Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

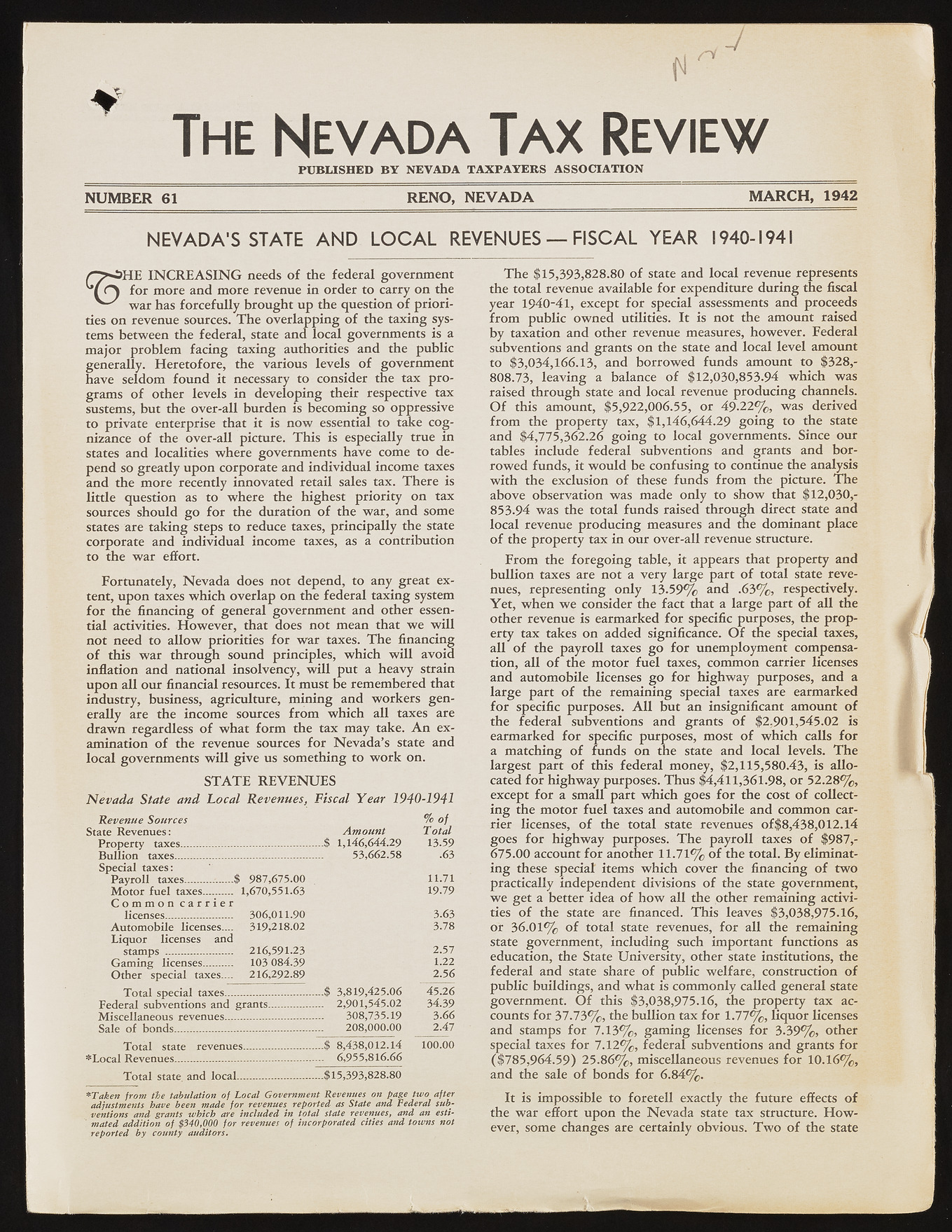

The Nevada Tax Review PUBLISHED BY NEVADA TAXPAYERS ASSOCIATION NUMBER 61 RENO, NEVADA MARCH, 1942 NEVADA'S STATE AND LO CAL REVENUES — FISCAL YEAR 1940-1941 / ^ ? O H E I N C R E A S I N G needs o f the federal governm ent f " ) fo r m ore an d m ore revenue in order to carry on the w a r has fo rcefu lly brou gh t u p the question o f p rio rities on revenue sources. T h e o verlappin g o f the taxin g systems between the federal, state and local governm ents is a m ajor problem facin g taxing authorities and the public generally. H eretofore, the various levels o f governm ent have seldom fo u n d it necessary to consider the tax p ro gram s o f other levels in developin g their respective tax sustems, but the o ver-all burden is becom ing so oppressive to private enterprise that it is n o w essential to take co gnizance o f the o ver-all picture. T h is is especially true in states and localities w here governm ents have come to depend so greatly u pon corporate and in dividu al income taxes and the m ore recently innovated retail sales tax. T h ere is little question as to w h ere the highest priority on tax sources should g o fo r the duration o f the w ar, and some states are taking steps to reduce taxes, principally the state corporate and in dividu al income taxes, as a contribution to the w a r effort. Fortunately, N e v a d a does not depend, to any great extent, u pon taxes w hich overlap on the federal taxing system fo r the financing o f general governm ent and other essential activities. H o w e v e r, that does not m ean that w e w ill not need to a llo w priorities fo r w a r taxes. T h e financing o f this w a r through sound principles, w hich w ill avoid inflation and national insolvency, w ill put a heavy strain u pon a ll ou r financial resources. It m ust be rem em bered that industry, business, agriculture, m in in g and w orkers gen erally are the income sources fro m w hich all taxes are d ra w n regardless o f w hat fo rm the tax may take. A n exam ination o f the revenue sources fo r N e v a d a ’s state and local governm ents w ill give us som ething to w o rk on. S T A T E R E V E N U E S N eva d a State and L o c a l Revenues, Fiscal Y ea r 1940-1941 Revenue Sources %of State Revenues: Amount Total Property taxes............. -$ 1,146,644.29 13.59 Bullion taxes.............. 53,662.58 .63 Special taxes: Payroll taxes..... ...$ 987,675.00 11.71 Motor fuel taxes...... 1,670,551.63 19.79 Common carrier licenses............... 306,011.90 3.63 Automobile licenses.— 319,218.02 3.78 Liquor licenses and stamps ............... 216,591.23 2.57 Gaming licenses...... 103 084.39 1.22 Other special taxes— 216,292.89 2.56 Total special taxes... ...$ 3,819,425.06 45.26 Federal subventions and grants..........? 2,901,545.02 34.39 Miscellaneous revenues... 308,735.19 3.66 Sale of bonds.............. 208,000.00 2.47 Total state revenues............... ...$ 8,438,012.14 100.00 ? Local Revenues.............. ... 6,955,816.66 Total state, and local...................$15,393,828.80 *Tak e n from the tabulation of Local Government Revenues on page two after adjustments have been m a d e for revenues reported as State a n d federal subventions a n d grants which are included in total state revenues, a n d an estimated addition of $340,000 for revenues of incorporated cities a n d towns not reported by county auditors. T h e $15,393,828.80 o f state and local revenue represents the total revenue available fo r expenditure d u rin g the fiscal year 1940-41, except fo r special assessments and proceeds from pu blic o w n ed utilities. It is not the am ount raised by taxation and other revenue measures, how ever. Federal subventions and grants on the state and local level amount to $3,034,166.13, and bo rro w e d funds am ount to $328,- 808.73, leavin g a balance o f $12,030,853.94 w hich w as raised through state and local revenue produ cin g channels. O f this amount, $5,922,006.55, o r 4 9 -2 2 % , w as derived from the property tax, $1,146,644.29 g o in g to the state and $4,775,362.26 g o in g to local governments. Since our tables include federal subventions and grants and b o rro w ed funds, it w o u ld be confusing to continue the analysis w ith the exclusion o f these funds fro m the picture. T h e above observation w as m ade only to show that $12,030,- 853.94 w as the total fu n ds raised th rou gh direct state and local revenue produ cin g measures and the dom inant place o f the property tax in ou r over-all revenue structure. F rom the fo re g o in g table, it appears that property and b u llio n taxes are not a very large part o f total state revenues, representing only 13.59% and .6 3 % , respectively. Y e t, w h en w e consider the fact that a large part o f a ll the other revenue is earm arked fo r specific purposes, the p ro p erty tax takes on added significance. O f the special taxes, all o f the payroll taxes g o fo r unem ploym ent compensation, a ll o f the m otor fu el taxes, com m on carrier licenses and autom obile licenses g o fo r h igh w ay purposes, and a large part o f the rem aining special taxes are earmarked fo r specific purposes. A l l bu t an insignificant am ount o f the federal subventions and grants o f $2,901,545.02 is earm arked fo r specific purposes, most o f which calls fo r a m atching o f funds on the state and local levels. T h e largest part o f this federal money, $2,115,580.43, is a llo cated fo r h igh w ay purposes. T h u s $4,411,361.98, o r 52.28% , except fo r a sm all part w hich goes fo r the cost o f collectin g the m otor fu e l taxes and autom obile and com m on carrier licenses, o f the total state revenues of$8,438,012.14 goes fo r h igh w ay purposes. T h e payroll taxes o f $987,- 675.00 account fo r another 11.71% o f the total. B y eliminatin g these special items w hich cover the financing o f tw o practically independent divisions o f the state governm ent, w e get a better idea o f h o w all the other rem aining activities o f the state are financed. T h is leaves $3,038,975.16, o r 3 6.01% o f total state revenues, fo r a ll the rem aining state governm ent, in cludin g such im portant functions as education, the State University, other state institutions, the federal and state share o f public w elfare, construction o f pu blic buildings, and w hat is com m only called general state governm ent. O f this $3,038,975.16, the property tax accounts fo r 37.73% , the b u llio n tax fo r 1.77% , liq u o r licenses and stamps fo r 7.13% , gam in g licenses fo r 3.39% , other special taxes fo r 7.12% , federal subventions and grants fo r ($785,964.59) 25.86% , miscellaneous revenues fo r 10.16% , and the sale o f bonds fo r 6.84% . It is im possible to foretell exactly the future effects o f the w a r effort u pon the N e v a d a state tax structure. H o w ever, some changes are certainly obvious. T w o o f the state