd tchhaatr geasn y whqiucehs tiino n ywoiutrh orpeisnpieonc t sthoo umladi nbtee neaxnccleu doerd from the charges to the joint account, be taken up with the Auditor of Disbursements here in Omaha or his representative at Los Angeles. In this connection it is pointed out the 3*69% of the expenses are borne directly by the Railroad Company. Please eheck this statement with your source of in V*